I. Binary choice (10 questions)

Question 1. Suppose you are told that Matt made $20,000 in 2014 and $24,000 in 2015. You are also told that the CPI in 2014 was 200 and in 2015 it was 250. From this information you conclude that Matt's real income:

a. Rose in 2015.

b. Fell in 2015.

Question 2. Consider a movie theater. The movie theater knows that if the price of tickets falls by 10%, the quantity demanded of movie tickets increases by 5%. From this information you can conclude that the absolute value of the price elasticity of demand is:

a. Greater than one.

b. Less than one.

Use the graph below to answer the next question:

Question 3. For this question, consider the linear demand curve represented in the above graph. You are told that the price elasticity of demand between the price of $10 and the price of $8 is equal to 1.5.

Using the arc elasticity formula, what is the quantity demanded, x, given this information?

a. 140 units.

b. 120 units.

Question 4. A representative firm in a perfectly competitive industry finds that it is currently producing 250 units of the good and selling these units for $5 per unit. The firm is also incurring production costs of $2200 at this level of production. Given this information and holding everything else constant, you predict:

a. That firms will exit this industry in the long run.

b. That more firms will enter this industry in the long run.

Question 5. Using 1983 as the base year, suppose that the CPI in 2014 is equal to 240 and the CPI in 2015 is equal to 300.

You are asked to change the base year. Which of the following statements is true given the information you have been provided?

a. Using 2014 as the base year and a one-point scale, the CPI in 2014 would be 1 and the CPI in 2015 would be 1.25.

b. Using 2015 as the base year and a hundred-point scale, the CPI in 2014 would be 90 and the CPI in 2015 would be 100.

Question 6. Consider an individual consumer with an income of $50, who consumes only two goods-apples that cost $2 per apple and peanut butter sandwiches that cost $2.50. Given this information, which of the following points lies beyond this individual's budget line?

a. 14 sandwiches, 8 apples

b. 8 sandwiches, 14 apples

Question 7. Deadweight loss:

a. When it occurs only impacts consumers of the good.

b. Represents the loss in total surplus when the market fails to produce the optimal amount of the good.

Question 8. Suppose you are told that the cross-price elasticity of demand for hamburgers with respect to the price of hotdogs is 0.30. Then, suppose that the quantity of hamburgers increases by 30%. Holding everything else constant, the price of hotdogs must have:

a. Increased by 10%.

b. Increased by 100%.

Question 9. A monopolist has a marginal revenue curve given by the equation:

MR = 100 – 2Q

From this information you infer that this monopolist will maximize its total revenue when it:

a. Charges a price equal to $50.

b. Produces a quantity less than 50 units.

Question 10. A perfectly competitive firm finds that when it produces 30 units, its average cost is greater than its marginal cost. When this same firm produces 40 units, its average cost is less than its marginal cost. From this information, you can infer that:

a. The firm should definitely not produce 30 or more units of output.

b. The firm's break-even level of output must be greater than 30 units or less than 40 units.

II. Multiple choice (20 questions).

Question 11. Jonah has two job offers starting in 2017 and his only concern is selecting the job offer that will give him the greater real income in 2017. He knows that San Francisco is an expensive city to live in and he has looked up the CPI for San Francisco for 2017 and finds that the CPI for San Francisco measured on a 100 point index is projected to be 450 for 2017. The same data source lists Houston as having a projected CPI for 2017 as 420. The two jobs offer salaries for 2017 of $60,000 in San Francisco and $50,000 in Houston. Given this information and holding everything else constant:

a. Jonah will be equally well off with the two job offers in terms of his real purchasing power.

b. Jonah will be have greater real purchasing power if he takes the job in San Francisco.

c. It is impossible to compare the real purchasing power given this information since no base year has been determined and that means we cannot compute a constant dollar salary comparison.

d. A dollar is a dollar and therefore Jonah should always take the higher salary offer no matter what the CPI index number for a community is.

Question 12. Consider the market for Badger T-shirts that can be described by the following demand and supply equations where P is the price per Badger T-shirt and Q is the quantity of Badger T-shirts:

Demand: Q = 100 – 2P

Supply: Q = 10 + 4P

Suppose that the government limits the number of Badger T-shirts that can be sold to 50 T-shirts.

