Question 1. A firm has increased all inputs used in the production of its product by 50%. As a result, the firm’s output has doubled. From this information we can conclude that the firm’s production function exhibits:

a. Increasing returns to scale.

b. Decreasing returns to scale.

c. Decreasing marginal returns.

d. Increasing marginal returns.

Question 2. If Peter’s marginal rate of substitu tion of x for y is given by MRSxy = 5 at his optimum consumption bundle, and if the price of x is $2, then what is the price of y?

a. $0.40

b. $2.50

c. $5.00

d. $10.00

e. $12.40

Question 3. The farmers in a small rural town face a perfectly elastic demand curve. In equilibrium, 10 units are sold. After the government imposes a $2 tax, th e producer tax incidence is $12. Given this information, what must the slope of the supply curve be?

a. 1/12

b. 1/10

c. 5/6

d. 1/5

e. 1/2

Question 4. Derek’s indifference curves for good x and good y are bowed toward the origin. Which of the following statements might have been said by Derek in regard to goods x and y?

a. “I don’t care how much y I have when I make decisions about how much x to buy.”

b. “Good x and y don’t mix very well. I’d rather just have more of one or the other.”

c. “I like x every bit as much as I like y. I’m happy either way!”

d. “The more y I have, the less I like x.”

e. “It’s boring to have too much of one or the other. I like variety.”

Use the following information to answer the next TWO (2) questions.

Deirdre’s Soap Company has a tota l cost curve for producing Q bars of soap given by the equation TC=2+Q+(1/2)Q2 . Her marginal cost is given by MC=1+Q.

Question 5. If Deirdre is producing 4 bars of soap, what is her total VARIABLE cost?

a. $5

b. $20

c. $14

d. $4

e. $12

Question 6. Given the initial information, if the market price is $4 per bar of soap, what will be Deirdre’s profit?

a. $2.50

b. $12.00

c. $9.50

d. $4.50

e. $9.00

Question 7. Researchers worry that the consumer price inde x may not measure infla tion accurately. Which of the following situations will NOT lead to inaccuracy in the calculation of the consumer price index?

a. Marshall’s (a clothing store) frequently discounts items in the store.

b. The internet has made it much easier to r esearch prices and to purchase goods quickly.

c. Many goods today are made with higher quality, compared to their counterparts 20 years ago.

d. Computers have become immensely popular in the past 30 years.

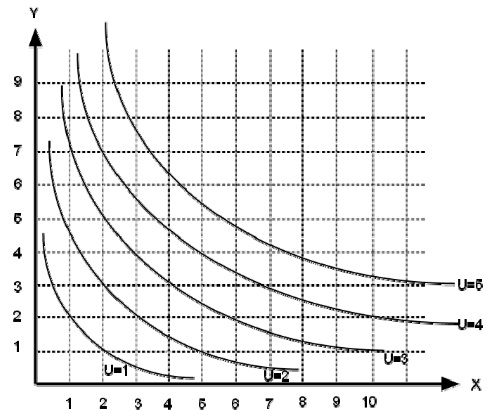

Question 8. Bob’s indifference curves between good x and good y are shown below where U is the symbol for the level of utility Bob gets from a particular i ndifference curve. Suppose Bob’s budget is $40, and both good x and good y cost $8. Given this inform ation and the graph below, what will be Bob’s highest attainable utility? ( Hint: you will need to carefully draw something on the graph. Choose the answer that seems most reasonable given what you drew.)

a. 1

b. 2

c. 3

d. 4

e. 5

Question 9. Consider the effect of an excise tax on the follo wing markets. In which market would you expect the consumer tax incidence to be relatively low?

a. The market for cigarettes: consumers are addict ed to cigarettes and have a hard time cutting back or quitting.

b. The market for rented apartments in a small, poor town: people are too poor to buy or build new housing, and they can’t afford to commute from another community that might have cheaper rental units.

c. The market for beef: most people like chicken and fish, too.

d. The market for insulin-dependent di abetics: diabeti cs need insulin! Use the following information to answer the next TWO (2) questions . Ruth needs new clothes. At the orig inal price of $10 for a shirt, Ruth will buy 4 shirts. Unfortunately for Ruth , the price of shirts has risen to an extreme $20 fo r a shirt! At such steep prices, she is only willing to buy 2 shirts. For this set of questions assu me that Ruth’s demand curve is linear.

Question 10. Using the midpoint (arc elasticity) formula and th e above information, what is Ruth’s price elasticity of demand?

a. 1/2

b. 1

c. 2

d. 3/2

Question 11. Using the point elasticity formula, which of the following is Ruth’s price elasticity of demand at a price of $10 per shirt?

a. 1/2

b. 1

c. 2

d. 3/2

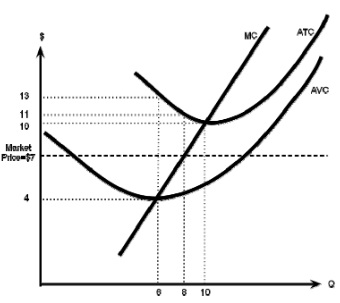

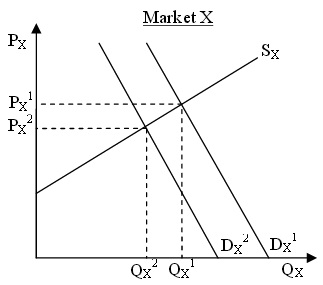

Use the following graph to answer the next TWO (2) questions.

