Assignment:

Question 1: Real versus nominal interest rates.

a. If the nominal policy rate is 2.41% and expected inflation is equal to 1.5%, what is the real interest rate?

b. If expected inflation increases to 2%, does the real cost of borrowing increase or decrease? Explain why.

Question 2: The IS-LM view of the world with more complex financial markets

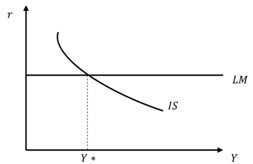

Consider an economy described by the following figure (notice that the only difference between this figure and the IS-LM model we have talked about lies in that we have the real rather than the nominal interest rate on the vertical axis):

a. If the nominal policy interest rate is 6%, and expected inflation rate is 4%. what is the value for the vertical intercept of the LM curve?

b. Suppose the nominal policy rate is 6%. If expected inflation decreases from 4% to ric what must the central bank do to the nominal policy rate to keep the LM curve from shining?

c. If the expected inflation rate decreases from 4% to 2%. does the IS curve shift? If so. why?

d. If the expected inflation rate decreases from 4% to 2%, does the LM curve shift? If so, why?

Question 3: Wage-setting equation

Consider the following wage-setting equation:

W = PeF(u,z)

a. List three examples of labor market institutions included in the parameter z.

b. Explain how an increase in the unemployment rate will affect the nominal wages associated with wage-setting behavior.