Assignment:

Introduction

Jan Ricter is the new Vice President of Human Resources for Keller Technology Inc. (KTI). Jan has been with the company since its inception and has continually performed well and was promoted to her current position a few months ago. Last week, Jan was part of an offsite executive committee meeting in which overall cost reductions again surfaced as a major issue. The decision to significantly reduce human capital costs (by 25%) was ultimately made. Jan knows that it is important to balance business efficiency considerations with compassion for employees who may lose their jobs after many years with KTI.

Additionally, Jan is concerned about the long-term success of the organization, the culture, and the morale and performance of the employees who remain in the event of a reduction in force (RIF). She knows that the road ahead will be rough and that it will be her responsibility to ensure that the organization navigates that road with care in order to maintain profitability. Jan is also struggling with the feeling that KTI does not need a RIF, or at least not a major one, to turn the company around and become profitable again.

Had she only paid more attention in her Organizational Behavior and Organizational Development classes while attending ETSU's College of Business and Technology, she might know exactly how to move forward. Fortunately, she still remembers enough to know that a RIF is usually the path of least resistance, but rarely the best one to take.

Keller Technology Inc. History

KTI, headquartered in San Jose, CA, was established in 1992 during the dot-com boom. It competes in the computer storage industry, specifically offering a tape drive portfolio of products which provides backup and recovery capabilities to organizations. About 18-months ago, KTI introduced a network attached product: a server dedicated to file sharing. KTI went public in 1998. It is publicly traded on the NASDAQ under the ticker symbol KTI. Over the past 10 years, the stock price has increased in value from $10.25 to a peak of $65.33 in 2014. Since then, the stock price has steadily declined and is currently trading around $33.00 per share. When it went public, KTI had a workforce of 100 employees.

Today, KTI has a workforce of approximately 1,500 regular employees and 150 part-time workers (not including the four member executive team and their support staff). The company's culture has historically been very employee-friendly. For example, even though private pension plans have all but become extinct, KTI provides a pension plan. This defined benefit retirement plan was established to provide a strong base for building retirement security for all KTI employees, including part-time workers.

Benefits under this plan is funded 100 percent by KTI with no contribution made by the employee (although they can contribute to a 401k). KTI contributes 10% of an employees' gross pay to the retirement plan yearly. Bob Cuellar, KTI's CEO, consistently tells employees, shareholders, and the press that "KTI is successful only because we have the most talented, well-trained, and rewarded employees in the industry." Due to its treatment of employees, KTI has been able to avoid the unionization of its workforce. However, because of the uncertain climate in the high-tech industry and rumors of a RIF, talk of unionization has arisen in the past year.

