Part A

Consider the following information

|

|

All Ords

|

|

|

|

Month

|

Index

|

Stock A

|

Stock B

|

|

|

Value

|

Return

|

Return

|

|

D

|

240.00

|

|

|

|

J

|

274.08

|

0.09570

|

0.07290

|

|

F

|

284.20

|

-0.00410

|

0.08350

|

|

M

|

291.70

|

0.05420

|

0.08410

|

|

A

|

288.36

|

-0.00400

|

0.06660

|

|

M

|

290.10

|

-0.03630

|

-0.00080

|

|

J

|

304.00

|

0.14640

|

0.02250

|

|

J

|

318.66

|

0.09630

|

-0.00920

|

|

A

|

329.80

|

0.02030

|

0.04580

|

|

S

|

318.56

|

-0.05630

|

-0.09810

|

|

O

|

320.00

|

0.03132

|

0.12740

|

|

N

|

334.16

|

-0.07770

|

0.09590

|

|

D

|

380.34

|

0.09800

|

0.05280

|

The risk free rate is 0.02 and you are considering investing 60% of your funds in Stock A and 40% in Stock B.

Calculate the following.

a) Expected Return of Stock A

b) Expected Return of Stock B

c) Standard Deviation of Stock A

d) Standard Deviation of Stock B

e) Coefficient of Variation of Stock A

f) Coefficient of Variation of Stock B

g) Covariance of Stocks A and B

h) Correlation Coefficient of Stocks A and B

i) Portfolio Return

j) Portfolio Standard Deviation and Variance

k) Weights of the Minimum Variance Portfolio

l) Proof that these weights lead to the Minimum Variance Portfolio

m) Weights of the Optimal Risky Portfolio with a risk-free asset

n) Proof that these weights lead to the Optimal Risky Portfolio

o) Discussion on what you would do with this portfolio

p) Calculate the beta for Stock A

q) Using the Excel regression function regress Stock A returns against the market

r) Calculate the beta for stock B

s) Using the Excel regression function regress Stock B returns against the market

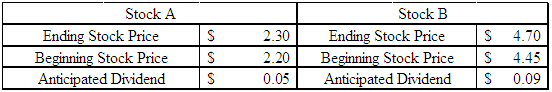

t) Using the estimated returns above determine if either Stock A or Stock B is under/over-priced according to the CAPM.