Problem 1: Ratios, common-size statements, and trend percents

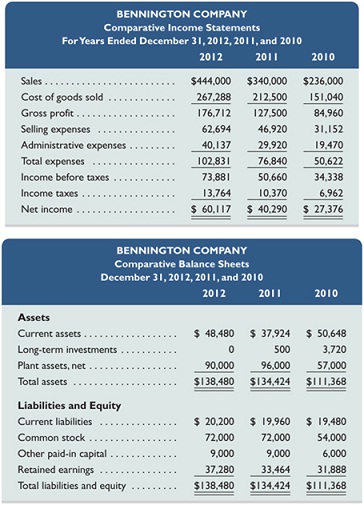

Selected comparative financial statements of Bennington Company follow.

Required

1. Compute each year's current ratio. (Round ratio amounts to one decimal.)

2. Express the income statement data in common-size percents. (Round percents to two decimals.)

3. Express the balance sheet data in trend percents with 2010 as the base year. (Round percents to two decimals.)

4. Comment on any significant relations revealed by the ratios and percents computed.

Problem 2: Calculation of financial statement ratios

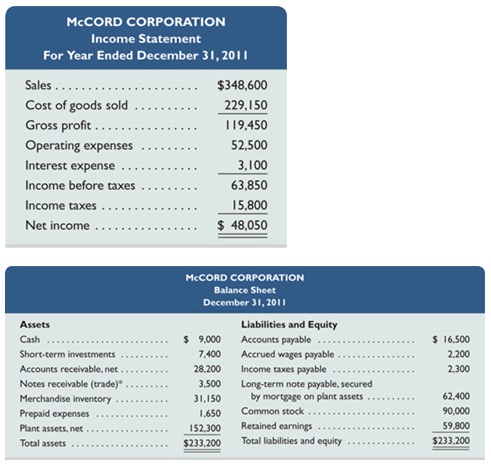

Selected year-end financial statements of McCord Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31, 2010, were inventory, $32,400; total assets, $182,400; common stock, $90,000; and retained earnings, $31,300.)

These are short-term notes receivable arising from customer (trade) sales.

Required:

Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on common stockholders' equity.