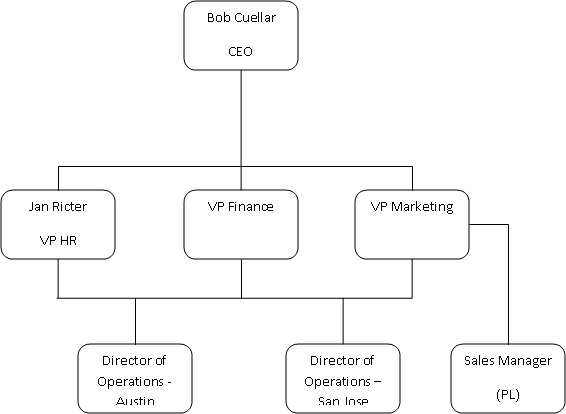

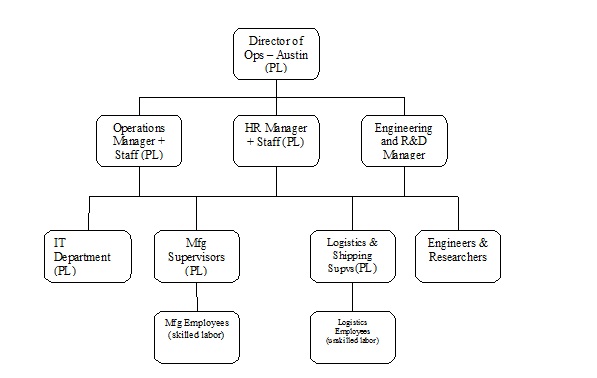

KTI's workforce has grown significantly since 1998, but has only remained steady over the past 5 years. KTI has two sites, headquarters and tape storage manufacturing in San Jose, CA, which employees about 70% of its workforce, and another site opened in 2015 in Austin, Texas which manufactures the attached storage units. A partial organization chart is provided.

Current Financial/Market Pressure

KTI has lost revenue and market share over the past three years. Sales of tape storage units are down 35% over the same time last year. Although attached storage units only comprise 20% of KTI's revenue, sales of attached storage units are up 25% over the same time last year. Thus, disappointing third-quarter results have just been reported, and the executive team held a three-day offsite meeting to discuss the current status and future strategy.

To turn revenues around in to the black, management believes that a reduction in human capital may be needed. Management is appropriately nervous that to turn KTI's market position around in a reasonable timeframe, they may have to implement a RIF in addition to any other human capital cost reductions.

A Difficult Reality

The executive team has determined that they must reduce human capital costs by approximately 25% per year while maintaining their current level of production. With the possibility of the agonizing decision to actually initiate a layoff, Jan considers a variety of criteria to determine who to layoff to reach the cost reduction target. She realizes that determining the selection criteria is one of the single most important things to consider. Jan also realizes that the methodology and decisions should be legally defensible to minimize the potential for litigation. Just as with any employment decision, RIFs must be made with the appropriate laws and guidelines in mind.

Assignment for Consulting Teams of MGMT 4020

Consulting Request

To make sure the Human Capital reduction efforts and/or a RIF process goes smoothly, Jan has contacted you for help. Jan wants to hire your team for several things. First, Jan needs help determining the right mix of human capital reduction and/or RIF strategies for KTI, taking into consideration the various important aspects outlined in the case.

Thus, your team's job is to determine and recommend a downsizing mix that Jan can employ to execute the RIF if that solves the true problem KTI has. You must be able to support your decisions through the facts in the case, additional resources, and by making some logical conclusions in the absence of solid facts. However, before you can reach a decision on the RIF, you must first figure out if an overrun in human capital costs is the ‘real' problem.

Additional Requirements

The Survivors

After the actual layoff, Jan knows that it is important to help the organization, especially the tape storage unit, return to normalcy and productivity. To help re-engage the surviving employees, it is critical that the management team be visible and available to both those affected by the reductions and those who survived. Therefore, you must develop a plan that directly stems from the changes you recommended in part one. For example, if your team decides to layoff 100 skilled laborers, what exact activities are you going to implement to offset the negative effects of this type of reduction?

If you have employees that take early retirement, what effects will this kind of reduction have on the organization and what activities will you initiate to overcome those effects? Thus, for each recommended reduction you must have a plan and specific activities to implement that you believe will overcome any negative effects of the reduction such as; the negative effects to surviving employees (motivation, fear of change, others), the culture, the intellectual and human resources capital, the stock price, reputation of KTI, etc.

Jan believes the RIF actually presents some rare opportunities for surviving workers and she wants them to focus on the positive aspects of being a survivor and not the negative aspects. So, how does an organization change the thinking of their employees to get them looking at a negative situation as an opportunity. Any manager can slash and burn jobs, but a leader can do this and make the organization's culture and future even stronger as a result.

NOTE: While you are given a lot of information in this case, you are not given all of the information you need to always make the best decision. This is called ‘bounded rationality' which we will discuss in class. Thus, at some point you will have to make a decision with limited information. To be a leader in any organization you must be able to make decisions even when you do not have all the facts. It is expected that not only will you have to make some decisions with limited information, but you are also expected to support those decisions in the absence of facts.