Question 1: Heather consumes two goods: pencils and envelopes. In 1998, Heather had $10 to spend and in 1998 the price of a pencil was $1and the price of an envelope was $2. In 1999, Heather had $40 to spend and in 1999 the price of a pencil was $4 and the price of an envelope was $2. Suppose that we plot pencils on the horizontal axis and envelopes on the vertical axis. Heather’s 1999 budget line has a greater horizontal intercept and a greater vertical intercept than her 1998 budget line.

A. True B. False

Question 2: If no close substitute for butter (such as margarine) existed, the demand for butter would be more inelastic.

A. True B. False

Question 3: If my price elasticity of demand for good X is – 0.25, then a decrease in the price of good X will reduce my consumer expenditure on this good.

A. True B. False

Question 4: Tom consumes only three goods: food (F), clothing (C), and entertainment (E). The prices of these three goods are PF, PC and PE respectively. Tom’s income is denoted by I . If PF.F - I < PC.C - PE.E , then Tom is not spending his entire income.

A. True B. False

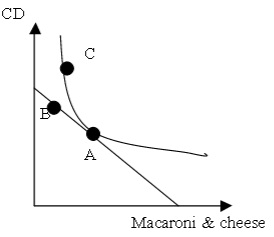

Question 5: Alice consumes two goods: CDs and generic macaroni and cheese. The following graph shows Alice’s budget line and one of her indifference curves:

Irrespective of income and prices, Alice prefers bundle A to bundles B and C.

A. True B. False

PART II: MULTIPLE CHOICE QUESTIONS

Question 6: A local power company raises the price of electricity. The price increase will increase the company’s revenues:

A. no matter what the elasticity of demand for electricity is.

B. only if the demand for electricity is elastic.

C. only if the demand for electricity is inelastic.

D. only if the demand for electricity is unit elastic.

E. we don’t know whether the company’s revenue will increase even if we know the price elasticity of demand.

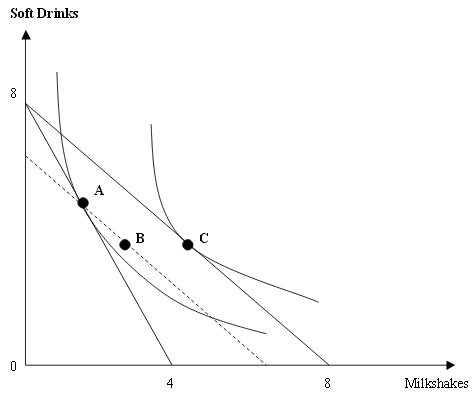

Question 7:

Ed’s budget and preferences are shown in the graph above. (The graph is not necessarily drawn to scale.) He has $8 per week to spend on soft drinks and milkshakes. Initially, the price of a soft drink is $1, and the price of a milkshake is $2. Given these prices, Ed chooses to consume bundle A. However, after a couple of weeks, the price of a milkshake decreases to $1, and Ed chooses bundle C instead. Which of the following statements is TRUE ?

A. The income effect is from point A to point B.

B. The income effect is from point C to point A.

C. The income effect is f rom point B to point C.

D. The substitution effect is from point B to point C.

E. The substitution effect is from point A to point C.

Question 8: If good X is inferior, the income elasticity of good X will be:

A. 0

B. 0.5

C. 1

D. negative

E. positive

Question 9: The market for rice has a VERY INELASTIC demand while the price elasticity of supply is 1. Suppose the government imposes an excise tax on the producers of this market. Which of the following statements is TRUE ?

A. The economic burden of the tax falls on producers and consumers equally.

B. The consumers bear most of the economic burden of the tax.

C. No matter how inelastic the demand curve is, the seller must bear most of the economic burden of the tax.

D. The tax on this good results in relatively large tax revenues while simultaneously discouraging consumption of the good.

E. (B) and (D)

Question 10 : Suppose the market for corn (quantities in tons) has the following demand and supply functions:

Supply: P = Q

Demand: P = 12 - 2Q

Now the government considers implementing either a price support program or a price subsidy program. Suppose the price support program has a price floor of $5 while the subsidy program has a guaranteed price of $5. Which of the following statements is TRUE ?

A. Under the price support program the government needs to buy 0.5 tons of corn from the producers.

B. Under the subsidy program the maximum price the government can RESELL the corn to the consumers is $5.

C. The cost for the government to implement the price support program is $20.

D. The cost for the government to implement the subsidy program is $20.

E. If we only compare the direct expenditure of the government for these two programs, the subsidy program costs more.

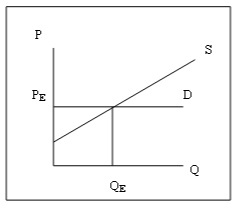

Question 11: The market for a specific brand of sugar is shown in the following figure. In this figure, the demand curve is a horizontal line and the supply curve is a straight line with a positive slope.

PE is the equilibriu m price BEFORE the tax and QE is the equilibrium price BEFORE the tax. Suppose the government wants to impose an excise tax on the producers of this brand of sugar, which is $1 per pound. Which of the following statements is TRUE ?

A. There must be a loss in consumer’s surplus after the tax is imposed.

B. The consumers bear an economic share of the tax even if the producers have the legal responsibility to collect the tax.

