Assignment Task: Singapore Taxation - Corporate Tax and Partnership

Problem 1: Onsen Waters Pte Ltd (OWPL), a Singapore incorporated company, is the sole distributor of water purification units manufactured in Japan for home and commercial use. These units are sold in the South East Asian Region through local franchisees managed by OWPL. In Singapore, OWPL sells the product through its main office and retail outlets. The company was incorporated in September 2014, with its first financial year ending on 31 July 2015. The company has been wholly owned by Onsen (Japan) Inc until 31 December 2016. On 1 January 2017, a share allotment was issued to OWPL's managing director, Ms Gemma Shui who owns 10% shareholdings in OWPL after the said issuance.

For the year ended 31 July 2017, OWPL reported a net profit of $540,000, after taking into account the following income/gain and expenses/losses:

Income:

(i) Rental income of $48,000 from a residential property in Country Z. The property was occupied by OWPL's country representative in Country Z until his last day of service in April 2016. The property was rented out on a short-term lease for one year from 1 August 2016 as OWPL could not recruit a replacement country representative to oversee the representative office. The rental income was deposited into a bank account in Country Z which is used to settle expenses incurred in Country Z relating to the property (see (iii) below under Expenses). The rental income will be subject to tax in Country Z at 10% and Country Z's headline tax rate is 18%. There is no tax treaty between Singapore and Country Z.

(ii) Interest income of $16,000 received on a deposit placement with a bank in Country Y. The interest income was credited into another bank account in Country Y which is used to settle an amount owing to a trade creditor in Country Y on 31 December 2016. There is no tax suffered on the interest income in Country Y.

(iii) Profit of $50,000 from sale of motor car purchased in financial year 2015. The car was used by an expatriate managing director until 15 December 2016 when he completed his employment contract with OWPL.

(iv) Enterprise Development Grant of $20,000 in respect of marketing and business development activity in Country Z.

Expenses:

(i) Depreciation charge of $96,050.

(ii) Voluntary top-up of Medisave accounts of Singapore citizen and permanent resident employees for 25 qualifying employees amounting to $54,500. The maximum deduction for each employee is $1,500 per year. The company does not provide any other medical benefits to its employees.

(iii) Expenses of $12,760 incurred in respect of the residential property in Country Z:

- Legal fees of $5,000 and stamp duty of $960 for drafting of lease agreement.

- Property tax of $6,800.

(iv) Interest expense paid to Singapore banks in respect of following:

- Loan to acquire the residential property in Country Z: $15,000.

- Working capital loan: $8,000.

(v) Representative office expenses of $165,000 comprising office rental ($50,000), staff salary ($110,000) and motor car hire charges ($5,000). The representative office in Country Z was set up to enable OWPL to penetrate the market in Country Z by providing product information to potential customers as well as act as a liaison between OWPL and its franchisees in Country Z. It is not authorized to negotiate nor confirm sales orders; these will be carried out by OWPL in Singapore. The representative office is a legally registered office in Country Z but it is not an incorporated entity in Country Z.

(vi) Mileage claims of $10,500 by staff for use of their personal motor cars for business purposes.

(vii) Goods and services tax (GST) of $4,340 expensed off in respect of following:

- Entrance fee to Tanglin Club (used for business entertainment): $3,150.

- Monthly subscription fee to Tanglin Club: $140.

- Gifts to customers and staff where the value of each gift exceeds $200: $1,050.

OWPL is not a GST registered company.

(viii) Expenses for Ms Gemma Shui and 2 employees who participated in a trade mission to Cambodia ($5,000 per person): $15,000. The approved number of employees for S14B claim is 2.

(ix) The company incurred the following non-structural renovations during the year:

- Reconfiguring the reception and meeting rooms at the company's main office (electrical re-wiring, fixed partition works and flooring works): $24,000.

