Assignment 1:

1. Classifying Cash Flows

Identify whether each of the following would be reported as an operating, investing, or financing activity on the statement of cash flows.

a. Purchase of investments

b. Disposal of equipment

c. Payment for selling expenses

d. Collection of accounts receivable

e. Cash sales

f. Issuance of bonds payable

2. Adjustments to Net Income-Indirect Method

Congress Corporation's accumulated depreciation—furniture account increased by $5,800, while $3,700 of patent amortization was recognized between balance sheet dates. There were no purchases or sales of depreciable or intangible assets during the year. In addition, the income statement showed a gain of $4,400 from the sale of land. Reconcile a net income of $65,500 to net cash flow from operating activities.

3. Changes in Current Operating Assets and Liabilities-Indirect Method

Covington Corporation's comparative balance sheet for current assets and liabilities was as follows:

Dec. 31, 2014 Dec. 31, 2013

Accounts receivable $16,000 $13,900

Inventory 55,200 64,900

Accounts payable 24,600 20,500

Dividends payable 22,000 24,000

Adjust net income of $110,500 for changes in operating assets and liabilities to arrive at net cash flow from operating activities.

4. Cash Flows from Operating Activities-Indirect Method

Malibu Inc. reported the following data:

Net income $283,600

Depreciation expense 72,500

Loss on disposal of equipment 37,200

Increase in accounts receivable 22,900

Increase in accounts payable 10,900

Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash out flows, cash payments, decreases in cash and for any adjustments, if required.

5. Land Transactions on the Statement of Cash Flows

Alpha Corporation purchased land for $386,000. Later in the year, the company sold a different piece of land with a book value of $205,000 for $180,000. How are the effects of these transactions reported on the statement of cash flows assuming the indirect method is used? Use the minus sign to indicate cash out flows, cash payments, decreases in cash and for any adjustments, if required. If a transaction has no effect on the statement of cash flows, select "No effect" from the drop down menu and leave the amount box blank.

Transactions Action Amount

Gain or loss on sale of land ___________ $ _____________

Cash received from sale of land ___________ $ _____________

Cash paid for purchase of land ___________ $ _____________

6. Effect of Transactions on Cash Flows

State the effect (cash receipt or payment and amount) of each of the following transactions, considered individually, on cash flows:

a. Sold equipment with a book value of $59,000 for $85,000.

b. Sold a new issue of $230,000 of bonds at 99.

c. Retired $340,000 of bonds, on which there was $3,400 of unamortized discount, for $354,000.

d. Purchased 6,400 shares of $25 par common stock as treasury stock at $48 per share.

e. Sold 7,000 shares of $25 par common stock for $41 per share.

f. Paid dividends of $1.50 per share. There were 26,000 shares issued and 4,000 shares of treasury stock.

g. Purchased land for $309,000 cash.

h. Purchased a building by paying $61,000 cash and issuing a $90,000 mortgage note payable.

7. Cash Flows from Operating Activities-Indirect Method

Indicate whether each of the following would be added to or deducted from net income in determining net cash flow from operating activities by the indirect method:

a. Increase in notes payable due in 90 days to vendors

b. Decrease in prepaid expenses

c. Increase in merchandise inventory

d. Loss on disposal of fixed assets

e. Decrease in accounts receivable

f. Decrease in salaries payable

g. Gain on retirement of longterm debt

h. Increase in notes receivable due in 90 days from customers

i. Depreciation of fixed assets

j. Amortization of patent

k. Decrease in accounts payable

8. Cash Flows from Operating Activities—Indirect Method

The net income reported on the income statement for the current year was $129,600. Depreciation recorded on store equipment for the year amounted to $21,400. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows:

End of the Year Beginning of the year

Cash $51,710 $47,060

Accounts receivable (net) 37,080 34,780

Merchandise inventory 50,620 52,940

Prepaid expenses 5,690 4,470

Accounts payable (merchandise creditors) 48,450 44,520

Wages payable 26,480 29,080

a. Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash out flows, cash payments, decreases in cash and for any adjustments, if required.

b. Cash flows from operating activities differs from net income because it does not use the _________ of accounting. For example revenues are recorded on the income statement when ______ .

9. Reporting changes in Equipment on Statement of Cash Flows

An analysis of the general ledger accounts indicates that delivery equipment, which cost $80,000 and on which accumulated depreciation totaled $36,000 on the date of sale, was sold for $37,200 during the year. Using this information, indicate the items to be reported on the statement of cash flows.

