CASE STUDY

PART 1

Axolotl Corporation (a small company from Eastern Washington) is currently producing avionic parts and equipment for use in both commercial airlines and the military. The company is considering an expansion project that will permit the company to fulfill the contracts. The CFO of the company has requested an analysis of the project for its acceptance. An expansion of production and testing capabilities will be required for the above project to be correctly implemented. The following report consists of a capital budgeting analysis of the project to establish whether or not the project is financial possible. The analysis is divided into four parts: NPV, IRR, Payback Period and Profitability index. Each of these is calculated individually below:

|

NET PRESENT VALUE ANALYSIS

|

|

|

Net Present Value of the project is worked out in the schedule given below:

|

(*The amounts are expressed in millions here due to space constraints.)

|

|

|

|

|

|

|

|

(Amount in Million $)

|

|

Year

|

0

|

1

|

2

|

3

|

4

|

5

|

6

|

7

|

8

|

9

|

10

|

|

Sales

|

0.00

|

55.00

|

56.65

|

58.35

|

60.10

|

61.90

|

63.76

|

65.67

|

67.64

|

69.67

|

71.76

|

|

Less: COGS

|

0.00

|

-34.10

|

-35.12

|

-36.18

|

-37.26

|

-38.38

|

-39.53

|

-40.72

|

-41.94

|

-43.20

|

-44.49

|

|

Gross Profit

|

0.00

|

20.90

|

21.53

|

22.17

|

22.84

|

23.52

|

24.23

|

24.96

|

25.70

|

26.48

|

27.27

|

|

Less: Sales, general and administrative exp.

|

0.00

|

-5.50

|

-5.50

|

-5.50

|

-5.50

|

-5.50

|

-5.50

|

-5.50

|

-5.50

|

-5.50

|

-5.50

|

|

Less: Depreciation of Equipment

|

0.00

|

-13.29

|

-22.78

|

-16.27

|

-11.62

|

-8.30

|

-8.30

|

-8.30

|

-4.15

|

0.00

|

0.00

|

|

Less: Depreciation of Building

|

0.00

|

-0.51

|

-0.51

|

-0.51

|

-0.51

|

-0.51

|

-0.51

|

-0.51

|

-0.51

|

-0.51

|

-0.51

|

|

EBT

|

0.00

|

1.60

|

-7.26

|

-0.11

|

5.21

|

9.21

|

9.92

|

10.64

|

15.54

|

20.46

|

21.26

|

|

Less: Tax @ 35%

|

0.00

|

-0.56

|

2.54

|

0.04

|

-1.82

|

-3.22

|

-3.47

|

-3.72

|

-5.44

|

-7.16

|

-7.44

|

|

EAT

|

0.00

|

1.04

|

-4.72

|

-0.07

|

3.39

|

5.98

|

6.45

|

6.91

|

10.10

|

13.30

|

13.82

|

|

Add: Depreciation of Equipment

|

0.00

|

13.29

|

22.78

|

16.27

|

11.62

|

8.30

|

8.30

|

8.30

|

4.15

|

0.00

|

0.00

|

|

Add: Depreciation of Building

|

0.00

|

0.51

|

0.51

|

0.51

|

0.51

|

0.51

|

0.51

|

0.51

|

0.51

|

0.51

|

0.51

|

|

Operating Cash Flow

|

0.00

|

14.84

|

18.57

|

16.71

|

15.51

|

14.80

|

15.26

|

15.73

|

14.76

|

13.81

|

14.33

|

|

Acquisition and Installment of Equipment

|

-93.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

|

After Tax Salvage Value of Equipment

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

1.63

|

|

Acquisition of Building

|

-20.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

|

After Tax Market Value of Building

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

12.36

|

|

Net Working Capital Adjustment

|

-13.75

|

-0.41

|

-0.42

|

-0.44

|

-0.45

|

-0.46

|

-0.48

|

-0.49

|

-0.51

|

-0.52

|

17.94

|

|

Net Yearly Cash Flows

|

-126.75

|

14.43

|

18.14

|

16.27

|

15.06

|

14.34

|

14.78

|

15.24

|

14.26

|

13.29

|

46.25

|

|

P.V. Factor of 15%

|

1.0000

|

0.8696

|

0.7561

|

0.6575

|

0.5718

|

0.4972

|

0.4323

|

0.3759

|

0.3269

|

0.2843

|

0.2472

|

|

P.V. of Cash Flows

|

-126.75

|

12.55

|

13.72

|

10.70

|

8.61

|

7.13

|

6.39

|

5.73

|

4.66

|

3.78

|

11.43

|

|

Net Present Value

|

-42.05

|

|

|

|

|

|

|

|

|

|

|

Notes and Workings:

1) Depreciation rates used for equipment as per MACRS 7-years schedule:

14.29%, 24.49%, 17.49%, 12.49%, 8.93%, 8.92%, 8.93% and 4.46%

2) Depreciation on Building = $20,000,000 / 39 years = $512,820.51 per year

3) Investment in net working capital will be made in the very beginning of each year. Entire NWC will be recovered in year 10.

4) After tax salvage value of equipment = Salvage Value - ((Salvage Value - Book Value) Tax)

= 2,500,000 - ((2,500,000-0)0.35)

= 2,500,000 - (2,500,000 x 0.35)

= 2,500,000 - 875,000

= $1,625,000

5) After tax salvage value of building = Market Value - ((Market Value - Book Value) Tax)

Book value = 20,000,000 -Total Depreciation of 10 years

= 20,000,000 - 5,128,205.10

= $14,871,794.90

After tax salvage value = 11,000,000 - ((11,000,000-14,871,794.90)0.35)

= 11,000,000 - (-3,871,794.90 x 0.35)

= 11,000,000 + 1,355,128.21

=$12,355,128.21

|

INTERNAL RATE OF RETURN

|

|

|

|

|

|

IRR has been calculated using trial and error method and excel formula:

|

|

|

|

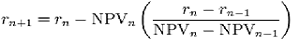

a) Internal Rate of Return has been calculated using trial and error method below:

|

|

|

|

Under trial and error method, first of all, two trial rates of return will be find out where asset's NPV is nearest to 0.

|

|

Here, those two rates are:

|

|

|

|

|

|

At 6% discounting rate, NPV =

|

$2,366,853.54

|

|

|

|

|

At 7% discounting rate, NPV =

|

|

|

|

|

|

Formula for calculation of IRR =

|

|

|

|

|

|

|

|

|

|

|

IRR = 7 + (3779783.63 ((7-6) / (-3779783.63-2366853.54)))

|

|

|

|

|

= 6.39%

|

|

|

|

|

|

|

|

|

|

|

b) IRR using Excel= 6.37%

|

|

|

|

|

|

Year

|

Cash Flows

|

Cumulative Cash Flows

|

Column1

|

|

0

|

$ (126,750,000.00)

|

$ (126,750,000.00)

|

|

|

1

|

$ 14,428,382.18

|

$ (112,321,617.82)

|

|

|

2

|

$ 18,143,657.18

|

$ (94,177,960.64)

|

|

|

3

|

$ 16,272,187.43

|

$ (77,905,773.21)

|

|

|

4

|

$ 15,063,928.59

|

$ (62,841,844.62)

|

|

|

5

|

$ 14,336,966.98

|

$ (48,504,877.65)

|

|

|

6

|

$ 14,778,484.92

|

$ (33,726,392.72)

|

|

|

7

|

$ 15,239,856.06

|

$ (18,486,536.67)

|

|

|

8

|

$ 14,256,730.67

|

$ (4,229,805.99)

|

Payback period lies between 8 and 9 years

|

|

9

|

$ 13,291,016.08

|

$ 9,061,210.08

|

|

|

10

|

$ 46,250,590.36

|

$ 55,311,800.45

|

|

|

Payback period = 8 + (4229805.99/13291016.08)

= 8.32 years

|

|

|

|

|

|

PROFITABILITY INDEX

|

|

|

Profitability Index = (Initial Investment + NPV) / Initial Investment

|

|

= (126,750,000 - 42,054,786.71) / 126,750,000

|

|

=0.67

|

|

|

CONCLUSION

|

|

The project should be rejected due to following reasons:

|

|

1) Negative NPV. (An investment should only be made if it its NPV is greater than zero.)

|

|

2) Required rate of return is more than IRR. (The project will generate rate of return that is less than its opportunity cost of capital.)