- Reinstatement (electrical re-wiring, re-painting, demolition and removal of fittings) of retail shop upon termination of lease. These reinstatement costs are contractually provided for in the lease agreement. The lease was not renewed due to low foot traffic thus resulting in poor sales: $15,000.

Section 14Q compliant renovation works were carried out in YA 2016 and 2017 at the costs of $18,000 and $243,000 respectively.

Other information - OWPL is entitled to claim capital allowances of $299,000 for YA 2018.

Required:

(a) Determine whether the rental income derived in Country Z and interest income derived in Country Y were received in Singapore in Year of Assessment (YA) 2018 for Singapore Income Tax purposes, stating the basis for your answer.

(b) Prepare an income tax computation for OWPL to compute its minimum net tax payable for YA 2018.

All items of income and expenses given in the question are to be accounted for unless otherwise stated. Where no adjustment is required, insert in "0". In arriving at statutory income, all income from non-trade sources should be addressed and all deductible expenses relating to non-trade sources should be clearly identified and deducted against the related source.

You will be required to:

(i) Analyze and apply the income tax exemption where applicable.

(ii) Distinguish between revenue and capital expenses from the taxation perspective as compared to accounting perspective and determine their deductibility.

(iii) Differentiate between special and double deduction and apply such deductions where applicable.

(iv) Formulate taxation for companies, being familiar with various sources of income, deductions, capital allowances and tax reliefs.

Problem 2: Scent and Wellness Pte Ltd (SWPL), a Singapore-incorporated company, is 80% owned by Scent and Wellness (UK) Ltd and 20% by its employees. It is in the business of manufacturing fragrances. During the year ended 31 December 2017, it acquired the following equipment/furniture:

- A delivery van costing $181,000 to replace an existing van that was donated to a charitable organization during the year.

- Modification works costing $30,000 to an existing company van that was donated to a charitable organization during the year. The works were done to modify the van to suit the charitable organization's needs.

- Renovation works costing $96,000 to reception area in the existing factory building. The works comprise electrical reconfiguration, new light fittings, flooring works and wall coverings to update the reception area. Approval from the Commissioner of Building and Control for the renovation works was not required.

- New reception counter costing $8,700 and sofa costing $4,500 for reception area.

- Costs of $85,000 incurred on extension to existing factory building. Application for the new extension to qualify for Land Intensification Allowance was made to the Economic Development Board ("EDB") and approval was granted on 15 February 2017. The costs incurred comprise architect and surveyor fees and building plan application fees. The extension works were not completed as at 31 December 2017.

Capital allowances on all plant and machinery acquired in prior years have been fully claimed by YA 2017 apart from the following:

- An automated manufacturing equipment costing $600,000 which qualifies for 3313% allowances. The equipment was purchased under a finance lease arrangement in financial year 2016 under the following terms: Cash down-payment paid on 15 March 2016 of $60,000. And Monthly repayment over 18 months of $31,500, with the first repayment made on 1 April 2016.

- Cost of construction of existing factory building of $2,400,000 (construction was completed in financial year 1997). The building qualifies for industrial building allowances and the non-qualifying area, including the reception area, comprise no more than 8% of the total floor area of the factory building.

During the year ended 31 December 2017, the company also wrote off the following equipment and furniture:

- Donated an old delivery van costing $150,000 (not including the modification works incurred during the year) to an institution of public character ("IPC") on 6 June 2017. The market value of the van before and after the modification works done are $100,000 and $127,000 respectively. The van was acquired in financial year ended 31 December 2013.

- The following furniture and appliances, used in company premises, were written off in November 2017: Refrigerator: $4,800 (purchased in May 2015). And Conference table: $6,300 (purchased in January 2015).

The refrigerator was sold to a second-hand dealer for $800 while the conference table was sent to a furniture recycling centre as there were no buyers due to its damages. There were no other low value assets purchased in the year ended 31 December 2015 except for the refrigerator.

