Problem 1:

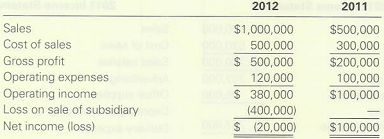

Basic Elements of Financial Reports Comparative income statements for Grammar Inc. arc as follows:

Required

The president and management believe that the company performed better in 2012 than it did in 2011. Write the president's letter to be included in the 2012 annual report. Explain why the company is financially sound and why shareholders should not be alarmed by the $20,000 loss in a year when operating revenues increased significantly.

Problem 2:

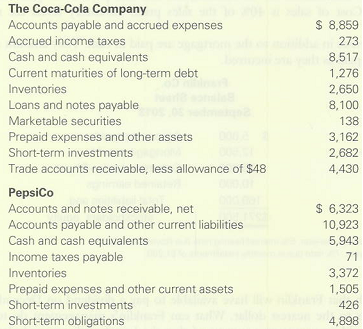

Comparing The Coca-Cola Company and PepsiCo

The current items, listed in alphabetical order, are taken from the consolidated balance sheets of The Coca-Cola Company as of December 31, 2010, and PepsiCo as of December 25, 2010. (All amounts arc in millions of dollars.)

Required

1. Compute working capital and the current ratio for both companies.

2. On the basis of your answers to (1), which company appears to be more liquid?

3. Other factors affect a company's liquidity besides working capital and current ratio. Corn-ment on the composition of each company's current assets and ways this composition affecy liquidity.