Question 1: AFTER-TAX COST OF DEBT:

The Heuser Company's currently outstanding bonds have a 10% coupon and a 12% yield to maturity. Heuser believes it could issue new bonds at par that would provide a similar yield to maturity. If its marginal tax rate is 35%, what is Heuser's after-tax cost of debt?

Question 2: COST OF COMMON EQUITY

Percy Motors has a target capital structure of 40% debt and 60% common equity, with no preferred stock. The yield to maturity on the company's outstanding bonds is 9%, and its tax rate is 40%. Percy's CFO estimates that the company's WACC is 9.96%. What is Percy's cost of common equity?

Question 3: PROJECT SELECTION

Midwest Water Works estimates that its WACC is 10.5%. The company is considering the following capital budgeting projects:

Project Size Rate of return

A $1 million 12.0%

B 2 million 11.5

C 2 million 11.2

D 2 million 11.0

E 1 million 10.7

F 1 million 10.3

G 1 million 10.2

Assume that each of these projects is just as risky as the firm's existing assets and that the firm may accept all the projects or only some of them. Which set of projects should be accepted? Explain.

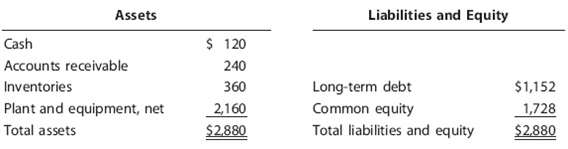

Question 4: WACC The Patrick Company's cost of common equity is 16%, its before-tax cost of debt is 13%, and its marginal tax rate is 40%. The stock sells at book value. Using the following balance sheet, calculate Patrick's WACC.

Question 5: WACC AND PERCENTAGE OF DEBT FINANCING Hook Industries' capital structure consists solely of debt and common equity. It can issue debt at rd = 11%, and its common stock currently pays a $2.00 dividend per share (D0 = $2.00). The stock's price is currently $24.75, its dividend is expected to grow at a constant rate of 7% per year, its tax rate is 35%, and its WACC is 13.95%. What percentage of the company's capital structure consists of debt?