Question 1: Deferred Tax

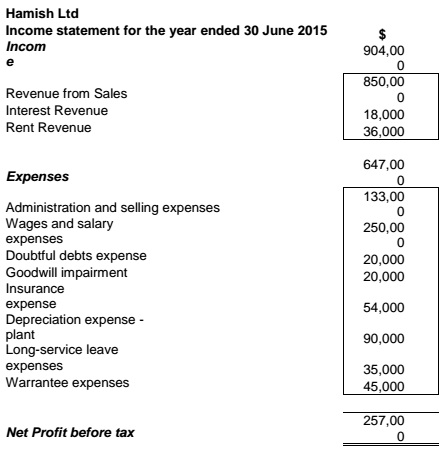

Hamish Ltd needs your assistance in calculating and disclosing the taxation expense for the financial year ended 30 June 2015. Hamish Ltd has supplied you with an extract from their income statement and from their balance sheet as well as a list of other information that needs to be considered.

The following information relates to the year ended 30 June 2015. Revenue from sales, including those on credit terms, is taxable when the sales are made. Administration and salary expenses are tax deductible when they are incurred. This also applies to wages and salary expenses. The following items that are included in the financial statements of Hamish Ltd are treated differently for accounting and tax purposes:

• At year end, accounts receivable owed to Hamish Ltd was $80,000, net after the provision for doubtful debts. Since Hamish Ltd expects that some of its debtors may be doubtful, it creates an allowance for doubtful debts. The opening balance (on 1 July 2014) of the allowance for doubtful debts was $5,000. The doubtful debts expense is not tax deductible until the debtor is actually written off as bad.

• The insurance expense amounts to $4,500 per month. During the year $60,000 was paid for insurance and on 30 June 2014 $13,500 was prepaid for the 2014 financial year. Insurance expense is only tax deductible when it is paid.

• Interest amounting to $12,000 was received during the year and an additional $6,000 was accrued to account for the total interest earned of $18,000 for the year. Interest is taxable when it is received.

• The plant was acquired on 1 July 2013 at a cost of $500,000. The plant has an economic life of 5 years with a residual value of $50,000. The straight line method of depreciation is used to depreciate the plant for accounting purposes. For taxation purposes, the straight line method over 4 years is used to calculate the depreciation, but only the cost of the plant is depreciable (i.e. ignore the residual).

• Hamish Ltd paid an amount of $10,000 during the year in respect of long service leave. In addition an amount of $25,000 had been accrued for accounting purposes during the year in respect of long service leave. Tax deductions for this item are available only when the amount is paid. At 30 June 2014 there was no accrual for long service leave.

• During the year $45,000 was received with respect to rent revenue, of which $36,000 relates to the current year. This is the first year that Hamish Ltd received any rent. Rent received is taxable when it is received.

• Warrantee expenses incurred amount to $45,000, of which $15,000 has been paid by year end. Warrantee expenses are only tax deductible if they have been paid. At 30 June 2014 there was no accrual for warrantee expenses.

• During the year the goodwill with an opening balance of $100,000 was impaired by $20,000. Goodwill impairment is not a deductible expense for tax purposes.

At the beginning of the year (i.e., at the 1st of July 2014), total taxable temporary differences amounted to $48,500 and total deductible temporary differences amounted to $5,000.

The tax rate was always 33% but changed to 28% during the current year. Hamish asked their tax consultants to calculate the taxable income and they came up with a figure of $314 000. You can assume that this figure is correct.

Required:

a) Calculate the deferred taxation that Hamish Ltd should provide for the year ended 30 June 2015. Complete the worksheet for this purpose. Prepare the journal entries (with narrations) to account for Hamish Ltd’s tax expense for the year ended 30 June 2015 in accordance with NZ IAS 12.

b) Show an extract from the income statement and the notes to the income statement of Hamish Ltd that clearly shows the required disclosure of the tax expense for the year ended 30 June 2015 in accordance with NZ IAS 12.

Question 2: Financial Instruments

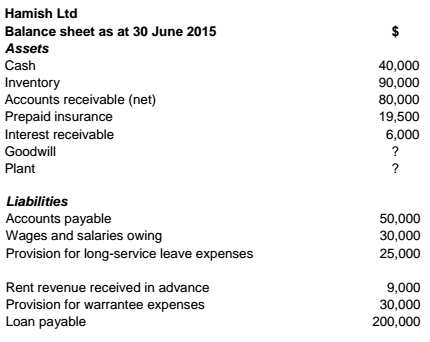

Extracts from Imu Ltd’s Financial Statements reveal the following:

The preference shares are cumulative redeemable preference shares paying dividends at 10% and were issued at the beginning of the 2012 financial year to fund the extension of the company’s head office building. It is redeemable at par value after 10 years. Imu Ltd’s only long-term liabilities consist of convertible notes that Imu Ltd issued at the beginning of the 2011 financial year for a 10 year period at an interest rate of 4% and that is convertible into ordinary shares at the option of the holders. At the time of issue, the interest rate for similar notes without a conversion option was 8%. The convertible notes are treated as debt in the financial statements. Assume a tax rate of 30%. No preference dividends are in arrears.

