Case Scenario:

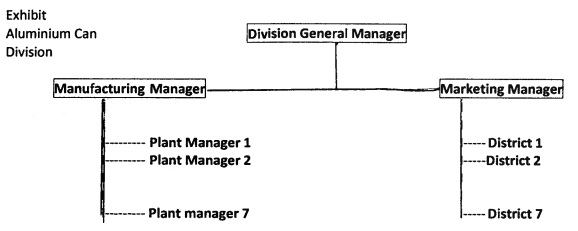

Alucan is a division of a widely diversified Fortune 1000 company. Exhibit 1shows the organization chart for the division. Alucan specializes in the manufacture of aluminum extruded products. Its chief line of products consists of aluminum cans of various sizes used by soft drink and other beverage producers and marketers for their products. The industry is highly competitive with a number of large

and small players. Margins are not very high with the result that profits are more dependent on volume. In addition, several beverage makers also have their own plants. Very often,these beverage manufacturers both make their own cans and also buy from outside suppliers. The Can industry also faces severe competition from other materials such as glass and plastic.

The company is geographically dispersed with plants all over North America and Europe. Most Alucan Co. plants are located close to their main customers, who are typically, soft drink or beverage (including alcoholic beverages) manufacturing units. These plants serve customers in their own geographic region. It is very common for a plant for example, to have a large portion of their sales going to a few customers. Most of the customers in turn,prefer to enter into large volume contracts with two or more (two being the general norm) can producers. The contracts are typically fixed for a period of time, with price changes (typically once a year) being indexed to raw material prices. Raw material and manufacturing overhead costs accounted for about 65% of production cost followed by labor (15%), marketing and general administration (9%), transportation (8%), and R &D (2%).In this line of business, customers relied on their suppliers for quality and delivery and would not hesitate to turn to other can producers if a supplier was found wanting on either cost or customer service or delivery or quality considerations.

As few as five beverage container manufacturers accounted for about 90% of the market. Four Global companies supplied aluminium to can producers, and at least two of them also manufactured cans and other containers. All can producers employed essentially the same technology and Alucan's product quality was comparable to it's competitors.

The Budget was used as the primary tool to achieve goal congruence. The Budgeting process started in May I June with each divisional general manager (DGM) submitting a preliminary forecast for sales and forecasts for income and capital requirements. These forecasts were typically not detailed. This was followed by Central Market research staff who undertook a more thorough study of market and other conditions for the next year and the following two years thereafter. The research staff then came out with a detailed forecast for each division integrating the divisional forecasts and considering all relevant factors such as macro economic conditions, competitive trends in the packaging industry,new products, inventory, etc. The forecasts were then forwarded to the divisions for review and fine tuning.

The DGM's then compiled their own detailed sales forecasts obtaining bottom up information from the district sales managers closer to the customers and to the field. The district sales forecasts were consolidated at the division level with no changes being made without the approval of the district manager. The process was then repeated at the corporate level. Once approved, these figures became agreed to fixed targets.

The overall sales budget was then translated into a sales budget for each plant, broken down according to the plants from which the finished goods would be shipped. Each plant then budgeted gross profit, fixed expenses,and pretax income. Profit was measured as the sales budget less budgeted variable costs (including OM,Dl,and VMO all at standard costs and rates) less budgeted fixed costs.The plant

manager was held responsible for this budgeted profit number even if actual sales fell below predicted

sales.

Cost standards and cost reduction targets were developed by the industrial engineering department. Before plant budgets were submitted, controller staff from the head office visited each plant to understand the plant's thinking behind its budget numbers so that they could present that to senior management. This also gave an opportunity for plant managers to understand senior management's objectives and strategy.The plant budgets were then submitted in September to the division head office where they were consolidated and presented to the DGM's for review. At this stage the DGM's had the option of asking plant for revisions to the budget if needed. The budgets were then presented to the CEO of the firm and finalized after further consultations with the DGM's. The finalized budget were then submitted to the Board of Director's in December for approval.

Once approved,budgets were difficult to change. Any problems that arose between sales and production at a given plant were expected to be resolved at the field level. It was expected that rush orders would be discussed and resolved between sales and production. While production could suggest various courses of action,it was always understood that the customer was the primary concern. Sales therefore had the final responsibility to get the product to the customer and sales had the final say on how quickly and how essential it was for the product to be shipped.

The firm periodically (once a month) monitored and reported variances (action was taken immediately to remedy the cause for the variances without waiting for the monthly report). Explanations were called for and provided to top management as needed.

The sales department had the sole responsibility for the prices,sales mix,and delivery schedules.The plant manager had the responsibility for plant operations and plant profits. Plant managers were motivated to meet their profit goals in a number of ways. First, only capable managers were promoted with profit performance being a main factor in determining capability. Second, their compensation packages were tied to achieving profit targets. Third,it was understood and impressed on all executives that they were expected to work in the best interests of the firm,putting aside interdepartmental rivalries and personality issues. Managers were also rewarded if they were perceived to be good corporate citizens,in addition to being capable.

Required to do:

Problem 1. Outline the strengths and weaknesses of the planning and control (budgeting) system described above? What, if any, are the changes you would suggest?

Problem 2. Is the firm correct in holding plant manager's responsible for profits? That is,is the firm correct in classifying plant as a profit center? Would not more goal congruence (and more fairness) be achieved by classifying plant as a cost center or some other kind of responsibility center? What do you think? Discuss clearly your reasons for your choice of responsibility center classification for Alucan's plants. Discuss also any recommendations you have (including reorganization) in this regard.