It is March 1, 2016. You recently began working as an intern for Beeber & Associates, a professional practice specializing in taxation services. At a recent meeting with a long-time client, you and an associate meet Janet Barns, owner and founder of Barns Recycling Services ("BRS") and a sister company, Barns Recycling International ("BRI"). In preparation for the meeting, you summarized some relevant facts from your review of prior years' files and permanent records (see Exhibit I). Extracts from BRS's financial statements over the last three years were also compiled for ease of reference during the meeting (see Exhibit II).

Now in her sixties, Janet wants to consider some estate and succession planning options as far as her corporate holdings are concerned. She does not want her children to experience the same uncertainty and upheaval as when Jack, her spouse, died suddenly five years ago. Janet is an articulate businesswoman who has specific ideas on how she wants her corporate interests transitioned since BRS and BRI represent a significant component of her net worth. You have noted her wishes from the meeting (see Exhibit III).

The associate in charge of the Barns engagement asks you to prepare a preliminary report addressed to her in which you recommend courses of action that meet Janet's objectives. The associate, a tax specialist, will review the preliminary report. Your report will also form part of the ultimate file documentation, so you are to ensure any references to authoritative support are noted. Finally, you are reminded that where choices exist, Janet would prefer the options that minimize costs, especially income taxes.

Exhibit I:

Background Information:

1) Janet Barns is 66 years old and currently the sole shareholder of BRS and BRI.

2) Janet and her spouse, Jack, had incorporated BRS in 1982. At that time, 1000 common shares were issued for $10 each, such that Janet and Jack each owned 500 common shares.

3) Since incorporation, substantially all the assets of BRS have been used in its business of recycling, refilling, and reselling ink cartridges. BRS was one of the first companies to capitalize on this service nationwide. Given the prolific use of ink cartridges across industries, its Canadian success was based on the substantial cost savings customers enjoyed.

4) Since Jack wanted to keep the business risks separate, BRI was incorporated in 1992 (Ontario corporation) to deal solely with the increasing demand from American businesses. It operated a branch in Michigan, USA. BRI issued Janet and Jack 500 common shares each. BRI recorded total paid up capital ("PUC") for its class of common shares at $1,000. Both PUC and adjusted cost bases ("ACB") have not changed since incorporation.

5) When Jack died, Jack bequeathed all his assets to Janet.

6) Although Janet and Jack jointly managed the operations of BRS, Jack primarily managed BRI. Soon after Jack's death, Janet seized an opportunity to sell all the business assets of BRI. The Canadian business continued to expand, so Janet wanted to focus on BRS. Based on professional advice, she left the sale proceeds in BRI and reinvested them with a professional investment manager.

7) BRI's investment returns have done well over the last couple of years, enough to supply Janet with a steady stream of dividends to complement her income.

8) BRS's annual net income per financial statements approximates its annual taxable income.

9) When Jack died, valuations were prepared, and they supported the value of BRS and BRI at $1.5 million and $2 million respectively. Today, the value of BRS is estimated at $3 million while the value of BRI has remained essentially the same at $2 million. Over the last 3 years, the value of BRS has climbed steadily (2013: $1.5 million; 2014: $2 million; 2015: $3 million).

10) On Jack's death, Janet, as executrix of his will, elected to trigger the deemed disposition of Jack's BRS shares at FMV in order to claim the enhanced capital gains deduction on his terminal return. All other assets were subject to the automatic spousal rollover.

11) Janet was born in Cambridge, Ontario, Canada, where she continues to live and work today. Janet has two children: a daughter, Tabitha (36 years old), and a son, Jerry (38 years old).

12) Jerry is a chemistry professor and lives in nearby London, Ontario with his spouse and two young children (Bethany, 10 years old and Ben, 8 years old). Other than the occasional consulting contract carried out in BRS's quality control department, Jerry's contribution to the family business is limited, and he likes it that way.

13) Tabitha returned home to settle in Cambridge after graduating with a business degree. She has been actively involved with helping her mom at BRS since her dad died. Tabitha also has two young children (6-year old Charlie and 4-year old Katie).

Exhibit II:

Barns Recycling Services

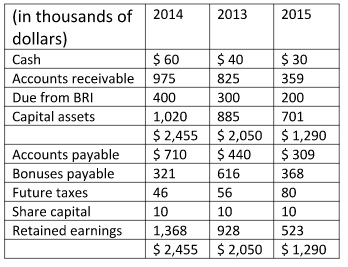

Extracts from Unaudited Balance Sheet

As at September 30

Barns Recycling Services

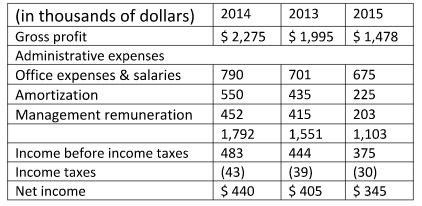

Extracts from Unaudited Income Statement

For the years ended September 30

Exhibit III

Notes from Meeting with Janet

1) Janet wants to reduce her active participation in the day-to-day business over the next few years.

2) Janet feels that within 3-4 years, Tabitha will probably be ready to take over BRS; however, she is reluctant to turn over complete control. Since it represents a significant portion of her net worth, Janet wants to be involved in policy decisions and provide guidance as Tabitha develops experience in the business.

3) Tabitha has shown the capacity to carry on the family business. The value of BRS has doubled over the last few years, and Janet recognizes that Tabitha's contribution has been a part of that growth. Janet is ready to transfer ownership of BRS to the next generation. She wants Tabitha to own 75% and her grandchildren to benefit from 25%. Janet hopes that, sometime in the future, one or more of her grandchildren will show an interest in the business. Since neither Tabitha nor her grandchildren have stores of cash, Janet is wondering how this transition can be legally effected. Janet wants options that will minimize cash requirements and tax costs overall.

4) Janet has read some articles on death taxes (income taxes triggered on death) and how the quantum of this liability can shock family members left dealing with the deceased's estate. Given that BRS is the most significant asset in her estate, she wants to give her family advance warning. After the transition of ownership is completed, Janet wants to get a handle on what death tax liability would be related to her shares of BRS. She is thinking she should redeem her BRS shares during her lifetime.

5) Tabitha has had some good ideas to grow BRS over the next couple of years such that BRS is projected to be worth $6 million in 3 years. She has convinced Janet that BRS needs to reconsider foreign expansion. Tabitha wants BRS to incorporate a wholly-owned subsidiary in the US. Projections suggest that the value of the US business will represent approximately 20% of BRS's estimated total future assets. From a Canadian tax perspective, Janet is not sure what options exist and which makes the most sense. She couldn't recall Jack's reasoning when BRI was originally established.

6) Janet wants to leave her interest in BRI to her grandchildren on death. She still needs a source of income from BRI for personal living expenses if she will be reducing her involvement in BRS, but she is contemplating transferring some of her BRI shares now. Her grandchildren are too young to work; so, Janet thinks this idea might be a way to save some tax during her lifetime while helping Tabitha and Jerry pay for their children's activities. Since she is undecided, Janet would like some guidance.

7) Janet has not forgotten Jerry. She will look to bequeath him other personal assets to equalize him. Addressing her corporate interests now and reviewing her related options is our current mandate. This preliminary report is just the initial step in an overall estate plan that will be a separate engagement.