Oneway Ltd had outperformed its competition for the past decade however analysts now consider that the company may experience little or no growth in the future.Not perturbed by this the company believes it could maintain a constant annual growth rate in dividends per share of 6 per cent in the future, or possibly 8 per cent for the next two years and 6 per cent thereafter based on estimates of expansion into Asian/pacific markets. By venturing into these markets, the risk of the firm as measured by beta was expected to immediately increase from 1.10 to 1.25.

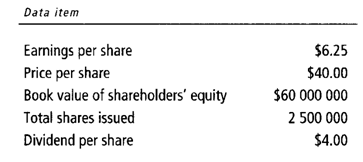

The chief financial has compiled the following financial data.

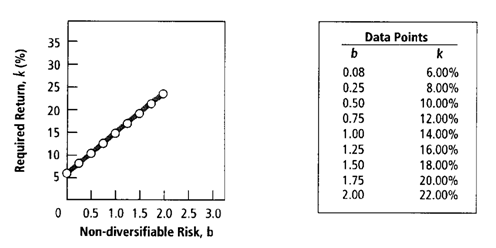

Figure 1: Security market line for Oncore International

Required

1. 'What is the firm's current price/earnings ratio?

2. 'What is the firm's current book value per share?

3a. What are the required return and risk premium for Oneway Ltd's shares using the capital asset pricing model (CAPM), assuming the beta of 1.10?

(Hint: Use the security market line - with data points noted - given in Figure 1 to find the market return.)

3b. What are the required return and risk premium for Oneway Ltd's shares using the (CAPM), assuming the beta of 1.25?

3c. What is the effect on the required return if the beta rises as expected?

4. If the securities analysts are correct and there is no growth in future dividends, what is the value per share of Oneway Ltd? (Note: Beta = 1.25.)

5a. If predictions are correct, what is the value per share of Oneway if the firm maintains a constant annual 6 per cent growth rate in future dividends? (Note: Beta = 1.25.)

5b. If predictions are correct, what is the value per share of Oneway if the firm maintains a constant annual 8 per cent growth rate in dividends per share over the next two years and 6 per cent thereafter? (Note: Beta = 1.25.)

6. Compare the current price of the shares and the share values found in questions 2, 4 and 5. Discuss why these values may differ. Which valuation method do you believe most clearly represents the true value of the Oneway shares?