Please show arithmetic and/or excel functions where appropriate.

1. Recently, one-year U.S. Treasury notes have been priced @ 0.30%, two-year @ 0.60%, three-year @ 1.0%, four-year @ 1.20%, and five-year @ 1.60%. Based on pure expectations, estimate the following implied forward rates of interest.

(a). The one-year rate in one year.

(b). The one-year rate in two years.

(c). Which rate do you have more confidence in, one-year in 1 year or the one-year in two years? Why?

(d). The two-year rate in one year.

(e). The three-year rate in two years.

(f). The five-year rate in five years.

2. Identify two distinct factors (including direction of change) that could cause one-year interest rates to shift in the direction you calculated for one-year hence relative to the cash or spot market today (i.e. 0.30%).

3. Based on the implied forward rate of interest for a one-year US Treasury note computed in question 1, indicate how and why the actual or realized rate will compare to the forward rate computed based on each of the following two term structure hypotheses:

(a). Pure expectation

(b). Liquidity preference

4. Recently, ten-year U.S. Treasury notes have been priced to yield 2.30% while ten-year treasury inflation-protected securities have been priced to yield 0.45%.

(a). Derive the average, annual implied rate of inflation in the U.S. for the next decade based on the pricing of these two securities.

(b). If consumer prices rise more rapidly than projected what will the US central bank likely do? How would the change in monetary policy impact the prices of bonds?

(c). How does inflation differ from core inflation? How does inflation measured from the consumer price index differ from that measured by the personal consumption expenditure index?

5. Recently, federal funds futures contracts that settle in 2017 are priced at 98.55. The US central bank targeted the trading range of federal funds between 0.00% and 0.25% when the quote was observed and were trading at 0.10%. Estimate the probability that the central bank will increase the trading range of federal funds from 0.10% to 2.00% as of mid-year 2017.

6. Determine the effective duration and type (- / +) convexity for a 3% (semiannual payment), 10-year corporate note priced to yield 3.5% and callable at par as of year five. A callable security priced at a premium will have the yield computed to the call date whild a callable security priced at a discount will have the yield computed to the maturity date. Shock yields by +/- 1% to estimate duration and the type convexity. Use any par.

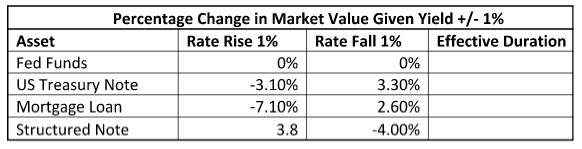

7. Estimate the effective duration of the following four assets. The chart shows the percentage change in the market value of each asset with interest rates rising or falling 1%.

8. A medium-grade firm needs $100 million of financing for five years. The firm can pay a fixed rate of 3.50% (semi-annual payment) or a floating-rate of LIBOR + 1.80% (quarterly payment). A dollar-denominated five-year swap with a fixed payment is priced at 1.75% (ask rate where the party pays 1.75% and receives three-month LIBOR) and the floating payment is priced at 1.72% (bid rate where the party pays three-month LIBOR and receives 1.72%). Three-month LIBOR is .30%

(a). ID the best method of borrowing funds fixed-rate and the effective annual yield of each alternative to borrow funds on a fixed-rate basis give one structure is semi-annual and the other is quarterly.

(b). ID the best method of borrowing funds floating-rate.

(c). What financial factors and economic factors affect the decision to borrow fixed or floating?

9. Recently, a company issued two euro-denominated securities off their global medium-term note program. The five-year, fixed-rate note pays a fixed rate of 3.00% (US custom of semi-annual payment) while the five-year floating-rate note pays the six-month EURIBOR + 130 basis points (1.30%). Five-year, euro-denominated swaps based on the six-month floating rate are priced with a fixed rate of 1.65% (asked) for fixed-rate payers and 1.60% (bid) for floating-rate payers. Is there any opportunity to achieve a higher fixed or floating yield via use of the swap market? Evaluate the transaction as an investment or asset not a financing or liability. How should the cash and swap market react, if at all, to the pricing of the two securities and swaps?