Problem 1. Consider the demand in the fish market

Price Quantity Demanded

1 9

2 8

3 7

4 6

5 5

6 4

7 3

8 2

9 1

10 0

i) Compute the price elasticity when the price changes from $6 to $5(use the arc elasticity formula). What is the change in total revenue from this price change?

ii) Compute the price elasticity when the price changes from $4 to $5(use the arc elasticity formula). What is the change in total revenue from this price change?

iii) Which range of price makes total revenue increase when price increases? Which range of price makes total revenue increase when price decreases?

iv) Which price yields the highest total revenue?

Problem 2. Consider the following two markets with different demand functions but similar supply functions.

QD1 = 10 - P

QD2 = 30 - 5P

QS = P

Now suppose that government levies a tax of $1.2 per unit on consumers.

i) Find the new equilibrium price and quantity after the tax in both markets.

ii) Which market has higher tax revenue?

iii) Compare tax incidence for consumers and producers in the two markets.

iv) Use the concept of price elasticity to explain the differences in tax incidence you found in the two markets.

Problem 3. Consider the following markets for pharmaceutical drugs and cosmetic products. Assume that both markets have identical supply curves and that the initial equilibrium price and quantity are the same in both markets (this is a bit contrived, but we want to focus on the effect of demand elasticity in this question).

a) Pharmaceutical drugs with inelastic demand

b) Cosmetic products with elastic demand

Suppose that there is a technology advance which doubles supply in both markets.

i) Which market has a larger change in quantity? Which market has a larger change in price?

ii) When the supply curve shifts, which producer is better off in terms of revenue?

iii) Suppose an excise tax of the same amount per unit was placed on the products in both markets. In which market is the deadweight loss the greatest?

Problem 4. A 10 percent increase in the price of hamburgers decreases the demand for soft drinks by 50 percent. What can we know from this information?

a. demand for hamburgers is perfectly inelastic

b. hamburgers and soft drinks are substitute goods

c. hamburgers and soft drinks are complement goods

d. hamburgers are inferior goods

Problem 5. A 10 percent increase in income decreases the demand for bus tickets by 3 percent. What can we know from this information?

a. bus tickets are normal goods

b. bus tickets are inferior goods

c. demand for bus tickets is price elastic

d. demand for bus tickets is price inelastic

Problem 6. Which of the following statements is true?

a. When supply is relatively inelastic, the deadweight loss from an excise tax is relatively large.

b. When demand is relatively elastic, the deadweight loss from an excise tax is relatively large.

c. When supply is more elastic than demand, the tax incidence falls more heavily on producers than on consumers.

d. When demand is more elastic than supply, the tax incidence falls more heavily on consumers than on producers.

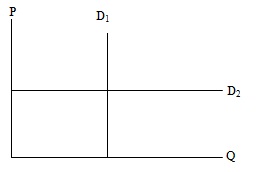

Problem 7. Consider the two demand curves depicted in the graph below. Suppose that the supply curve shifts right. Which statement is true?

a. In market 1, the equilibrium price decreases, the equilibrium quantity increases, and total revenue decreases.

b. In market 2, the equilibrium price decreases, the equilibrium quantity increases, and total revenue increases.

c. In market 1, the equilibrium price does not change, but the equilibrium quantity increases and total revenue increases.

d. In market 2, the equilibrium price does not change, but the equilibrium quantity increases and total revenue increases.