Given this information and holding everything else constant, what is the value of consumer surplus?

a. $1250

b. $375

c. $184.50

d. $625

Question 13. You are told that incomes have fallen by 15% due to recent economic events. You are also told that the income elasticity of demand for bananas has a value of 4 while the income elasticity of demand for Ramen noodles have a value of -2. From this information you can conclude:

a. That Ramen noodle consumption has risen by 30% while banana consumption has risen by 60%.

b. That Ramen noodle consumption has fallen by 30% while banana consumption has fallen by 60%.

c. That Ramen noodle consumption has fallen by 30% while banana consumption has risen by 60%.

d. That Ramen noodle consumption has risen by 30% while banana consumption has fallen by 60%.

Question 14. Consider Henrietta's consumption pattern this summer in Boise. She enjoys buffalo burgers and milkshakes. The buffalo burgers cost $10 each and for the last buffalo burger she consumed she received 12 utils of satisfaction. The milkshakes cost $4 each and for the last milkshake she consumed she received 6 utils of satisfaction. Given this information and holding everything else constant, this means that: Henrietta should _______since her marginal utility per dollar spent on buffalo burgers is less than her marginal utility per dollar spent on milkshakes. As she changes her consumption bundle, her additional marginal utility per dollar spend on milkshakes will ____. She is purchasing the optimal combination of milkshakes and buffalo burgers when the marginal utility per dollar spent on buffalo burgers is equal to the marginal utility per dollar spent on milkshakes.

a. buy more buffalo burgers; increase

b. buy more milkshakes; decrease

c. buy more milkshakes; increase

d. buy more buffalo burgers; decrease

Question 15. Consider the market for elite college educations (saythe Ivy League and a small group of "near Ivy League" schools). It is widely believed that attending and graduating from one of these schools results in exceptional lifetime outcomes. If this belief is widespread then which of the following price elasticity of demand values do you think is most likely to measure the demand for elite college educations?

a. 0.04

b. 0.99

c. 1.40

d. 2.40

Question 16. The demand curve given for a good is: Q = 50 -(1/2)P. Suppose that initially in this market the price of the good is $60 per unit. Given this information and this demand curve, producers in this market know that if they charge a price _____ than their revenue will ______.

a. greater than $60 per unit of the good; increase

b. less than $20 per unit of the good; increase

c. greater than $60 per unit of the good but less than or equal to $100 per unit of the good; increase

d. less than $60 per unit of the good but greater than or equal to $50 per unit of the good; increase

Question 17. An unregulated monopolist will:

a. Produce too little of the good and charge too high a price for the good.

b. Will produce a quantity where the marginal cost of producing an additional unit of the good is greater than the marginal revenue from selling an additional unit of the good.

c. Will produce a higher quality good than will a perfectly competitive industry.

d. Imposes no allocative efficiency costs on society

Use the following information to answer the next TWO (2)questions.

Consider a small, closed economy that produces bottles. This country knows that its domestic demand curve is given by the following equation where P is the price per bottle and Q is the number of bottles:

Domestic Demand: Q = 600 - 200 P

You are also told that the domestic supply curve is linear and that the domestic producers know that when the price of a bottle is $1, they can supply 100 bottles. You are also told that for every $1 increase in the price of a bottle there is an increase in the quantity sup

plied of 100 bottles.

Question 18. Given the above information and holding everything else constant, which of the following statements is true?

I. Producer surplus is equal to consumer surplus in this market.

II. When this market is in equilibrium total surplus is equal to $300.

III. If the world price for bottles is $2.50, domestic consumers will be in favor of opening this market to trade.

a. Statements I, II and III are all true statements.

b. Statements I and II are true statements.

c. Statement II is true.

d. Statements II and III are true statements.

Question 19. Suppose that the world price of bottles is $1 per bottle. Suppose that the market for bottles is opened to trade and at the same time, a tariff is implemented that raises the price per bottle to $1.50 in this market. Given this information and holding everything else constant, domestic producers will produce _____ bottles and the deadweight loss associated with using higher cost domestic producers will equal ____.

a. 50 bottles; $25

b. 150 bottles; $12.50

c. 50 bottles; $125

d. 50 bottles; $12.50

Question 20. The marginal cost curve:

a. Intersects the average total cost curve at the minimum point of the marginal cost curve.

b. Intersects the average variable cost curve at the minimum point of the marginal cost curve.

c. Intersects the average total cost curve above the minimum point of the average total cost curve.

d.Intersects the average total cost curve at the minimum point of the average total cost curve.

