Assignment:

PROJECT AND REPORT

Select one mutual fund from each of three different firms. Acquire infonnation about the fiords, their policies, their costs, etc. Track and graph the value(s) of the funds from starting week 2 through ending week 11. Determine your before-tax rate of return on each of the funds (including your costs of investment). Assess the relative performance of each of the funds.

Note: There are a large number of sites on www from which information and guidance can be acquired. For example, you will find several sites if you use the key word "mutual find" and "investment" in the search engine of Google or Yahoo.

A one-page Project Status Report is due on week ending 5. This is mandatory for every student to submit it and will not be graded. It is used to monitor your prowess. If you miss the deadline, you will lose the grade for final report. The report should briefly describe the work accomplished to date. The report must be typed.

The final Project Report is due on week ending 12, and should include:

• Abstract (one paragraph)

• Description of Purpose (maximum one paragraph)

• Statement of Process (maximum one page)

• Presentation and Discussion of Results (maximum four pages)

• Appendixes (to include copy of status report plus supporting documentation, including references as appropriate)

1. The report must be typed, double-spaced, using an easily-read font with standard margins, on 8-1/2" x 11: paper.

2. It is expected that proper English grammar, spelling and sentence structure will be used.

3. The report should be stapled in the upper-left-hand corner and no covers or bindings should be used

4. Spreadsheets should be used for data analysis, and graphical representations must be computer-generated.

5. It is a fundamental principle of academic integrity that the authorship of the intellectual content of work that is submitted as part of a class assignment must be fairly represented. Contributions of language and thought must be appropriately credited; submissions that do not do so are not acceptable.

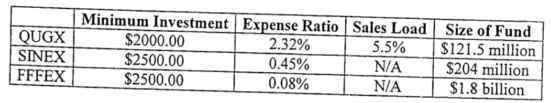

The group has focused on three mutual funds for the analysis in this report: Quaker Investment Aggressive Trust (QUAGX) from the Quaker Funds, S&P500 Index Fund (SINEX) from the Strong Funds, and the Fidelity Freedom 2030 Fund (FFFEX) from the Fidelity Funds. Over the course of the project, the group will be charting weekly price per share values for each fund. A chart of the price per share for each fund is attached to this status report. These prices will be used to determine the values of a hypothetical investment in each fund. The goal is to track the before-tax rate of return for each fund and to use the tools that have been learned in the course to assess their relative performance. To make a proper analysis, such costs as sales loads and management expense fees will have to be considered. Close attention will also be paid to fund policies such as minimum balances, as well as penalty fees that could be assessed.

An initial breakdown of each fund is as follows:

The minimum initial investments for each fund require us to use at least $2500.00 as our initial costs. Cash flow analysis will be included in the final report to account for these initial costs, as well as for any fees (negative cash flow) or dividends (positive cash flow) during the analysis period from February 18, 2002 to April 12, 2002. The overall goal of the final report is to use the methods learned in the course to illustrate which fund performed the best for the 8-week period.