Question 1: Dilution

Here is the financial data on Pisa Construction, Inc.

Stock price- $40

Number of shares- 10,000

Book net worth- $500,000

Market value of firm- $400,000

Earnings per share- $4

Return on investment- 8%

Pisa had not performed spectacularly to date. However, it wishes to issue new share to obtain $80,000 to finance expansion into a promising market. Pisa's financial advisers think a stock issue is a poor choice because, among other reasons, "sale of stock at a price below book value per share can only depress the stock price and decrease shareholders' wealth." To prove the point they construct the following example: "Suppose 2,000 new shares are issued at $40 and the proceeds are invested (neglect issue costs.) Suppose return on investment doesn't change. Then...

Book net worth= $580,000

Total earnings= .08(580,0000)= $46,400

Earnings per share= 46,4000/12,000= $3.87

Thus, EPS declines, book value per share declines, and share price will decline proportionately to $38.70"

Evaluate this argument with particular attention to the assumptions implicit in the numerical example.

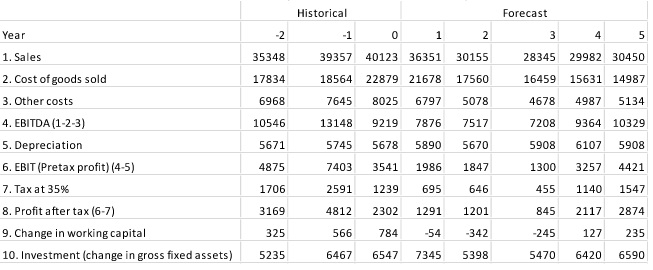

Question 2: Company Valuation

Chiara Company's management has made the projections (in the attached chart). Use this table as a starting point to value the company as a whole. The WACC for Chiara is 12% and the long-run growth rate after year 5 is 4%. The company has $5 million debt and 865,000 shares outstanding. What is the value per share?

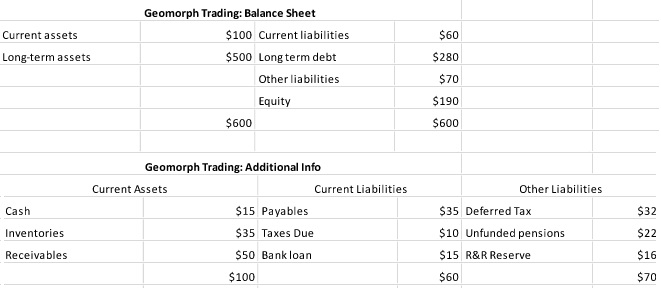

Question 3: Leverage Ratios

Take another look at Geomorph Trading's balance sheet (attached) and consider the following additional information (attached)

The "R&R reserve" covers the future costs of removal of an oil pipeline and environmental restoration of the pipeline route.

There are many ways to calculate a debt ratio for Geomorph. Suppose you are evaluating the safety of Geomorph's debt and want a debt ratio for comparison with the ratios of other companies in the same industry. Would you calculate the ratio in terms of total liabilities or total capitalizations? What would you include in debt- the bank loan, the deferred tax account, the R&R reserve, the unfunded pension liability? Explain the pros and cons of these choices.