Question 1: Use the following statements (#1 - #4) to answer the following question. For a monopolist to practice price discrimination, it must be able to:

(1) prove that there are legitimate cost differences that justify different prices.

(2) separate buyers into separate classes of consumers.

(3) calculate the willingness to pay of each potential purchaser or group.

(4) control each group’s demand for the product.

A. Both (1) and (2)

B. Both (2) and (3)

C. Both (1) and (3)

D. Both (2) and (4)

E. Both (3) and (4)

Question 2: It is the case that output levels will be highest when a firm is ________ and lowest when it is ________ .

A. perfectly competitive ; a price - discriminating monopolist

B. perfectly competitive ; a monopolist

C. a price - discriminating monopolist ; a monopolist

D. a perfectly price - discriminating monopolist ; a monopolist ic competitive

E. a oligopoly ; a perfectly price - discriminating monopolist

Question 3: Suppose a perfectly competitive market has the following market demand and market supply schedules:

Quantity demanded Price Quantity supplied

9 $3 3

8 $4 4

7 $5 5

6 $6 6

5 $7 7

4 $8 8

The perfectly competitive firms in the market are all purchased by a single, second degree price discriminating monopolist who charges two different prices: $8 and $6. Assume that the monopolist produces the allocatively efficie nt quantity of output for the market. What amount of consumer surplus is transferred from consumers to producers?

A. 0

B. $2

C. $4

D. $6

E. $8

Question 4: As a result of using the marginal cost pricing rule to regulate a natural monopoly,

A. the natural monopoly will in cur an economic loss.

B. the natural monopoly earns a normal profit.

C. the monopolist produces an inefficient amount of product.

D. the monopolist is allowed to cover all its costs and earn a normal profit.

E. it yields a smaller consumer surplus than does a average cost pricing rule.

Use the following information for Question 5 and Question 6:

Assume that you have a market where the demand for the product is linear and equal to P = 100 - 4Q. Also assume that all firms produce the good using a constant marginal cost function where MC = 4, no matter how many units are produced.

Question 5: What price will be set in the market if a monopolist sets the price to maximize its profits?

A. $12

B. $36

C. $52

D. $56

E. $60

Question 6: What is the deadweig ht loss from the monopoly?

A. $144

B. $288

C. $444

D. $576

E. $864

Question 7: Suppose there is a perfectly competitive industry and that the equilibrium price in the market is equal to $10. Furthermore, suppose that the representative firm’s marginal cost is given by:

MC = (2/5)Q - 22

and that the firm’s marginal social cost is given by:

MSC = (2/5)Q - 18

If this firm produces the socially optimal level of output it will decrease production by:

A. 2 units.

B. 4 units.

C. 6 units.

D. 8 units.

E. 10 units.

Question 8: In a perfectly competitive world, which of the following statement is FALSE?

A. The equilibrium wage is equal to the value of the marginal product of labor.

B. To maximize profit, the firm should hire the number of workers such that MRP=W .

C. To maximize profit, the firm should produce that quantity of output where P=MC .

D. The long - run labor supply curve is less wage elastic than the short - run labor supply curve.

E. Each firm is a wage taker.

Question 9: Which of the following statements is TRUE?

A. The perfectly competitive equilibrium is allocatively efficient.

B. A perfect price discriminating monopolist produces the allocatively efficient output.

C. A monopolist always produces the allocatively efficient output.

D. Both (A) and (B) E. (A), (B), and (C)

Question 10: The Smallville City Council decides to install additional streetlights. Which of the following statements is FALSE?

A. The new system may not be implemented if the council decides to provide it through the market mechanism.

B. The Smallville residents are not l ikely to disclose the real value they place on the new system.

C. The market outcome for the provision of the new streetlight system will be efficient.

D. There will be a free rider problem in the provision of the new streetlight system.

E. In order to find the mar ket demand for the streetlight system, the city council needs to add the residents’ individual demands for streetlights vertically.

Use the following information to answer Questions 11 and 12: Hally produces watches in a perfectly competitive output market and hires labor in a perfectly competitive market. The price of a watch is $5. As Hally hires more workers, watches are produced according to the following production function.