Required:

a) Define ‘financial instruments’ and give two examples of financial assets and financial liabilities.

b) Discuss briefly the debt vs. equity requirements suggested by the financial instruments standard and how these instruments (preference shares and convertible notes) should be treated in the financial statements of Imu Ltd in terms of NZIFRS.

c) For the convertible debt, calculate the values of the debt and the equity portion (if any) and show the loan redemption table for the first five years of the debt.

d) What will be the impacts if Imu Ltd changes its accounting for redeemable preference shares and convertible debt to comply with NZIFRS. Show clearly the impact on the balance sheet figures (for 2015) and the profit figure, as well as on debt and asset ratios.

Excerpts from the present value tables:

at 4% at 8%

Present value of $ 1 after 10 years 0.6756 0.4632

Present value of $1 for 10 years 8.1109 6.7101

Question 3: Deferred Tax

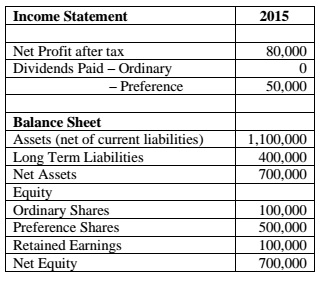

The following is an extract from the Income Statement and Balance Sheet of Simba Limited for 30 June 2015.

Further information:

1. Amounts received from sales, including those on credit terms, are taxed at the time the sales are made.

2. Administration and Salary expenses incurred have either been paid or accrued as at year end. For tax purposes these items are deductible when incurred, unless discussed separately in the points that follow below.

3. Interest revenue is only taxable when actually received from the bank. During the year $18,000 of the interest revenue was received from the bank.

4. The allowance for doubtful debts is only deductible for tax purposes if the amounts are written off as bad debts. At year end, accounts receivable owed to Simba Limited was $78,000. Simba Limited expects that some of this amount will be doubtful, and accordingly, it creates an allowance for doubtful debts of $13,000 on 30 June 2015. On 1 July 2014 the balance for the allowance for doubtful debts was $8,000.

5. The amount of goodwill was initially recorded as $100,000. At year end, Simba Limited performed an impairment test on the goodwill and determined that the goodwill has been impaired by $20,000. An impairment was therefore done and recognised in the income statement. Goodwill impairment is not allowed as a deductible expense for taxation purposes.

6. Insurance expenses are deductible for tax purposes when paid. During the year $15,000 was paid for insurance.

7. Long service leave is only deductible for tax purposes when paid. During the year $5,000 was paid for long service leave.

8. Warranty claims are only deductible for tax purposes when paid. During the year no warranty claims was paid out. The opening balance of the warranty claims provision on 1 July 2014 was $10,000.

9. Simba purchased a chips making plant on 1 July 2011 for $550,000. For accounting purposes, this plant is depreciated straight line over five years with a residual of $50,000 and for tax purposes, straight line over four years with no residual.

10. At the beginning of the financial year (i.e., as at 1 July 2014), total taxable temporary differences amounted to $112,500 and total deductible temporary differences amounted to $18,000.

11. The tax rate changed from 33% to 28% during this financial year.

REQUIRED:

1. Using the worksheet supplied, determine the tax bases for all assets and liabilities, the temporary differences arising and the balance of the deferred tax asset and deferred tax liability on 30 June 2015, using a tax rate of 28%. Provide the journal entries that will be needed to account for deferred tax for the 2015 financial year, including entries for the change in tax rate. Provide all calculations clearly.

2. Calculate the taxable income and current tax for Simba Limited for the year ended 30 June 2015. Provide the journal entries that will be needed to account for current tax for the 2015 financial year.

3. Show the required disclosure for income tax in the Income Statement (including notes) in accordance with NZ IAS 12 for Simba Limited for the year ended 30 June 2015 (including the reconciliation required by para 81).

