Use the given information for the next THREE (3) questions.

Consider the market for peanuts. The market demand for peanuts is given by the following equation: QD =7.5 - P. Market supply for peanuts is: QS = P – 1/2. Suppose the government levies an excise tax on producers of $2 per unit of peanuts sold.

Question 1. What is the equilibrium quantity supplied and net price received by producers after the government implements this excise tax on peanuts?

a) P = $8, Q = 3.5

b) P = $3.5, Q = 4

c) P = $4, Q = 3.5

d) P = $3, Q = 2.5

Question 2. Given this excise tax on peanuts, what are the consumer and producer tax incidence that result from the tax?

a) Consumer incidence=$2.50, Producer incidence=$2.50

b) Consumer incidence=$8, Producer incidence=$8

c) Consumer incidence=$3.50, Producer incidence=$2.50

d) Consumer incidence=$2.50, Producer incidence=$3.50

Question 3. What is the deadweight loss caused by the imposition of this excise tax?

a) $1.20

b) $1.00

c) $2.00

d) $1.50

Question 4. In a perfectly competitive market, which of the following statements is a reason that a firm would exit the market in the short run?

a) Marginal cost exceeds price at the profit maximizing quantity.

b) Average variable cost is less than marginal revenue at the profit maximizing quantity.

c) Minimum average total cost is greater than price.

d) Minimum average variable cost is greater than price.

Question 5. A firm is producing at an output level such that the firm’s average total cost is greater than its marginal cost. If this firm produces one additional unit of output, how will its average total cost change?

a) The firm’s average total cost will increase.

b) The firm’s average total cost will decrease.

c) The firm’s average total cost will stay the same.

d) The direction of change in the firm’s average total cost is indeterminate.

Question 6. The market for baseballs is perfectly competitive. In the long run, each firm is producing 100 baseballs and selling them for $2 each. What is the marginal cost of producing the 100th baseball for a firm in this industry?

a) $2

b) $200

c) $1

d) $0.02

Use the following information to answer the next THREE (3) questions.

Year CPI Nominal Price of Skittles

1980 150 $0.60

1990 225 $0.75

2000 300 $1.50

The above table provides information about the CPI and the nominal price of skittles for three different years. Assume that the base year for the data in the table is 1975.

Question 7. What is the percentage increase in the average price of all goods from 1980 to 2000?

a) 350%

b) 200%

c) 100%

d) 133%

Question 8. What is the real price of Skittles measured in 1975 dollars in the year 2000?

a) $0.33

b) $0.50

c) $0.40

d) $0.75

Question 9. Look at the real price of Skittles between 1980 and 1990. The real price of Skittles _______ going from 1980 to 1990.

a) Increased

b) Decreased

c) Stayed the same

d) There is not enough information to answer this question.

Question 10. Suppose the market demand for trucks is P=55-2QD and the market supply for trucks is P=1+QS . In this market, suppose the government is going to implement an excise tax on truck producers in order to decrease the quantity of trucks sold to 15 trucks. How big will the excise tax need to be in order for the government to successfully reduce truck purchases to this level?

a) $3 per truck

b) $6 per truck

c) $9 per truck

d) $10 per truck

Consider the following information for the next THREE (3) questions.

The current price of a box of Kleenex tissues is $1.50 and you are using 6 boxes. Also the current price of a roll of Charmin toilet paper is $0.50 and you are using 6 rolls. When the price of a box of Kleenex goes up to $2.50, you now use 4 boxes of Kleenex tissues and 10 rolls of Charmin toilet paper.

Question 11. Using the midpoint method (the arc elasticity method), what is the elasticity of demand for Kleenex when the price increases from $1.50 to $2.50?

a) 0.8

b) 2.5

c) 0.5

d) 0.333

Question 12. Suppose your demand curve for Kleenex is linear. Using the point elasticity of demand formula, what is the price elasticity of demand for Kleenex at a price of $1.50?

a) 0.3

b) 0.5

c) 1.2

d) 0.333

Question 13. Using the midpoint method (the arc elasticity method), what is the cross price elasticity of Charmin toilet paper when the price of Kleenex tissues goes from $1.50 to $2.50? Kleenex and Charmin, given the above information, are ___________.

