Question 1: The launch of a latest product is being considered and four possible output levels are being considered based on consumer reaction. The variable costs related with these levels are illustrated below:

Consumer reaction Adverse Average Good Excellent

Variable costs (Rs 000`s) 20 30 45 70

There are fixed costs of Rs 36,000 and the C/S ratio is expected to be 60%.

Required:

a) Compute the profit and loss at each of the four level.

b) Compute the break even in sales value.

c) Compute the level of sales at which the profit of Rs 10,000 would be made.

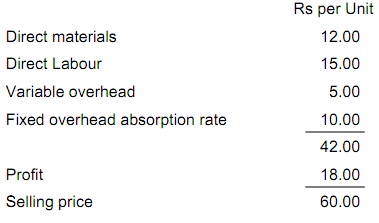

Question 2: Knight Co. manufactures a single product, Good Knight. Cost and selling price details for the product Good Knight are as shown below:

The given additional information is as well available:

Budgeted production for the month was 10,000 units though the company managed to generate 11600 units, selling 10400 of them and incurring fixed overhead costs of Rs 54800.

Required:

a) Compute the marginal costing profit for the month.

b) Compute the absorption costing profit for the month.

c) Describe how closing inventories are valued under the marginal and the absorption costing?