Question 12. What are the firm’s total costs at the current market price?

a. $56

b. $78

c. $24

d. $100

e. $88

Question 13. What is the firm’s economic profit at the current level of production? (Hint: the current level of production is determined by the market price.)

a. -$32

b. -$30

c. $18

d. $30

e. $56

Question 14. Ludwig consumes goods x and y, on the x and y axes respectively. His marginal utility for x is given by MU x =1/(2x) and his marginal utility of good y is given by MU y =1/y. Consider the indifference curve going through the point x=20, y=10. What must be the absolute value of the slope of the indifference curve going through this point?

a. 4

b. 1/2

c. 2

d. 1/2

e. 3

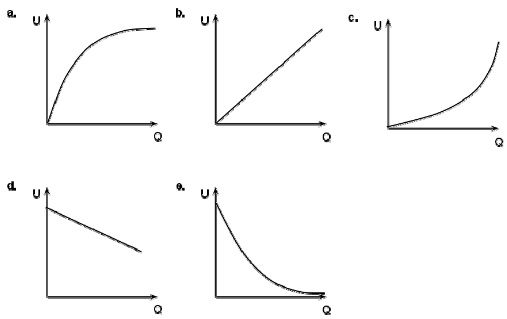

Question 15. Which of the following graphs might represent the util ity function of an individual with decreasing marginal utility? In the graphs U stands for total utility and Q stands for the quantity of the good.

Question 16. The demand for Grouper (a type of fish) is equal to 40 pounds at a price of $20. At any price, if the price of Grouper increases by $1, then demand for grouper decreases by 4 pounds. At what price and quantity would fishermen maximize their total revenue from selling grouper given this information?

a. Q = 8, P = $8

b. Q = 40, P = $10

c. Q = 12.5, P = $50

d. Q = 60, P = $15

Use the following information for the next TWO (2) questions. Professor Kelly’s cookie company has an average total cost curve given by ATC=4/Q+1+Q and a marginal cost curve given by MC = 2Q+1.

Question 17. At what price would this company earn zero economic profit?

a. $4

b. $2

c. $5

d. $6

e. $1.50

Question 18. The total cost curve for the cookie company is:

a. TC=4+Q+Q2

b. TC=2Q2 +Q

c. TC=2+1/Q

d. TC=4/Q+3Q+2

Question 19. Suppose that the cross-price elasticity of demand be tween sun dials and digital clocks is 1.2 for Kim and -0.6 for Luke. This means that Kim vi ews sun dials and digital clocks as _________ and that Luke views sun dials and digital clocks as _________.

a. complements; substitutes

b. inferior; normal

c. normal; inferior

d. substitutes; complements

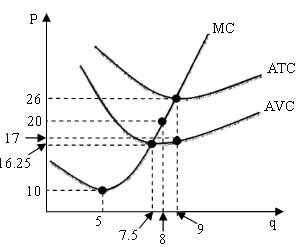

Use the following graphs of a perfectly competitive firm to answer the next TWO (2) questions

Question 20. In the short run, the firm will produce a positive qu antity as long as the price is greater than _____. In the long run, the firm will produce a positive qua ntity as long as the price is greater than or equal to _____.

a. $16.25; $26

b. $26; $16.25

c. $10; $26

d. $16.25; $16.25

Question 21. What is the value of fixed costs for the firm?

a. $0

b. $50

c. $73

d. $81

Question 22. If labor is the only variable re source and the firm experiences diminishing returns to labor then a. As the level of output increases, margin al cost will eventually increase. b. As the level of output increases, average va riable cost may be either decreasing or increasing. c. Marginal product of labor stays the same as more workers are hired, while marginal product of capital decreases. d. The firm’s total output always decr eases as more workers are hired. e. Statements (a) and (b) are both true statements.