SWPL has adjusted profits of $2,800,000 for YA 2018 based on tax adjustments arising from items charged/expensed off to the Profit and Loss Account for the year ended 31 December 2017 but not including any special deduction allowed under Section 14Q. The company has not carried out any Section 14Q compliant renovation works up till 31 December 2016. The company has unabsorbed capital allowances brought forward from YA 2016 of $155,000 and there has been no change in its business activities nor any substantial change in SWPL's ultimate shareholders since its incorporation in 1995. The company did not derive any income from non-trade sources.

Required:

(a) Calculate the statutory income for SWPL for the YA 2018. The company has always claimed maximum allowances available as well as elected for Section 21 provisions. You are to show all workings clearly. Where an expenditure does not qualify for capital allowance, insert "0" against the expenditure.

(b) The company intends to rent out the residential apartment it owns in financial year 2018 instead of using it as staff accommodation. It intends to engage an interior designer to refresh the layout and design of the apartment in order to secure higher rentals. The company estimates that it will have to spend $50,000 on tiling, flooring and electrical works, $25,000 on carpentry works (kitchen cabinets and wardrobes) as well as $30,000 on new kitchen appliances and air-conditioning equipment. Explain if the projected expenditures qualify for tax deduction under Sections 14/14Q and/or capital allowances.

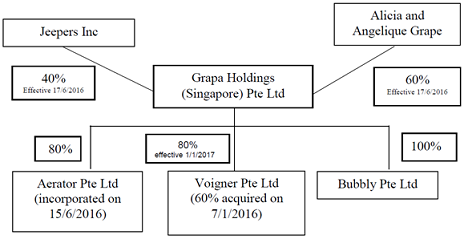

Problem 3: Alyssa, Alicia and Angelique Grape, all tax residents in Country Z, are the shareholders of Grapa Holdings (Singapore) Pte Ltd ("Grapa") since its incorporation in Singapore in 2005. On 17 June 2016, Alyssa sold her 40% shareholdings to Jeepers Inc, a company solely owned by Richard since its incorporation, leaving the remaining 60% to be held equally between her siblings, Alicia and Angelique. Grapa is an investment holding company and it holds equity investments in wine companies in Singapore, Indonesia, Thailand and China. In Singapore, Grapa is the sole shareholder of Bubbly Pte Ltd since 2009. In 2016, Grapa acquired 60% of the shares in a Singapore incorporated company, Voigner Pte Ltd from Ms Syrah Ong and increased its shareholdings to 80% on 1/1/2017. Ms Ong continued to hold on to the remaining shares in 2017. Grapa also holds 80% shareholdings in Aerator Pte Ltd, a company incorporated in Singapore on 15/6/2016; the balance 20% is held by Mr Sober Chin, a well-respected wine connoisseur. The group structure can be summarized as follows:

In addition, the tax position of the various Singapore companies is as follows:

|

|

Grapa Holdings

|

Aerator

|

Voigner

|

Bubbly

|

|

Year of Assessment 2017:

|

|

Assessable Income

|

NIL

|

$700,000

|

NIL

|

$245,000

|

|

Unabsorbed loss c/f

|

NIL

|

NIL

|

($20,000)

|

NIL

|

|

Year of Assessment 2018:

|

|

Net dividend loss

|

($50,000)

|

NA

|

NA

|

NA

|

|

Adjusted trade profit

|

NIL

|

$200,000

|

$260,000

|

$618,000

|

|

Capital allowances

|

NIL

|

($350,000)

|

($180,000)

|

($80,000)

|

All the companies have the same accounting year end of 31 December and there has been no change to their business activities. It is forecasted that Aerator is likely to incur tax losses in the near future.

Required:

Determine and explain how the loss items from Years of Assessment 2017 and 2018 may be utilized. In your explanation of the options available, state clearly the conditions to be satisfied and whether the conditions are met or not, giving your reasons for your conclusion. All relevant dates and common shareholders and their shareholdings on the relevant dates are to be shown clearly. No computations need to be prepared and you are to consider all options available.

