1. If the assets in which borrowed funds are invested are able to earn a rate of return greater than the interest rate required by the lender, then financial leverage is positive.

True False

2. One would expect the book value of a share of stock to be about the same as the stock's market value.

True False

3. The acid-test ratio is always smaller than the current ratio.

True False

4. All debt is considered in the computation of the acid-test ratio.

True False

5. When computing the acid-test ratio, a short-term note receivable would be included in the numerator.

True False

6. The purchase of marketable securities for cash will lower a firm's acid-test ratio.

True False

7. As the inventory turnover increases, the number of days required to sell the inventory one time also increases.

True False

8. Negative working capital indicates that the sum of all current assets is negative.

True False

9. The formula for the gross margin percentage is:

A. (Sales - Cost of goods sold)/Cost of goods sold

B. (Sales - Cost of goods sold)/Sales

C. Net income/Sales

D. Net income/Cost of goods sold

10. The gross margin percentage is most likely to be used to assess:

A. how quickly accounts receivables can be collected.

B. how quickly inventories are sold.

C. the efficiency of administrative departments.

D. the overall profitability of the company's products.

11. Financial leverage is negative when:

A. the return on total assets is less than the rate of return on common stockholders' equity.

B. total liabilities are less than stockholders' equity.

C. total liabilities are less than total assets.

D. the return on total assets is less than the rate of return demanded by creditors.

12. A company's current ratio and acid-test ratios are both greater than 1. Issuing bonds to finance purchase of an office building with the first installment of the bonds due in the current year would:

A. decrease net working capital.

B. decrease the current ratio.

C. decrease the acid-test ratio.

D. affect all of the above as indicated.

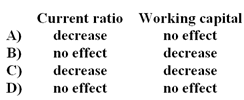

13. What is the effect of a purchase of inventory on account on the current ratio and on working capital, respectively? (Assume a current ratio greater than one prior to this transaction.)

A. Option A

B. Option B

C. Option C

D. Option D

14. At the beginning of the year, a company's current ratio is 2.2. At the end of the year, the company has a current ratio of 2.5. Which of the following could help explain the change in the current ratio?

A. An increase in inventories.

B. An increase in accounts payable.

C. An increase in property, plant, and equipment.

D. An increase in bonds payable.

15. A company's current ratio and acid-test ratios are both greater than 1. The collection of a current accounts receivable of $29,000 would:

A. increase the current ratio.

B. decrease the current ratio.

C. not affect the current ratio or the acid-test ratio.

D. decrease the acid-test ratio.

16. Assume a company has a current ratio that is greater than 1. Which of the following transactions will reduce the company's current ratio?

A. Selling office equipment at book value.

B. Paying a cash dividend already declared.

C. Borrowing by taking out a short-term loan.

D. Selling equipment at a loss.

17. Higgins Company presently has a current ratio of 0.6. It is currently negotiating a loan, but it has been informed it must improve its current ratio before the loan will be approved. Which of the following actions would improve its current ratio?

A. Pay off a portion of its long-term debt.

B. Use cash to pay off some current liabilities.

C. Purchase additional inventory on credit.

D. Collect some of the current accounts receivable.

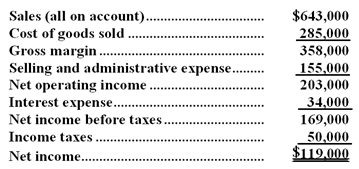

18. Ozols Corporation's most recent income statement appears below:

The gross margin percentage is closest to:

A. 33.2%

B. 55.7%

C. 300.8%

D. 125.6%

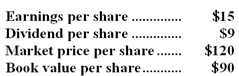

19. The following data have been taken from your company's financial records for the current year:

The price-earnings ratio is:

A. 12.5

B. 6.0

C. 8.0

D. 7.5

20. Last year the return on total assets in Jeffrey Company was 8.5%. The total assets were 2.9 million at the beginning of the year and 3.1 million at the end of the year. The tax rate was 30%, interest expense totaled $110 thousand, and sales were $5.2 million. Net income for the year was:

A. $145,000

B. $222,000

C. $332,000

D. $178,000

21. Brandon Company's net income last year was $65,000 and its interest expense was $20,000. Total assets at the beginning of the year were $640,000 and total assets at the end of the year were $690,000. The company's income tax rate was 30%. The company's return on total assets for the year was closest to:

A. 9.8%

B. 10.7%

C. 12.8%

D. 11.9%

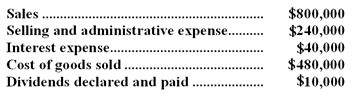

Selected financial data from Osterville Company for the most recent year appear below:

The income tax rate is 40%.

22. Net income as a percentage of sales was:

A. 5%

B. 3%

C. 2.25%

D. 1.75%

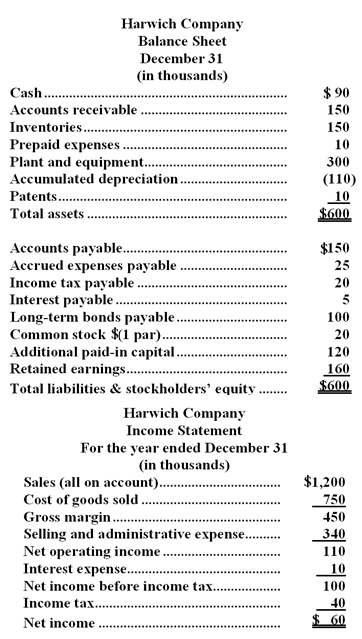

Financial statements for Harwich Company for the most recent year appear below:

The balances in the Cash, Accounts Receivable, Inventory, Bonds Payable, Common Stock, and Additional Paid-In Capital accounts are unchanged from the beginning of the year. A $0.75 per share dividend was declared and paid during the year. On December 31, Harwich Company's common stock was trading at $24.00 per share.

23. Harwich Company's current ratio at December 31 was closest to:

A. 1.95

B. 2.67

C. 1.33

D. 2.00

24. Harwich Company's acid-test ratio at December 31 was closest to:

A. 0.45

B. 0.83

C. 2.00

D. 1.20

25. Harwich Company's inventory turnover ratio for the year was closest to:

A. 8

B. 3

C. 5

D. 7.5

26. Harwich Company's average collection period for the year was closest to:

A. 72 days

B. 8 days

C. 120 days

D. 46 days

27. Harwich Company's price-earnings ratio at December 31 was closest to:

A. 3.00

B. 8.25

C. 8.00

D. 7.25

28. Harwich Company's book value per share at December 31 was closest to:

A. $7.00

B. $15.00

C. $24.00

D. $30.00

29. Harwich Company's debt-to-equity ratio at the end of the year was closest to:

A. 0.33

B. 0.50

C. 0.67

D. 1.00