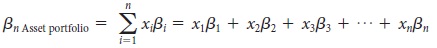

Problem: You are working as an intern at Coral Gables Products, a privately owned manufacturing company. You got into a discussion with the Chief Financial Officer (CFO) at Coral Gables about weighted average cost of capital calculations. She pointed out that, just as the beta of the assets of a firm equals a weighted average of the betas for the individual assets (as shown below):

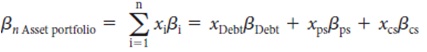

The beta of the assets of a firm also equals a weighted average of the betas for the debt, preferred stock, and common stock of a firm:

1) Why must this be true? Please provide your explanation with appropriate examples.

2) Discuss your understanding of WACC and explain how the individual cost of each capital component (equity, preference and debt capital) can be calculated.