Workers hired/week Watches produced/week

1 10

2 15

3 19

4 22

5 24

6 25

Question 11: What is the marginal revenue product (MRP) of the second worker hired?

A. 10

B. 20

C. 25

D. 100

E. 150

Question 12: Suppose we know there is another watchmaker named Joe, and the wage at Joe’s firm is $17.50 per week. Assume that both the output m arket and the labor market are perfectly competitive. How many workers will Hally hire?

A. 1

B. 2

C. 3

D. 4

E. 5

Question 13: Which of the factors below will cause the market labor demand curve to shift?

A. Demand for the firm’s output changes.

B. The price of a complement ary input changes.

C. The price of a substitute input changes.

D. The number of firms in the market changes.

E. All of the above.

Question 14: What is the equilibrium outcome in the following game?

Player 2

Left Right

Player 1 Up 10,10 - 3,15

Down 15, - 3 0,0

A. Up, Left

B. Down, Left

C. Up, Right

D. Down, Right E.

The game does not have an equilibrium.

Question 15: What are the dominant strategies for each player in the following game?

Player 2

Left Right

Player 1 Up 100,10 - 3,150

Down 15,- 30 20,0

A. Player 1: Up, Player 2: Left

B. Player 1:Down, Player 2: Right

C. Player 1: No dominant strategy, Player 2: Right

D. Player 1: No dominant strategy, Player 2: No dominant strategy

E. Player 1: Up, Player 2: No dominant strateg

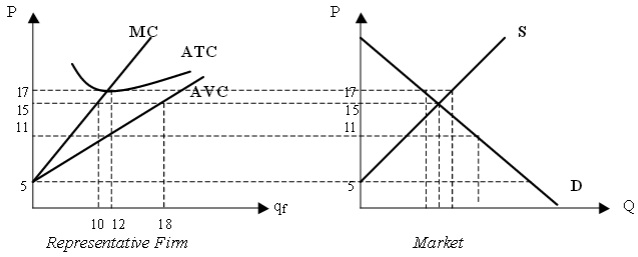

Use the following figure to a nswer Question 16, Question 17, and Question 18

The graph above depicts the perfectly competitive market for carrots. The panel on the left shows the cost structure of a representative firm and the pa nel on the right shows the demand and supply conditions in the market. There are 200 carrot suppliers in the market. Assume this is a constant cost industry.

Question 16: The short run equilibrium quantity in the market is ________ and the short run equil ibrium price is ________ . Each firm supplies ________ carrots and makes _________ economic profits in the short run.

A. 2000, 15, 10, negative

B. 2400, 17, 12, zero

C. 2000, 11, 10, positive

D. 3600, 15, 18, negative

E. 2400, 11, 12, zero

Question 17: Which of the fol lowing statements is TRUE?

A. In the long run, the number of carrot suppliers in the market will be more than 200.

B. In the long run, the price of carrots will increase.

C. In the long run, the quantity of carrots supplied by each firm will decrease.

D. Both (A) an d (B)

E. (A), (B), and (C)

Question 18: Which of the following statements is TRUE?

A. The marginal cost curve for each firm is given by MC = Q + 5 .

B. The short run market supply curve is given by P = (1/200)Q + 5 .

C. In the short run, the carro t suppliers will continue production as long as they can cover their variable costs.

D. The breakeven point for the firm is given by qf = 12.

E. All of the above

Question 19: In a perfectly competitive market,

A. all firms are price setters.

B. each firm produces s imilar but differentiated products.

C. price equals ATC in the short run.

D. price equals marginal revenue only in the long run since firms do not have any fixed costs.

E. the consumer surplus is maximized.

Question 20: Which of the following statements is TRUE ?

A. In order to maximize profits a firm has to set MR equal to price.

B. In order to maximize profits a firm has to set MR equal to MC .

C. In order to maximize profits a firm has to set MC equal to ATC .

D. In order to maximize profits a firm has to set ATC equal to price.

E. In order to maximize profits a firm has to set MC equal to price.

Question 21: An apple grower has a total cost function given by the equation TC = 10 + 8Q where Q is measured in pounds. The market for apples is perfectly competitive. The price of a pound of apples is ________ when the market is in equilibrium.

