SECTION A:

Use your kills to Analyze, compare, criticize, evaluate and justify the answers in a process to solve the assignment.

Required:

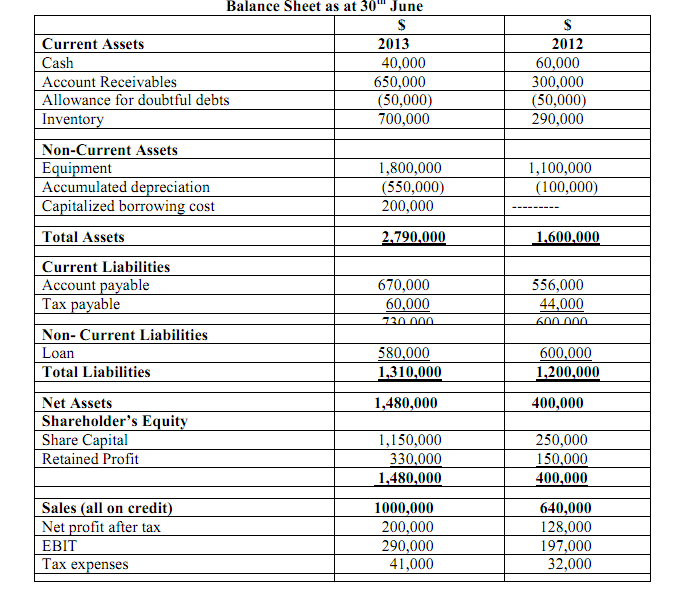

a. What is the interest expense for 2013?

b. How much equipment was purchased during the year?

c. What was the depreciation expense for 2013?

d. Were any share issues? If any, calculate the value.

e. How much in dividend was paid during the year 2013?

f. How much cash was received from customers during the year?

g. How much was paid in tax?

SECTION B:

(Scenario based)

Scenario 1

Deagan formed a lawn service business as a summer job. To start the business on 1 May, he deposited $1,000 in a new bank account in the name of the proprietorship. The $1,000 consisted of a $600 loan from his father and $400 of his own money. Deagan rented lawn equipment, purchased supplies, and hired fellow students to mow and trim his customer's lawns.

At the end of each month, Deagan mailed bills to his customers. On August 31, he was ready to dissolve the business and return to University for the next semester. As he was so busy, he kept few records other than his cheque book and a list of amounts owed to him by customers.

At 31 August, Deagan's cheque book shows a balance of $690, and his customers still owe him $500. During the summer, he collected $4,250 from customers. His cheque book lists payments for supplies totalling $400, and he still has fuel, whipper snapper cord, and other supplies that cost a total of $50. He paid his employees $1,900, and he still owes them $200 for the final week of the summer.

Deagon rented some equipment from Sea Machine Shop. On 1 May, he signed a six-month lease on mowers and paid $600 for the full lease period. Sea will refund the unused portion of the prepayment if the equipment is in good shape. In order to get the refund, Deagan has kept the mowers in excellent condition. In fact, he had to pay $300 to repair a mower.

To transport employees and equipment to jobs, Deagan used a trailer that he bought for $300. He figures that the summer's work used up one-third of the trailer's service potential. The business cheque book lists a payment of $460 for cash withdrawals by Deagan during the summer. Deagan paid his father back during August.

Required

a) Prepare the income statement of Deagan Lawn Service for the four months May through August.

b) Prepare the classified balance sheet of Deagan Lawn Service at 31 August.

c) Was Deagan's summer work successful? Give the reason for your answer.

Scenario 2

Suppose your group is opening a Billabong office in your area. You must make some important decisions-where to locate, how to advertise, and so on-and you must also make some accounting decisions. For example, how often will you need financial statements to evaluate operating performance and financial position?

Will you use the cash basis or the accrual basis? When will you account for the revenue that the business earns? How will you account for the expenses?

Required

Write a report to address the following considerations:

a) Will you use the cash basis or the accrual basis of accounting? Give a complete description of your reasoning.

b) How often do you want financial statements? Why? Discuss how you will use each financial statement.

c) What kind of revenue will you earn? When will you record it as revenue? How will you decide when to record the revenue?

Scenario 3

Brent and Den worked for several years as sales representatives for Xerox Corporation. During this time, they became close friends as they acquired expertise with the firm's full range of copier equipment. Now they see an opportunity to put their experience to work and fulfil lifelong desires to establish their own business. The local TAFE College is expanding, and there is no copy centre within eight kilometers of the campus. Business in the area is booming-office buildings and flats are springing up, and the population of this section of the city is growing.

Brent and Den want to open a copy centre near the campus. A small shopping centre across the street from the TAFE has a vacancy that would fit their needs. Brent and Den each have $20,000 to invest in the business, but they forecast the need for $30,000 to renovate the store. Xerox will lease two large copiers to them at a total monthly rental of $4,000. With enough cash to see them through the first six months of operation, they are confident they can make the business succeed. The two work very well together, and both have excellent credit ratings. Brent and Den must borrow $80,000 to start the business, advertise its opening, and keep it running for its first six months.

Required

Assume the roles of Brent and Den, the partners who will own the Copy Centre.

1. On behalf of Brent and Den write a loan request that Brent and Den will submit to a bank with the intent of borrowing $80000 to be paid back over three years. The loan will be a personal loan to the partnership of Brent and Den, not to the Copy Centre. The request should specify all the details of Brent's and Den's plan that will motivate the bank to grant the loan. Include a budgeted income statement for the first six months of the copy centre's operation.