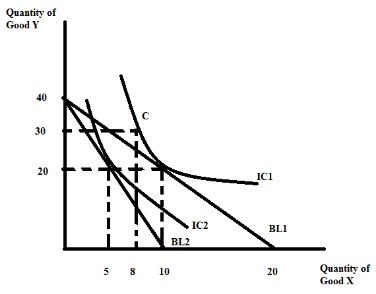

Use the figure below to answer the next TWO (2)questions. The figure below depicts an individual's indifference curve map as well as two budget lines.

Assume that point C represents where this individual would go if he were facing the prices implicit to budget line 2 (BL2) but had his income adjusted so that he could achieve his initial level of satisfaction (IC1)

Question 21. Given the above graph, which of the following statements is true?

I. If the initial situation is depicted as BL1 and you know that the price of good Y is $0.50, then the price of good X is $1.

II. In comparing BL1 and BL2 we can note that there has been a change in the level of income.

III. The income effect given the above graph is equal to a decrease of 3 units of good X.

IV. The income effect given the above graph is equal to a decrease of 2 units of good X.

a. Statements I, II, and III are all true statements.

b. Statements I, II and IV are all true statements.

c. Statements I and III are true statements.

d. Statements I and IV are true statements.

Question 22. Given the above information, if you knew that the initial level of income (used in constructing BL1) was $80, what would be the increase in income this individual would need in order to be able to consume bundle C?

a. $24

b. $44

c. $144

d. $56

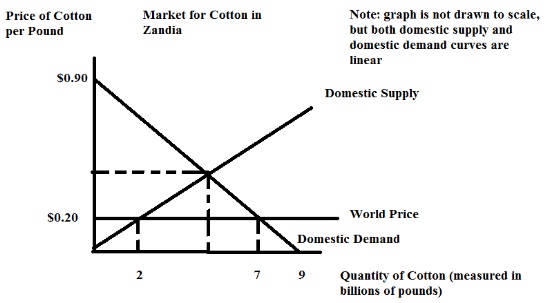

Use the following figure to answer the next TWO(2)questions. The figure depicts the cotton market for Zandia which is a small, openeconomy.

You are told that the domestic supply curve is:

Domestic Supply: P = .1Q

Question 23. In the above figure, if this market is closed to trade and we calculate total surplus we get one value. If the market opens to trade, the total surplus is a different value. The deadweight loss from this market being closed to trade is the difference between these two values. What is the deadweight loss of this market being closed to trade?

a. $0. 20

b. $0.625

c. $0.45

d. $0.3125

Question 24. In the above figure, suppose the world price of the good rose to $0.50 and the market was opened to trade. Given this information and holding everything else constant, this economy would _____.

a. import zero units of the good

b. import one unit of the good

c. export one unit of the good

d. export 5 units of the good

Question 25..

Which of the following statements is true about marginal cost?

I. Marginal cost represents the addition to total cost from producing an additional unit of the good.

II. Marginal cost represents the addition to total cost from selling an additional unit of the good.

III. Marginal cost represents the addition to variable cost from producing an additional unit of the good.

a. Statements I, II and III are all true statements.

b. Statements I and II are true statements.

c. Statements I and III are true statements.

d. Statement I is a true statement.

Question 26. Consider the market for blenders in a small, open economy. You know that the domestic demand and domestic supply curves for blenders are given by the following equations where P is the price per blender and Q is the quantity of blenders given in billions:

Domestic Demand: Q = 510 - 2P

Domestic Supply: Q = 150 + 2P

Furthermore, you know that the world price of blenders is $30 per blender. Suppose this small economy imposes an import tariff on blenders such that imports equal 160 blenders.

Given this information and holding everything else constant, then the imposition of this tariff caused the quantity of imports into this economy with the tariff to:

a. fall by 160 blenders.

b. fall by 80 blenders.

c. fall by 40 blenders.

d. fall by 200 blenders.