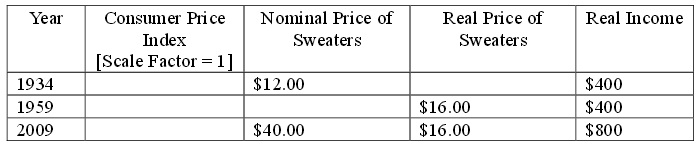

Use the following information to answer the next THREE (3) questions . You are doing a project on inflation in the country of Inflation-topia. You are unable to get much data, but you obtain information on some nominal and real prices. You know that the base year is one of the three years in the table, but you are unsure which one it is. You have the following information:

Question 23. Suppose that the base year is 1934 and the nominal pr ice of sweaters in 1959 was $32.00. What was the consumer price index in 1959? What was the percent inflation from 1959 to 2009?

a. Price index = 1/2; Inflation from 1959 to 2009 = 50%

b. Price index = 2; Inflation from 1959 to 2009 = 20%

c. Price index = 1/2; Inflation from 1959 to 2009 = 200%

d. Price index = 2; Inflation from 1959 to 2009 = 25%

Question 24. Using the information in the table as well as the info rmation provided in the last question, what is the value of nominal income in Inflation-topia in 2009?

a. $1600

b. $320

c. $800

d. $2000

Question 25. For this question only, suppose you know that the inflation rate was positive (larger than zero ) from 1934 to 1959 and from 1959 to 2009 in Inflation-topia. Given the information in the table, which of the following statements could be true:

a. The base year was 1959 and the real price of sweaters in 1934 was $6.00.

b. The base year was 1934 and the nominal pr ice of sweaters in 1959 was $40.00.

c. The base year was 1934 and the nominal price of sweaters in 2009 was higher than the nominal price of sweaters in 1959.

d. The base year was 1959 and the real price of sweaters in 1934 was $12.00.

Question 26. Which of the following answer choices could explain the shift depicted in market for good X from demand line Dx1 to demand line Dx2 ?

(i) There was an increase in the price of good Y; cross-price elasticity of demand between X and Y is negative.

(ii) There was a decrease in the price of good Y; cross-price elasticity of demand between X and Y is negative.

(iii) There was an increase in income; income elasticity of demand is negative.

(iv) There was a decrease in income; income elasticity of demand is positive.

a. (i) only

b. (ii) only

c. (i) and (iii)

d. (i), (iii) and (iv)

Question 27. In a perfectly competitive industry, a firm will pr oduce a positive quantity in the short run as long as price is greater than ____. In the long run, a fi rm will remain in the indu stry as long as price is greater than or equal to _____.

a. Average variable cost; average total cost.

b. Marginal cost; average variable cost.

c. Average variable cost; average fixed cost.

d. Average total cost; average variable cost.

Question 28. Phil and Eleanor consume playing cards (PC) and candy (C). They have recently suffered a drop in household income, and now need to figure out how to change their consumption. If Eleanor had it her way, they would cut back on their consumption of playing cards and candy equally. Phil, who is a nervous eater, is happy to cut back on playin g cards, but he wants to purchase more candy. Which of the following pairs of income elasticities for El eanor and Phil accurately reflect this information?

a. Eleanor: εPC = 1.5, ε C = 0.9; Phil: εPC = 1.5, ε C = 0

b. Eleanor: εPC = -0.8, ε C = -0.5; Phil: εPC = -1, ε C = 1.5

c. Eleanor: εPC = 0.6, ε C = 0.6; Phil: εPC = 6, ε C = -1.5

d. Eleanor: εPC = 0.75, ε C = 0.75; Phil: εPC = -1, ε C = 0.5

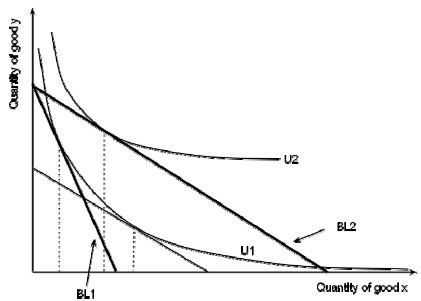

Use the graph below to answer the next TWO (2) questions.

The graph below represents the indifference curves (U1 and U2) and budget lines (BL1 and BL2) for an individual consuming good x and good y. An additional line, parallel to budget line 2 (BL2) but tangent to U1, has been added for your convenience.

Question 29. Going from BL1 (budget line 1) to BL2 (budget li ne 2), a change has occurred. Which of the following statements best describes this change?

a. The individual’s income increased.

b. The individual’s income decreased.

c. The price of good x increased.

d. The price of good x decreased.

e. The price of good y decreased.

Question 30. After the shift from BL1 to BL2, we observe that the income effect for good x is ______ and the substitution effect for good x is _______.

a. Positive; negative

b. Negative; positive

c. Negative; negative

d. Positive; positive

For the next THREE (3) questions , use the following demand and supply curves: D: P = 80 - Q S: P = Q

Question 31. If the government imposes an exci se tax of $2 per unit on supplie rs, what will be the market equilibrium price (i.e., the price that consumers pay)?

a. $42

b. $41

c. $39

d. $40

e. $38

Question 32. What is consumer tax incidence equal to when the excise tax is $2 per unit?

a. $40

b. $80

c. $1.5 per unit

d. $39

e. $2 per unit

Question 33. Suppose the government wishes to impose an excise tax in this market that would result in 38 units of the good being sold. What would the excise ta x need to be in order to reach this goal?

a. $4 per unit

b. $6 per unit

c. $1 per unit

d. $3 per unit

e. $5 per unit