Assessment:

Business Analysis and Interpretation

1.Student Enterprises has the following business transaction estimates relating to the first quarter of 2018

$

Credit Sales 180960

Cash Sales 162624

Receipts from Accounts Receivable 145640

Wages 85020

Office Furniture 27176

Prepayments 7698

Administrative Expense 24816

Depreciation on Office Furniture 1554

Receipt of Loan 28500

Credit Purchases 95456

Payments of Accounts Payable 93104

Accrued Expense 986

Prepayments 1327

The cash balance at 1 January 2018 was $79 550.

Required

Prepare a cash budget for the quarter ending 31 March 2018.

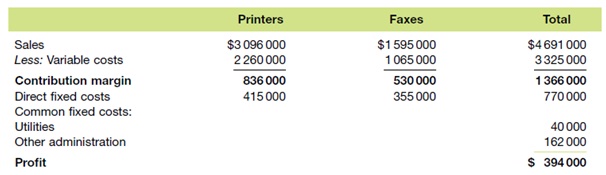

2. Student Industries sells IT equipment, specialising in printers and faxes. The following statement reflects the contribution margin of each activity, and overall profit levels.

Required

a. Calculate the contribution margin ratios for each of the two areas of activity, and in total.

b. Using the total contribution margin ratio, calculate the level of sales required to break even by item and in total.

3. Student Industries is considering buying asmall industrial machine which costs $124 000 and is expected to earn annual net cash inflows of $54 600, $49 600, $44 600 and $39 700, before it wears out sufficiently to be unreliable and must be sold for an estimated $12 400.

Required

a. If funds earn 11 per cent, what is its NPV?

b. If funds earn 15 per cent, what is its NPV?

c. Advise management on your recommendation regarding purchase of the machine subsequent to your NPV calculations.

d. What advice would you give management if the required payback period was two years?

Show calculations for a, b and d.