1.Assume that all investors have the same information and care only about expected return and volatility. If new information arrives about one stock, can this information affect the price and return of other stocks? If so, explain why?

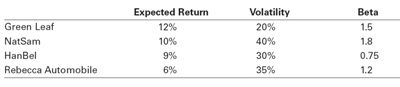

2.Assume that the CAPM is a good description of stock price returns. The market expected return is 7% with 10% volatility and the risk-free rate is 3%. New news arrives that does not change any of these numbers but it does change the expected return of the following stocks:

a. At current market prices, which stocks represent buying opportunities?

b. On which stocks should you put a sell order in?

3.Suppose the CAPM equilibrium holds perfectly. Then the risk-free interest rate increases, and nothing else changes.

a. Is the market portfolio still efficient?

b. If your answer to a is yes, explain why. If not, describe which stocks would be buying opportunities and which stocks would be selling opportunities.

4.You know that there are informed traders in the stock market, but you are uninformed. Describe an investment strategy that guarantees that you will not lose money to the informed traders and explain why it works.