Question 4:

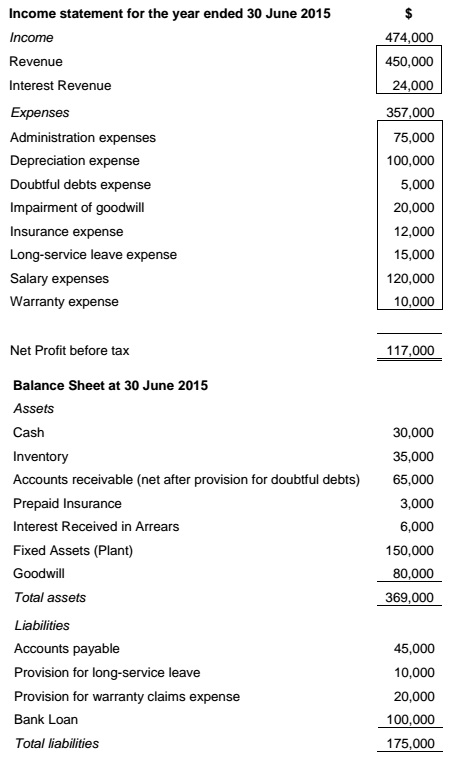

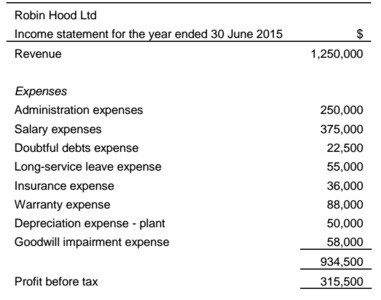

It is the year ending 30 June 2015 and Robin Hood Limited has prepared the following Income Statement:

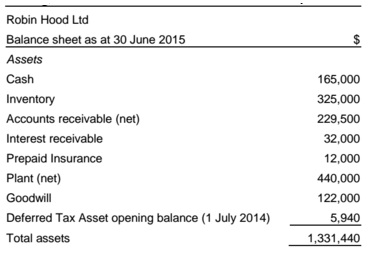

Robin Hood Limited has also prepared the following Balance Sheet as at 30 June 2015, before taking into account the income tax consequences for 2015:

Robin Hood Limited also has the following information for the year ending 30 June 2015:

- The plant was acquired on 1 July 2013 at a cost of $540,000. The plant has an economic life of 10 years with a residual value of $40,000. The straight line method of depreciation is used to depreciate the plant for accounting purposes. For taxation purposes, the straight line method over 5 years is used to calculate the depreciation, based on the cost of the plant.

- Amounts received from sales, including those on credit terms, are taxed at the time the sales are made. All administration and salary expenses incurred have been paid as at year end. These items are deductible for tax purposes when paid.

- At year end, accounts receivable owed to Robin Hood Limited was $270,000. Robin Hood Limited expects that some of this amount will be doubtful, and accordingly, it creates an allowance for doubtful debts of $40,500 on 30 June 2015. On 1 July 2014 the balance for the allowance for doubtful debts was $18,000. Doubtful debts are not deductible expenses for tax purposes until a debtor is actually written off as bad.

- Robin Hood Limited has accrued $32,000 as interest income earned from its new investment this year, although the amount will not be received until 30 August 2015. The interest income will be taxed by the Inland Revenue on a cash basis.

- Robin Hood paid insurance amounting to $48,000 during the financial year. However, only $36,000 ($3,000 per month) relates to this financial year (the rest relates to the next financial year). Insurance expenses are deductible for tax purposes when paid.

- The amount of goodwill was initially recorded as $180,000. At year end, Robin Hood Limited believed that the goodwill has been impaired by $58,000 and recognised the impairment in the income statement. This is the first time that Robin Hood Limited has recognised goodwill impairment. However, goodwill impairment is not allowed as a deductible expense for taxation purposes.

- An amount of $55,000 had been recognised for accounting purposes during the year with regard to long service leave. However, at year end (30 June 2015), only $11,000 had been paid out. Tax deductions for this item are available only when the amount is paid.

- During the year, Robin Hood Limited recognised $88,000 for its warranty expenses. At year end (30 June 2015), $23,000 had been paid out on warranty claims. Only actual amounts paid are allowed as a tax deduction.

- At the beginning of the financial year (i.e., as at 1 July 2014), total taxable temporary differences amounted to $58,000 and total deductible temporary differences amounted to $18,000.

- The tax rate changed from 33 percent to 28 percent at the beginning of the current year (1 July 2014).

REQUIRED:

1. Calculate the taxable income and current tax for Robin Hood for the year ended 30 June 2015.

2. Complete the worksheet for the calculation of deferred tax assets and liabilities as well as the provision for deferred tax for the year. This worksheet should clearly show the calculation of the temporary differences.

3. Prepare journal entries (with narrations) to account for the current and deferred tax in accordance with NZ IAS 12 for the year ending 30 June 2015 for Robin Hood Limited.

4. Show the required disclosure for income taxes in the Income Statement (including notes) in accordance with NZ IAS 12 for Robin Hood Limited for the year ended 30 June 2015 (including the reconciliation required by para 81).