A. $10

B. $18

C. $8

D. $12

E. Cannot be derived from the given information.

Question 22: Which of the following statements is an example of a positive externality?

A. Joon smokes in the cla ssroom o n a rainy day .

B. When the price of notepads increases, Miaojie buys fewer pencils .

C. Vien drinks coffee in the college library when s he is studying.

D. Oya buys cheese instead of butter when the price of butter increases.

E. Rocky cleans the entry way to his apartment building

Question 23: The market demand curve for good X is given by P = 300 - 0.1QD . The market is a perfectly competitive market with 100 identical firms. The marginal cost equation for a representative firm given by MC = 20Q . Which of the following statements is TRUE?

A. The equilibrium price is $200 and quantity is 1000 units.

B. If all 100 firms in the market are acquired by a big firm which will act like a perfect price discriminating monopolist in this industry, the equilibrium price would be $200 and quantity would be 1000 units.

C. The consumer surplus in the market, if it is perfectly competitive, is $50,000.

D. The consumer surplus in the market, if all 100 firms are acquired by a perfect price discriminating monopolist , is zero.

E. All of the above.

Question 24: Which of the following statement s is TRUE ?

A. A subsidy for the producer of a positive externality would increase the private cost of production.

B. The marginal social cost is greater than the marginal private cost for negative production externalities.

C. The marginal social benefit is greater than the marginal private benefit for negative consumption externalities.

D. Goods with negative production externalities are underproduced from the view point of the society .

E. A tax on the producer of negative externalities would de crease the private cost of production.

Question 25: Which of the following statement s is FALSE ?

A. Private goods are goods for which people can be excluded fr o m using it and one person ’ s consumption preven ts another person ’s consumption.

B. The optimal provision of public goods is determined at the point where the marginal cost to society equals the marginal benefit to society.

C. The government can assign property rights or levy taxes to get rid of externalities .

D. A tax on the producer of a negative externality would decrease the private cost of production.

E. Positive externalities are benefits gained by third parties who don't pay for the consumption or production

Use the following information to answer Question 26 and 27: Joe, Sally and Mike live on the same street. Joe’s demand curve for snowplowing is

P = 100 - 2Q

where Q is the number of hours of snowplowing. Suppose Mike and Sally falsely report their demand for snowplowing as

P = 5 - 2Q

(this represents Sally and Mike’s individual demands for snowplowing). In reality, Sally and Mike have the same demand for snowplowing as does Joe (but they don’t choose to reveal it!).

Assume MC = 8.

Question 26: Sally and Mik e would like to

A. pass a positive externality along to Joe.

B. share the economic incidence of snowplowing with Joe.

C. free ride on Joe.

D. pass a negative externality along to Joe. E. benefit from the fact that snowplowing is rival but non - excludable.

Question 27 : If Sally and Mike do not reveal their true demands for snowplowing and the good is provided publicly (assume the allocatively efficient output is produced), then the equilibrium price and the equilibrium quantity will be

A. $8 and 16.2 hours.

B. $8 and 18 ho urs.

C. $8 and 40.5 hours.

D. $8 and 43 hours.

E. $8 and 46 hours.

Question 28: Monopolistically competitive industries are characterized by all of the following EXCEPT

A. a small number of firms.

B. zero economic profit in the long run.

C. differentiated products.

D. excess productive capacity.

E. free entry and exit

Question 29: If there is free entry in monopolistic competition, which of the following statements is TRUE?

A. The demand curve facing a given firm will become more elastic as more firms enter the market.

B. The demand curve for the monopolistically competitive firm will shift inward with entry of new firms. We would expect that at each price the firm would sell fewer units of output as more firms enter the industry.

C. The demand curve for the monopolistically com petitive firm will shift outward as consumer preferences for more variety will increase the demand for the good.

D. Economic profits are positive for each firm.

E. Both (A) and (B).

Question 30: A collusive agreement is not enforceable because:

A. a firm has an incentive to deviate because marginal revenue is greater than marginal cost.

B. a firm will earn higher economic profits when it deviates from the collusive output.

C. a firm will earn lower economic profits when it deviates from the collusive output.

D. Both (A ) and (B).

E. Both (A) and (C).