|

|

SENSITIVITY ANALYSIS

|

|

Sensitivity Analysis for +/-10% change in revenue is as below:

|

|

|

|

Particulars

|

% Change in Revenue

|

NPV @ 15% Cost of Capital (Calculated by changing values of Revenue)

|

% Change in NPV

|

Sensitivity (% Change in NPV / % Change in Revenue)

|

|

-10% Revenue

|

-10%

|

$ (48,467,100.45)

|

15.25%

|

1.525% for every 1% change in revenue

|

|

Base Case Revenue

|

0

|

$ (42,054,786.71)

|

0%

|

|

+10% Revenue

|

10%

|

$ (35,642,472.98)

|

15.25%

|

|

Thus, NPV will change 1.525% for every 1% change in base case revenue.

|

|

|

|

For a positive NPV, the sales will have to be increased by = 100% / 1.525% = 65.57%

|

|

Case - Part 2a

Since the analysis of the capital budgeting project indicates that the project should not be implemented, Axolotl has a problem. They have already signed the contract to produce the material. Management is now searching for ways to make the project viable and has settled on exploring the potential opportunities of a different financial structure. The board has asked you to evaluate the cost of equity and the weighted average cost of capital for three alternative ways to finance the project.

First, finance at the existing debt to equity ratio and weighted average cost of capital. Second, finance the incremental investment with 50% debt and 50% equity and find the effect on the cost of capital. Third, finance the incremental investment with 100% equity. These two alternatives require a change in the cost of equity which results in a change in the weighted average cost of capital.

Use book weights and the following information in your calculation.

Market Risk Premium 0.07

T-Bill Rate 0.04

T-Bond Rate 0.065

Tax Rate 0.35

Beta 1.25

Long-Term Debt Yield 0.0675

Existing Discount Rate 0.15

Equity Shares Outstanding 31,470

Yield to Maturity at Issue Date 0.06

Par Value $1,000

Years to Maturity 18

Long Term Bond Price $922.52

Bond Pays Semiannually

|

Axylotyl Corporation

|

|

|

|

|

Thousands of $

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets

|

|

|

|

|

|

Current Assets:

|

Cash

|

|

40000

|

|

|

Accounts Receivable

|

|

91000

|

|

|

Inventory

|

|

136570

|

|

|

Total Current Assets

|

|

267570

|

|

|

Long-Term Assets:

|

|

|

|

|

|

Plant, Property and Equipment

|

|

125000

|

|

|

Other Assets

|

|

7000

|

|

|

Total Long-Term Assets

|

|

132000

|

|

|

Total Assets

|

|

3995570

|

|

|

|

|

|

|

|

Liabilities and Equity

|

|

|

|

|

|

Current Liabilities:

|

Accounts Payable

|

|

55000

|

|

|

Commercial Paper

|

|

0

|

|

|

Accrued Expenses and Taxes

|

|

17000

|

|

|

Long Term Debt Maturing within 1 Year

|

|

|

|

|

Capital Lease Obligations Due within 1 Year

|

|

|

|

Total Current Liabilities

|

|

72000

|

|

|

Long Term Liabilities:

|

|

|

|

|

|

Long-Term Debt

|

|

42470

|

|

|

Capital Lease Obligations

|

|

|

|

|

Deferred Income Taxes

|

|

|

|

|

Total Long-Term Liabilities

|

|

42470

|

|

|

|

|

|

|

|

Total Liabilities

|

|

114470

|

|

|

Shareholder Equity:

|

|

|

|

|

|

Common Stock

|

|

8000

|

|

|

Capital in Excess of Par

|

|

18000

|

|

|

Retained Earnings

|

|

259100

|

|

|

Total Equity

|

|

285100

|

|

|

|

|

|

|

|

Total Liabilities and Equity

|

|

399470

|

|

|

|

|

|

|

|

|

|

|

|

Part 2b

As you all know, Management has already signed the contract and committed to a project which has a large, negative net present value. This presents a problem which they must solve quickly.

After considerable thought, a thorough re-engineering of the manufacturing facility led to a reduction in the cost of goods sold to 55% from 60%. It also resulted in increased flexibility in the products the facility could produce. As a result of the increased flexibility, Sales and Marketing now estimates that sales revenue would increase to $60,000,000 from $50,000,000 and would grow at 7% rather than the original estimate of 4%.

Your boss has now asked you to evaluate the project in light of this new information. In addition, the instructions indicate that you should pick the financing scheme (from Part B) that makes the project the most profitable.

Your report should include a brief discussion of the project from the beginning, a discussion of the three financing alternatives and their effect on the WACC, an analysis of the revised project using the alternative discount rates and a conclusion as to whether or not the project should be undertaken.