Problem 4: Chloe and Samantha are partners in Being Einstein LLP (BEL), which runs a chain of maths and science tuition centers in Singapore. They have agreed to share the partnership profits and losses equally in the current financial year. The net accounting profit of BEL for the year ended 30 June 2017 is $105,000 after charging/crediting the following items:

Receipts:

Interest income of $9,000 from DBS Bank, an approved bank in Singapore.

Expenses:

Annual salary and fixed annual cash allowances of $48,000 and $12,000 respectively are paid to each partner. The allowances are given to the partners for business entertainment and travelling expenses.

Medical expenses of $16,800 including medical insurance premiums of $8,500 for the partners ($3,500 for Chloe and $5,000 for Samantha). The partnership did not implement any Portable Medical Benefits Scheme or Transferable Medical Insurance Scheme and neither has it made any voluntary contributions to the employees' Medisave Account. In this regard, staff remuneration (not including partners' salary and allowances) amounts to $483,000. You do not need to address the deductibility of staff remuneration.

Club subscription fees of $9,600 paid on personal club memberships held by the partners at The British Club (Chloe - $3,600) and The Tanglin Club (Samantha - $6,000). The clubs are used for both personal and business purposes and the partners are unable to identify the business portion.

Costs of $10,400 incurred on sending Chloe and the office manager to 2 trade missions conducted by Spring Singapore to Thailand and Vietnam.

Depreciation of office equipment and furniture of $43,000.

Cash sponsorship of $5,000 made to an approved IPC and in return BEL could put up banners advertising BEL's services and teachers at a fun fair organized by the IPC to raise funds for its beneficiaries.

Required:

(a) Compute the adjusted profit and divisible profit for BEL for the YA 2018.

All items of income and expenses in the question are to be accounted for. Where no adjustment is required, insert in "0".

(b) Compute the assessable income of Chloe and Samantha for YA 2018, taking into consideration the following information:

The partners are entitled to share in capital allowances of $33,000 from BEL.

Chloe's and Samantha's contributed capital as at 30 June 2016 were $60,000 and $40,000 respectively. On 1 July 2016, Samantha contributed an additional capital of $20,000.

Chloe's and Samantha's past relevant deductions as at 30 June 2016 were $50,000 and $40,000 respectively.

Chloe has unabsorbed trade losses of $15,000 brought forward from year ended 30 June 2016 while Samantha has unabsorbed trade losses of $8,000 brought forward from the same financial year. These unabsorbed trade losses were allocated from BEL.

Chloe derived the following income during the year ended 31 December 2017: Interest income of $5,000 from a loan to ABC Pte Ltd of which $500 was received in January 2018. The interest is due every month end although Chloe does not impose any penalty on late payment so long as the interest is paid within the following month.

Samantha derived the following income/gain during the year ended 31 December 2017: Royalty income of $4,500 from writing an article in The Straits Times. Winnings of $50,000 from betting in Toto.

Chloe made cash donations of $3,000 to the National Kidney Foundation, an institution of public character, on 1 April 2017 while Samantha made cash donations of $2,000 on 15 August 2017 to Mercy Relief, an institution of public character, in response to Mercy Relief's appeal for funds for humanitarian aid to Indonesian victims of a volcanic eruption.

(c) State Chloe's and Samantha's past relevant deduction as at 30 June 2017.

If you want to enhance your knowledge and skills regarding the above-mentioned course, then Corporate Tax and Partnership Assignment Help service is the best option available in the internet.

Tags: Corporate Tax and Partnership Assignment Help, Corporate Tax and Partnership Homework Help, Corporate Tax and Partnership Coursework, Corporate Tax and Partnership Solved Assignments, Singapore Taxation Assignment Help, Singapore Taxation Homework Help, Income Tax Exemption Assignment Help, Income Tax Exemption Homework Help, Statutory Income Assignment Help, Statutory Income Homework Help