Assignment

1. Florida Corp. currently has an EPS of $4.04, and the benchmark PE for the company is 21 (the benchmark PE can be the PE ratio of comparable companies). Earnings are expected to grow at 5.5% per year.

a) What is your estimate of the current stock price?

b) What is the target stock price (i.e., forecasted stock price) in one year?

c) Assuming the company pays no dividend, what is the implied return on the company's stock over the next year? What does this tell you about the implicit stock return using PE valuation?

2. Most corporations pay quarterly dividends on their common stock rather than annual dividends. Barring any unusual circumstances during the year, the board raises, lowers, or maintains the current dividend once a year and then pays this dividend out in equal quarterly installments to its shareholders.

a) Suppose a company currently pays an annual dividend of $3.60 on its common stock in a single annual installment, and management plans on raising this dividend by 3.8% per year indefinitely. If the required return on this stock is 10.5%, what is the current share price?

b) Now suppose the company in (a) actually pays its annual dividend in equal quarterly installments; thus, the company has just paid a dividend of $ 0.90 per share, as it has for the previous three quarters. What is your value for the current share price now? (Hint: find the equivalent annual end-of-year dividend for each year.) Comment on whether you think this model of stock valuation appropriate. Assume that the quarterly dividends are reinvested at the required return.

3. Panther Corp. has a bond issue with a face value of $1,000 that is coming due in one year. The value of Panther's assets is currently $1,090. Rick Grimes, the CEO, believes that the assets in the firm will be worth either $920 or $1,380 in a year. T-bill rate is 4.8%.

a) What is the value of Panther's equity? The value of the debt? Use no arbitrage concept. (Hint: you can consider equity as call option.)

b) Suppose Panther can reconfigure its existing assets in such a way that the value in a year will be $800 or $1,600. If the current value of assets is unchanged, will the stock holders favor such a move? Why or why not?

4. A call option with an exercise price of $45 and four months to expiration has a price of $3.80. The stock is currently priced at $42.75, and the risk free rate is 5% per year. What is the price of a put option with the same exercise price?

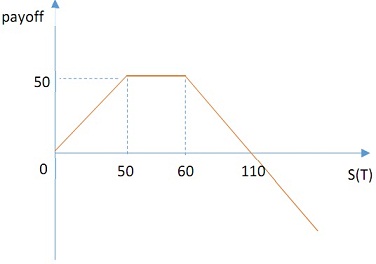

5. Devise a portfolio using only call options and shares of stock with following value (payoff) at option expiration date. You need to specify the strike prices of call options that you employ.

6. You are considering purchasing a put option on a stock with a current price of $33. The exercise price is $35, and the price of the corresponding call option is $2.25. According to the put-call parity theorem, if the risk-free rate of interest is 4% and there are 90 days until expiration, the value of the put should be.

7. Suppose that today is January 1 of the first year. Miami Corp. expects that the EBIT in this year will be $300. During the same period, depreciation costs will be $14 and amortization will be $6. Capital expenditures are $60, and the planned increase in net working capital is $30. The tax rate is 0.35. The debts of Miami Corp. are $250. The weighted average cost of capitals is 10%.

(a) What is the free cash flow to the firm (FCFF)?

(b) If the firm pays $20 as interest expense and there is no change in the debts, what is the free cash flow to the equity (FCFE)?

(c) Suppose that the FCFF of the firm will increase at 10% during year 2 and 8% during year 3. After year 3, the growth rate will be 5%. What is the value of the equity? Use FCFF for (c).

(d) Suppose that the FCFE of the firm increases at 7% per year. What is the cost of equity of Miami Corp.?

Format your assignment according to the following formatting requirements:

1. The answer should be typed, double spaced, using Times New Roman font (size 12), with one-inch margins on all sides.

2. The response also include a cover page containing the title of the assignment, the student's name, the course title, and the date. The cover page is not included in the required page length.

3. Also Include a reference page. The Citations and references should follow APA format. The reference page is not included in the required page length.