a) -1.5; substitutes

b) 1; substitutes

c) -0.5; complements

d) 1; complements

Question 14. Suppose your nominal annual wage was $75,000 in 1995, and you are making a nominal wage of $125,000 in 2011. If the value of the CPI in 1995 is 150 and the value of the CPI in 2011 is 200, what can you say about your purchasing power in 2011 relative to you purchasing power in 1995? My purchasing power in 2011 is

a) Increasing relative to my purchasing power in 1995.

b) Decreasing relative to my purchasing power in 1995.

c) Unchanged relative to my purchasing power in 1995.

d) Impossible to determine given the information that is available

Question 15. A perfectly competitive firm’s shutdown price occurs where

a) marginal cost is at its minimum value.

b) the gap between average variable cost and marginal cost is largest.

c) average total cost attains its minimum value.

d) marginal cost equals average variable cost.

Use the following information to answer the next TWO (2) questions.

Babe Ruth likes both baseball bats and baseball gloves. The table below describes the utility he receives from his consumption of specific numbers of bats and gloves.

Number of Bats Total Utility from Bats Number of Gloves Total Utility from Gloves

1 100 1 50

2 150 2 90

3 170 3 110

4 180 4 120

Question 16. Suppose the price of a baseball bat is $40. If Babe Ruth’s optimal bundle is 3 bats and 1 glove, what is the price of a glove?

a) $70

b) $30

c) $10

d) $100

Question 17. The price of a helmet is $54, and the price of a bat is still $40. If Babe’s optimal consumption bundle includes 3 bats, 1 glove, and 2 helmets, what is the marginal utility of that second helmet?

a) 108 utils

b) 54 utils

c) 27 utils

d) Not enough information is provided to answer this question.

Question 18. If the income elasticity of a good is negative, the good is a(n) _________.

a) Complement

b) Substitute

c) Normal good

d) Inferior good

Mary enjoys Milkshakes and Coffee. The table below describes all the consumption bundles that Mary can consume with her $30. We will let Milkshakes=M, Coffee=C.

Bundle # of Milkshakes # of Coffees Amount Spent

A 10 0 30

B 7 9 30

C 5 15 30

D 3 21 30

Question 19. If Mary’s utility function is: U(M,C)=2M+C, which bundle maximizes her utility?

a) Bundle A

b) Bundle B

c) Bundle C

d) Bundle D

Use the following information to answer the next THREE (3) questions.

Assume the potato chip industry is perfectly competitive and that the market price is initially $5 for a bag of potato chips. The table below provides information about the costs of a representative firm, Firm A, in the potato chip industry.

Number of Workers Bags of Chips Total cost

0 0 20

1 2 26

2 5 30

3 7 38

4 8 43

5 9 50

Question 20. Assume Firm A picks a quantity to maximize their profits. What will Firm A’s profits equal at this quantity?

a) -$30

b) -$3

c) $5

d) $50

Question 21. Which of the following statements is true for Firm A given the above information? (Hint: think about fixed costs.) Holding everything else constant,

a) Firm A should shut down immediately.

b) Firm A should produce in the short run but exit the market in the long run.

c) Firm A should produce in the short run and in the long run.

d) Firm A should not produce in the short run but should produce in the long run.

Question 22. Suppose that a number of potato chip-producing firms leave the industry in the long run and this exiting of firms causes the market price to increase to $7. Assume that Firm A has not yet made a decision about exiting the industry when this price change occurs. Which of the following statements is true?

a) Firm A should shut down immediately.

b) Firm A should produce in the short run but exit the market in the long run.

c) Firm A should produce in the short run and in the long run.

d) Firm A should not produce in the short run but should produce in the long run.

Question 23. Suppose the market demand for tickets and market supply of tickets are given by the equations

Demand: P = 25 - Qd

Supply: P = 1 + Qs

Furthermore, suppose the government implements an excise tax of $4 per ticket. This tax is levied on consumers. What is the reduction in consumer surplus due to the imposition of this excise tax?

a) $22

b) $24

c) $20

d) $50

Question 24. Suppose, in the market for peppers, demand is very inelastic, and supply is unit elastic (the elasticity of supply is equal to 1 all along the supply curve). If the government levies an excise tax on pepper producers, which of the following statements is TRUE?

a) Producer tax incidence will equal 0.

b) Consumer tax incidence will equal 0.

c) Producer tax incidence will be higher than Consumer tax incidence.

d) Consumer tax incidence will be higher than Producer tax incidence.

