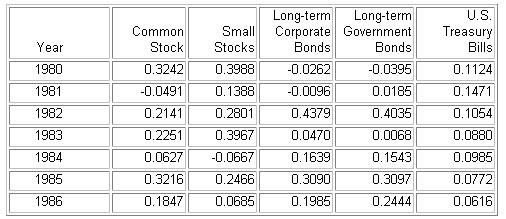

Problem 1) The following are the returns for 1980 to 1986 on 5 types of capital-market instruments: common stocks, small-capitalization stocks, long-term corporate bonds, long-term U.S. government bonds, and U.S. Treasury Bills. You can use a spreadsheet program to make calculations.

A) Calculate the average return for each type of security.

B) Calculate the variance for common stock based on the annual returns from question A

C) Calculate the holding period return for common stocks, corporate bonds, and US T-bills, given the annual returns from question A.

2) Four equally probable states of the economy may prevail next year. Below are the returns on the stocks of P & Q companies under each of the probable states. (For the purposes of this exercise, we assume that the economy definitely will fall within one of these four probable states.)

State of Economy Probability P Stock Q Stock

Mild Recession 25.0% 4.00% 5.00%

Low Growth 25.0% 6.00% 7.00%

Moderate Growth 25.0% 9.00% 10.00%

Rapid Growth 25.0% 4.00% 14.00%

A. Given the equally probable 4 possible economic conditions, calculate the expected return for P stock and for Q stock.