Attempt all the questions.

Section-A

Question1) Discuss the various GAAPs that are mandatory to be followed briefly.

Question2) What are the different components of total cost.

Question3) What are the statements of financial information? Discuss two items from each.

Question4) Explain statement of changes in financial positions, with the example.

Section-B

Case Study

M/s XYZ Ltd manufactures a product “PLVS” at its plant at Meerut, the maximum capacity of which is 200 units per month. Details of raw materials that go into making of 1 units of “PLVS” are provided to you below:-

Sl.No Raw material description Standard Qty per finished unit (No) Standard purchase price per unit (Rs. 00)

1 A 1 6

2. B 2 5

3. C 3 4

4. D 4 3

5. E 5 2

6. F 6 1

Standard fixed overheads are Rs. 20,00,000/- per month while the standard variable overhead rate has been estimated as equal to Rs.1,400/- per unit of finished goods.

You are required to compute the:

a) Standard cost of the product.

b) Compute the production volume variance in case the company produces and sells only 100 units of finished goods in the concerned month.

c) Compute the usage and material price variances considering the following actual data (actual production and sale: 100 units)

Raw material description Actual quantity consumed (Nos) Actual price (Rs.’00)

A 102 7

B 201 6

C 310 5

D 415 4

E 540 3

F 610 2

d) Assuming no deviation in actual selling price (Rs. 30,000/-) and the actual overheads from what was projected in Standards, you are required to compute actual profits.

Attempt all the questions.

Section-A

Question1)

Write short notes on:

• P V Ratio

• Margin of Safety

• Material Variances

• Absorption Costing

Question2)

Explain the meaning of the term `variance analysis’. What is its significance in controlling and monitoring costs?

Question3)

a.) What are the pre-requisites of installation of responsibility accounting system?

b.) Distinguish between ‘cost centre’ and ‘profit centre’.

Question4)

a) Distinguish between standard costing and budgetary control.

b) “Calculation of variances in standard costing is not an end in itself, but a means to an end” Discuss.

Section-B

Case Study

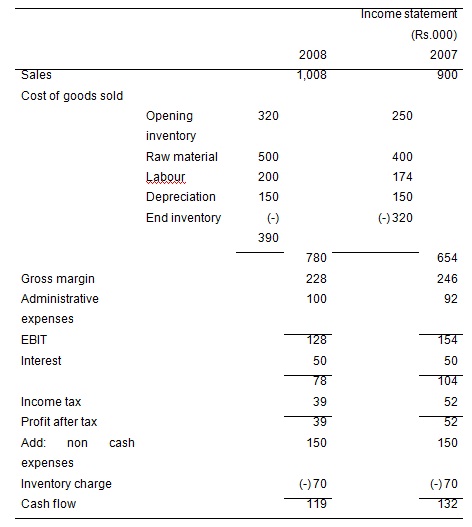

Ramesh developed original specification of the product and founded Ramesh Manufacturing Ltd. In 2007 the firm manufactured 980 nos at the average price of Rs.900/- each. In 2008 due to continuous price rise of inputs, he raised his prices at the average of 12%, as he knew he could sell plant’s full capacity of 980 nos per year. In spite of price rise for the product, which sold for over Rs.1000/- for the first time. Ramesh was surprised to learn in late 2008 (as may be seen from the financial statements) that Ramesh Manufacturing Ltd show the decline in earnings and still worse, decline in cash flow.

His accountant has bought the following:

i) We are following FIFO system for purpose of issues.

ii) Costs are going up faster than 12% and they will go up further in 2009.

iii) We are not setting aside enough to replace the machinery; we need to set aside Rs.1,65,000/- not Rs.1,50,000/- so as to be able to buy new machinery.

iv) It is still not late to switch to the LIFO for 2008. This will reduce closing inventory to Rs.3,30,000/- and raise cost of goods sold

Required:

a) What is the weighted average inflation factor for the firm using LIFO?

b) If the firm desires a 15 percent profit margin on sales, how much should the firm charge for the product per unit?