C. The producers bear the whole economic burden of the tax.

D. There is no deadweight loss; tha t is, this tax is efficient.

E. Tax revenues will increase if the government raises the level of the excise tax.

Question 12: Emily spends her entire income on movies and popcorn. The price of a movie is $8 and the price of popcorn is $2. At these prices, Emily chooses her optimal bundle, which is (4 movies, 2 popcorn). Assuming that we plot movies on the horizontal axis and popcorn on the vertical axis, what is the slope of the indifference curve at the optimal bundle?

A. – 4

B. – 1/4

C. – 2

D. – 1/2

E. None of the above.

Question 13: The following figure provides a graph of an individual’s budget line for two goods, apples and bananas. The graph is not necessarily drawn to scale.

Which of the following is TRUE ?

A. The price of an apple is $4 and the price of a banana is $12.

B. The price of an apple is $4 and the price of a banana is $8 .

C. The price of an apple is $10 and the price of a banana is $5.

D. The price of an apple is $5 and the price of a banana is $10.

E. The price of an apple is $12 and the price of a banana is $4

Question 14: Al eats only burgers and fries. In a regular fast food place, the price of a burger is $2.00 and the price of a basket of fries is $1.00. At his current consumption bundle, Al’s marginal utility of consuming 1 more burger is 20 and his marginal utility of consuming 1 more basket of fries is 15. Given this inf ormation, which of the following is FALSE ?

A. Al’s current consumption bundle maximizes his utility.

B. In order to maximize his utility, Al should consume more burgers and fewer fries.

C. Al’s total utility is 35 at his current consumption bundle.

D. (A) and (B)

E. (A) , (B) and (C)

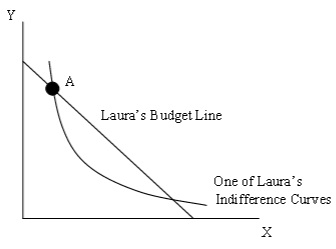

Question 15: Laura is contemplating consuming bundle A in the figure below:

Given the information in the figure, which of the following statements is TRUE?

A. Point A is Laura’s optimal bundle since the indifference curve intersects the budget line at point A.

B. At point A, the slope of the indifference curve equals the slope of the budget line.

C. Laura can find another point that she can afford such that this new point is on a higher indifference curve than the indifference curve drawn in the figure.

D. Laura is not using all of her income at point A.

E. At point A, the marginal utility of spending one more dollar on good X equals the marginal utility of spending one more dollar on good Y.

Question 16: Using the information in the table below, which of the following statements is TRUE ?

Year CPI Nominal Wage

1980 100 (base year) $6/hour

1990 200 $10/hour

2000 300 $12/hour

A. The real wage is increasing from 1980 to 2000.

B. The real wage is decreasing from 1980 to 2000.

C. The real wage in 1990 is $8/hour.

D. The real wage in 2000 is greater than the nominal wage in 2000.

E. (A) and (D)

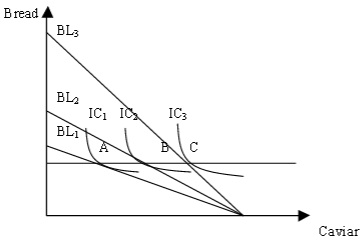

Question 17:

In the graph above, Bob’s three indifference curves (IC1, IC2, and IC3) are drawn along w ith three budget lines (BL1 , BL2 , and BL3). Bob’s income is the same in all three budget lines, however, the price of bread is different in each case. Which of the following statements is FALSE ?

A. Bob’s demand for bread is perfectly elastic.

B. Bob prefers bun dle B to bundle A.

C. If Bob’s budget line is BL3, Bob maximizes his utility by choosing bundle C.

D. The price of bread implied by BL2 is greater than the price of bread implied by BL1 but smaller than the price of bread implied by BL3.

E. (A) and (D)

PART III: PROBLEM

Please write legibly. Make sure to show ALL your work. You may not receive any credit if you fail to show your work. Put your answers in the blanks provided. The demand and supply equations for widgets are given as:

Demand: P = 12 - QD

Supply: P = 2QS

A. Find the equilibrium price and quantity in the widget market.

The equilibrium price is: _____

The equilibrium quantity is: _____

B. An excise tax of $3/unit is levied on the producers of widgets. Find the new equilibrium price and quantity. What is the amount of tax revenues generated?

The new equilibrium price is: ____

The new equilibrium quantity is: ____

Tax revenues: ___

C. Suppose instea d of the initial supply curve, the supply curve is given by: P = (1/2)QS.

The demand curve is still the same as before. Find the equilibrium price and quantity. What will be the equilibrium price and quantity if an excise tax of $3/unit is levi ed on widgets in this case? What will be the tax revenues?

The equilibrium price before tax is: ____

The equilibrium quantity before tax is: ____

The equilibrium price after tax is: ____

The equilibrium quantity after tax is: ____

Tax Revenues:____

D. Compare the economic burden of the tax in part (B) to that in part (C).

Hint: In your answer make sure you consider the relative magnitude of the economic burden for consumers and producers in each case. Discuss why these differen ces might arise.