Transaction Section of Statement of Cash Flows Added or Deducted

$80,000 cost of office equipment

$36,000 accumulated depreciation

$37,200 sales price

$6,800 loss on sale of equipment

(assume the indirect method is used)

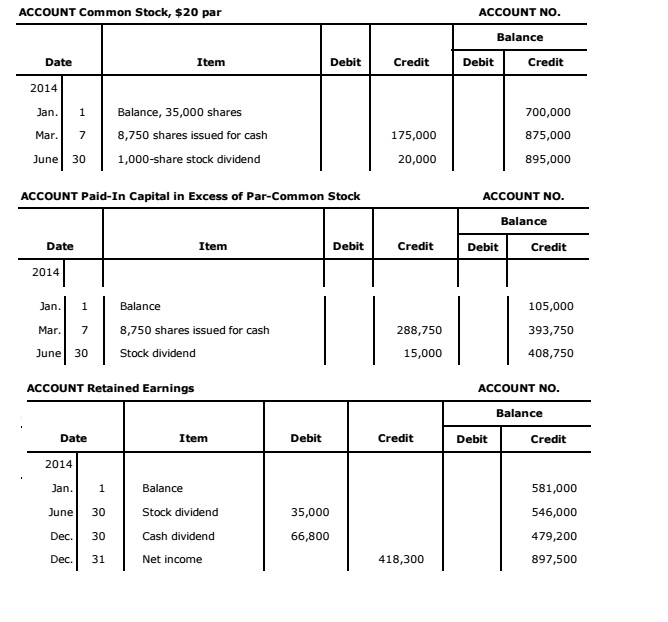

10. Reporting Stockholders' Equity Items on Statement of Cash Flows

On the basis of the following stockholders' equity accounts, indicate the items, exclusive of net income, to be reported on the statement of cash flows. There were no unpaid dividends at either the beginning or the end of the year.

If an amount is not reported on the statement of cash flows, enter in "0" in the Amount column.

Item Section of Statement of Cash Flows Added or Deducted Amount

Sale of common stock

Cash dividend

Stock dividend

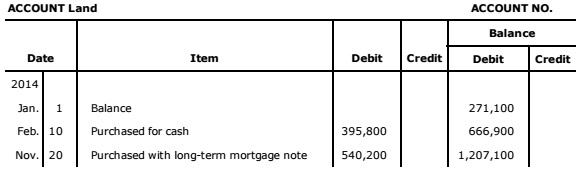

11. Reporting Land Acquisition for Cash and Mortgage Note on Statement of Cash Flows

On the basis of the details of the following fixed asset account, indicate the items to be reported on the statement of cash flows:

Item Section of Statement of Cash Flows Added or Deducted Amount

Purchase of land for cash

Purchase of land by issuing

longterm mortgage note

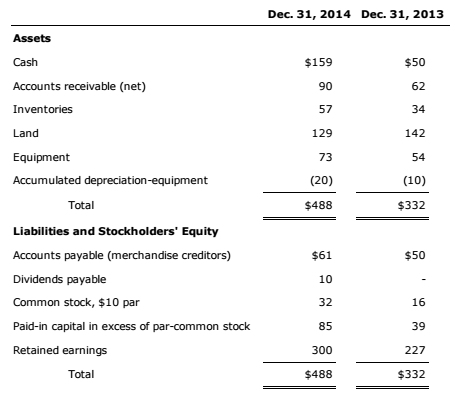

12. Statement of Cash Flows—Indirect Method

The comparative balance sheet of TruBuilt Construction Inc. for December 31, 2014 and 2013, is as follows:

The following additional information is taken from the records:

1. Land was sold for $33.

2. Equipment was acquired for cash.

3. There were no disposals of equipment during the year.

4. The common stock was issued for cash.

5. There was a $105 credit to Retained Earnings for net income.

6. There was a $32 debit to Retained Earnings for cash dividends declared.

a. Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Use the minus sign to indicate cash out flows, cash payments, decreases in cash and for any adjustments, if required.

b. Was TruBuilt Construction Inc.'s cash flow from operations more or less than net income?

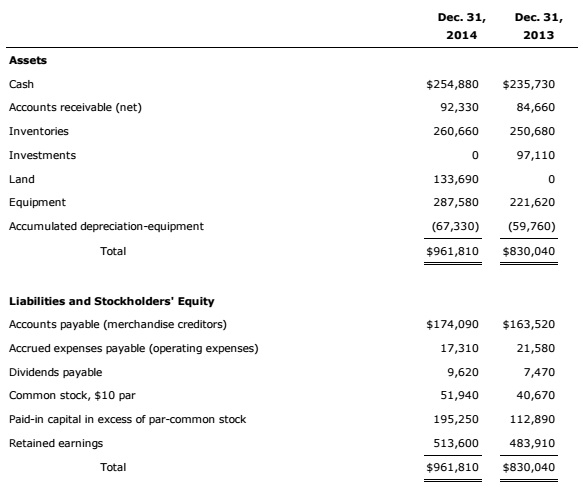

13. Statement of Cash Flows—Indirect Method

The comparative balance sheet of Mavenir Technologies Inc. for December 31, 2014 and 2013, is shown as follows:

The following additional information was taken from the records:

a. The investments were sold for $113,620 cash.

b. Equipment and land were acquired for cash.

c. There were no disposals of equipment during the year.

d. The common stock was issued for cash.

e. There was a $68,700 credit to Retained Earnings for net income.

f. There was a $39,010 debit to Retained Earnings for cash dividends declared.

Required:

Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Use the minus sign to indicate cash out flows, cash payments, decreases in cash and for any adjustments, if required.