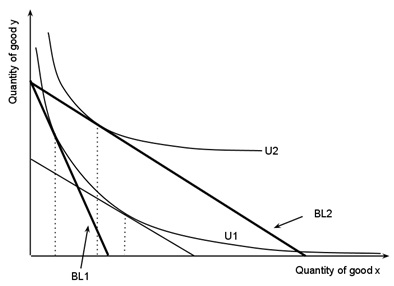

Use the graph below to answer the next TWO (2) questions.

Question 25. A price change has taken you from BL1 (budget line 1) to BL2 (budget line 2), which of the following is true:

a) Your income and substitution effects for good X are both positive.

b) Your income and substitution effects for good X are both negative.

c) The income effect for good X is positive, and the substitution effect for Good X is negative.

d) The income effect for good X is negative, and the substitution effect for Good X is positive.

Question 26. Given the above graph, which of the following statements is TRUE?

a) Good X is inferior and Good Y is normal.

b) Good X is normal and Good Y is inferior.

c) Both Good X and Good Y are inferior.

d) Both Good X and Good Y are normal.

Question 27. At the optimal consumption bundle, you are consuming 3 boxes of apples and 3 boxes of oranges. If the Marginal Rate of Substitution of Apples for Oranges is -6 at the optimal consumption bundle (MRSAO=-6), and the price of a box of Oranges is $1.80, what is the price of a box of Apples?

a) $0.30

b) $1.80

c) $5.40

d) $10.80

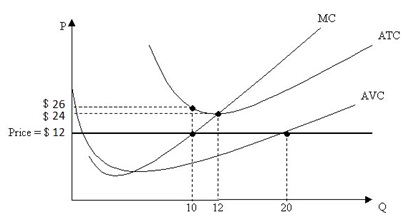

Use the following graph of a representative firm in a perfectly competitive industry to answer the next THREE (3) questions

Question 28. Based on the graph above, what quantity will the firm choose to produce if the market price is $12 per unit?

a) 10 units

b) 12 units

c) 20 units

d) There is not enough information to determine the quantity.

Question 29. Based on the graph above, what is the total cost for the firm in the short run?

a) $24

b) $26

c) $260

d) $288

Question 30. Based on the graph above, what can we say about the long run?

a) In the long run firms that remain in the industry will produce 12 units of output.

b) In the long-run all firms in the industry will earn positive economic profits.

c) In the long run, we can anticipate that the market price will fall and that will enable producers in this industry to sell more output and thereby enhance their revenue.

d) In the long run the price in the market will be greater than the marginal revenue.

Question 31. Suppose that Ron’s Burger Emporium (RBE) is a firm operating in a perfectly competitive industry. Given this information, which of the following statements must be true?

a) From the perspective of RBE, the market supply curve for burgers is perfectly elastic.

b) From the perspective of RBE, the demand curve for burgers is perfectly elastic.

c) RBE will make the same profit regardless of the quantity of burgers it decides to produce.

d) RBE’s decision about how many burgers to produce will affect the market price of burgers.

Question 32. For a given level of income, Joe maximizes his utility when he consumes 8 cookies and 4 glasses of milk when the price of cookies is $1 per cookie and the price of milk if $.50 per carton. But, when the price of milk increases to $1 per glass while holding constant Joe’s income and the price of cookies, Joe finds that his utility is maximized when he consumes 7 cookies and 3 glasses of milk. Assuming that Joe’s demand curve for milk is linear, which of the following equations best represents his demand for milk?

a) Pm = 1 - .5Qm

b) Pm = 2.5 – 50Qm

c) Pm = .5Qm + 2.5

d) Pm = 2.5 - .5Qm

Question 33. Which of the following statements is true?

a) In the long run it is possible for a firm to experience both diminishing returns to an input as well as returns to scale.

b) In the long run a firm that experiences decreasing returns to scale as output increases will find that its average total cost over this range of output is increasing as output increases.

c) In the long run a firm that has increasing average costs of production as output increases is a firm that experiences increasing returns to scale over this range of output.

d) The long run occurs when all inputs in a productive process are variable and the long run is always measured as a period of time that is five years or longer.