Problem:

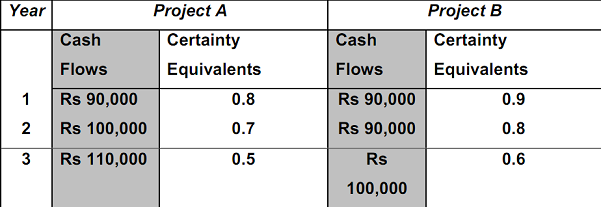

Lucky Corporation is considering an investment in one of two mutually exclusive proposals: Project A which involves an initial outlay of Rs 170,000 and Project B which has an outlay of Rs 150,000. The Certainty Equivalent Approach is employed in evaluating risky investments. The current yield on treasury bills is 0.05 and the company employs this as the riskless rate. The expected values of net cash flows with their respective certainty equivalents are:

PV Factor @ 5%

Yr 1 0.952

Yr 2 0.907

Yr 3 0.864

Required:

Question1. Which Project should be acceptable to company?

Question2. Justify which Project is riskier?

Question3. If the company was to use risk adjusted discount rate technique, which Project should be analysed with higher rate?

Question4. Appraise the usefulness of Investment Appraisal methods when choosing between alternative investment projects.

Question5. Mention two sources of finance which can be employed for long-term business development.