Question 27. Assume a perfectly competitive industry, with constant returns to scale, that is initially in long run equilibrium. Now suppose there are fewer consumers in this market. This indicates _____ demand for the good. In the short run, the market price will _____and the market output will _____. In the long run, the market price will __________ and the market output will______.

a. More; increase relative to its initial level; increase relative to its initial level; increase relative to its initial level; return to its original level

b. More; increase relative to its initial level; increase relative to its initial level; return to its original level;increaserelative to its initial level

c. Less; decrease relative to its initial level; decrease relative to its initial level; return to its original level; decrease relative to its initial level

d. Less; decrease relative to its initial level; increase relative to its initial level; decrease relative to its initial level; increase relative to its initial level

Question 28. Assume a perfectly competitive industry. In the short run suppose that the market price for the good is $10. You also know that the minimum point on the average variable cost curve occurs at $6 per unit while the minimum point on the average total cost curve occurs at $11 per unit. From this information you know that in the short run, firms in this industry ____ and in the long run, holding everything else constant, there will be ____.

a. earn positive economic profit; entry of new firms into the industry

b. earn positive economic profit; exit of existing firms from the industry

c. earn negative economic profit; entry of new firms into the industry

d. earn negative economic profit; exit of existing firms from the industry

Question 29. Consider a market with a downward sloping market demand curve that can either be served by a perfectly competitive industry or by a monopoly. Holding everything else constant, which of the following statements is true?

I. Consumers of this good would prefer that the market be a perfectly competitive market.

II. A monopoly will produce more of this good than will be produced if this industry is a perfectly competitive market.

III. Both production scenarios will be allocatively efficient as long as there is a market to provide the good.

a. Statement I is a true statement.

b. Statements I and III are true statements.

c. Statements II and III are true statements.

d. Statement III is a true statement.

Question 30. Suppose the perfectly competitive market for good X is initially in long run equilibrium. Then, suppose the price of a complementary good to good X increases due to increased costs of production for the complementary good. Given this information and holding everything else constant, which of the following statements is true?

I. In the short run, the price of good X will rise.

II. In the short run, the quantity of good X produced in

the market will fall.

III. In the long run, the price of good X will rise relative to its initial level.

IV. In the long run, there will be fewer firms in the market for good X.

a. Statements I and II are true statements.

b. Statements II and III are tru

e statements.

c. Statement II is a true statement.

d. Statements II and IV are true statements.

Section III: 2 Problems

Problem 1: The figure below represents the market for a good that initially is in equilibrium.

Assume that both the demand and supply curves are linear.

a. Given the above graph, write an equation for the market demand curve in y-intercept form.

b. Given the above graph, write an equation for the market supply curve in y-intercept form.

Suppose the government levies an excise tax on producers of $8 on the sale of this good. You job is to analyze this tax.

c. With this excise tax, what is the price that consumers will now pay for the good?

Show how you found this price and provide an explanation of your work for full credit.

d. Given this excise tax, what is the value of producer tax incidence, PTI? For full credit show your work and provide an explanation of what you are doing.

e. Given this excise tax, what is the value of the deadweight loss, DWL, due to the imposition of this excise tax? Show your work for full credit.

f. Given this excise tax, who bears the greater economic incidence of the tax? Provide a full explanation for your answer with supporting evidence. Use complete sentences!

Problem 2: Oliver spends all his income on goods X and Y. He does not buy any other goods. Oliver’s income is $120, the price of good X is $2, and the price of good Y is $3.

a. Find the equation for Oliver’s budget line based upon the above information, and then draw this budget line in the space below. Make sure your graph is completely and carefully labeled.

Find the x and the y intercepts for this budget line.

Oliver's budget line: ______

b. Given the above information, which of the following bundles can Oliver afford? Show your work.

Bundle 1: (60,0) ___________

Bundle 2: (30,30) ___________

Bundle 3: (15,25) ___________

Bundle 4: (8,35) ____________

c. Given the above information, find the bundle that will maximize Oliver’s utility if you know that marginal utility from good X is 1/X and the marginal utility from good Y is constant and equal to 1/20. Show your work.

The bundle that maximizes Oliver's utility is (X, Y) = ________

d. Find the bundle that will maximize Oliver’s utility if you know that the price of good X has increased to $4. Assume there are no other changes to Oliver's income, the price of good Y, the marginal utility from good X, or the marginal utility from good Y. Show your work.

The new bundle that maximizes Oliver's utility is (X, Y) = ____

e. Using the optimal consumption bundles you found in parts (c) and (d), find the equation for Oliver's demand curve for good X and then draw this demand curve in the space below. Assume that the demand curve is linear. The equation for Oliver's demand curve in

y-intercept form is: _________