I. Binary Choice Questions:

Problem 1. An open economy, where producers and consumers are free to trade at world prices, is always better for domestic consumers than a closed economy.

a. true

b. false

Problem 2. When marginal cost is rising but less than average variable cost as output increases, then

a. average total cost must be falling.

b. average variable cost must be rising.

Problem 3. Ordinal utility captures only ran king and not strength, or numerically significant measurements, of preferences.

a. true

b. false

Problem 4. If my price elasticity of demand for good X is – 0.25, then a decrease in the price of good X will ____ my consumer expenditure on this good.

a. decrease

b. increase

Problem 5. A negative income elasticity of demand is always associated with inferior goods .

a. true

b. false

Problem 6. The marginal product of labor:

a. illustrates the output produced by a labor force for a given level of capital.

b. expresses the addition to total output from hiring an additional unit of labor.

Problem 7. If a good is “normal” then a decrease in income will result in:

a. a lower demand for the good.

b. a higher demand for the good.

Problem 8. If no close substitute for butter (s uch as margarine) existed, the demand for butter would be more inelastic.

a. true

b. false

Problem 9. The unit elastic point always occurs at the midpoint of the demand curve if the demand curve is linear and intersects both the y - axis and x - axis.

a. true

b. false

Problem 10. Suppose a firm is producing 100 units of output, incurring a total cost of $10,000 and total variable cost of $6,000. What is the average fixed cost?

a. $40

b. $60

II. Multiple Choice Questions

Problem 11. Consider the market for bicycles. The demand is given by P = 90 – 3Qd . Suppose that the price changes from $30 to $15. Using the midpoint method, what is the price elasticity of demand?

a. 2/5

b. 3/5

c. 1/3

d. 1/2

Problem 12. Lucy and her grandmother are having a debate about public policy. Lucy argues that public policies designed to help the poor should always provide funds where the use of these funds is restricted to specific purchases. Her grandmother argues that public policy to help the poor should provide funds to the poor but allow the poor to decide how best to allocate these funds. Which of the following statements is true given this scenario?

a. Lucy’s choice of policy will alter the prices that the poor face: she hopes by altering these prices to encourage the poor to consume more of one type of good and less of another type of good.

b. Lucy believes that the poor need guidance in how they allocate their budgets.

c. It is unlikely that Lucy’s grandmother would send Lucy a sweater for her birthday.

d. All of the above statements are true

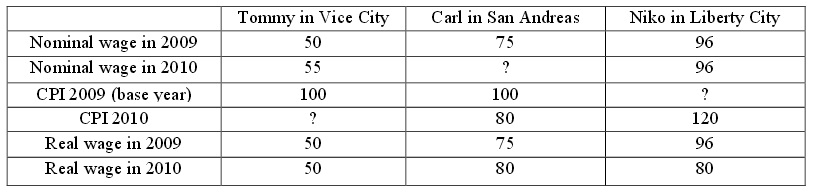

Use the following in formation for the next three questions.

Problem 13. Given the information above regarding Tommy, what must be the CPI in 2010 for Vice City?

a. 5

b. 11

c. 105

d. 110

Problem 14. Given the information above regarding Carl, what must his nominal wage be in 2010?

a. 64

b. 75

c. 80

d. 100

Problem 15. Given the information above regarding Niko, what must inflation have been in Liberty City between 2009 and 2010?

a. 8%

b. 20%

c. 80%

d. 83%

Problem 16. If labor is the only variable resource and the marginal product of labor falls as more workers are hired :

a. marginal cost will eventually increase as the level of out put increases.

b. average total cost may still be declining as the level of output increases.

c. then the firm is experiencing diminishing returns to labor.

d. all of the above are true statements

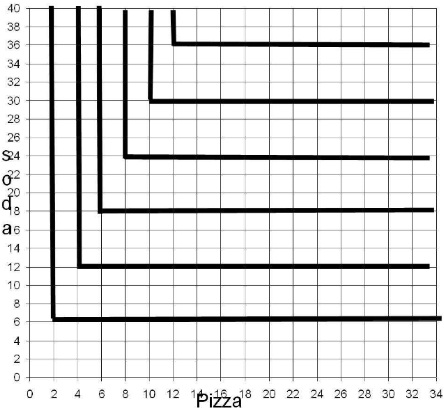

Use the following information for the next five questions. Robinson consumes soda and pizza and the graph illustrates his indifference curves. The quantity of pizza is on x - axis and the quantity of soda is on y - axis.

Problem 17. From Robinson’s indifference curves, we can determine that Robinson is indifferent between having (10 pizzas, 12 sodas) and having:

a. (4 pizzas, 30 sodas)

b. (12 pizzas,10 sodas)

c. (12 pizzas, 18 sodas)

d. (20 pizzas, 6 sodas)

Problem 18. Suppose Robinson has an income of $24, and that the price of pizza = $3 and the price of soda = $1. Given this information, how much soda must Robinson give up i n order to get one more pizza?

a. 2 sodas

b. 1/3 sodas

c. 3 sodas

d. 1 sodas

Problem 19. Given the income and prices from the previous question, and the above indifference curve map, Robinson’s optimal consumption bundle is:

a. (12 pizzas, 36 sodas)

b. ( 4 pizzas, 12 sodas)

c. (8 pizzas, 12 sodas)

d. (8 pizzas, 0 sodas)

Problem 20. Holding everything else constant, suppose the price of pizza decreases to $1. The change in the quantity demanded of pizza due to the decrease in the price of pizza is:

a. 4 pizzas

b. 5 pizzas

c. 1 pizza

d. 2 pizzas

Problem 21. Fill in the blanks in the following statement based upon the decrease in the price of pizza described in the previous question. The substitution effect due to the decrease in the price of pizza is equal to an increase of ____ units while the income effect due to this change in price is equal to an increase of ____ units.

a. 2,2

b. 0,4

c. 1,1

d. 0,2

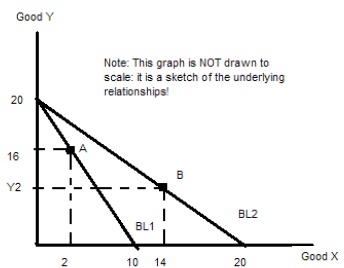

Answer the next three questions based on the following information and diagram. The diagram below represents an individual who initially faces budget line BL1. Points A and B represent utility maximizing consumption bundles of good X and good Y for this individual given his budget lines BL1 and BL2.

Problem 22. Given the above diagram and the information it conveys, which of the following statements is true?

a. Th e individual’s real income increases as a result of moving from BL1 to BL2.

b. The individual’s marginal rate of substitution of good X for good Y at point A and point B are equal since both points are utility maximizing points.

c. The change from BL1 to BL2 could represent a tax on good X since a tax on good X will change the price of good X.

d. All of the above statements are true

Problem 23. Given BL2, we know that point B represents the consumption bundle, (X, Y2), that maximizes this individual’s utility. Which of the following combinations of good X and good Y is the combination represented by point B in the graph?

a. (X, Y2) = (14, 14)

b. (X, Y2) = (14, 10)

c. (X, Y2) = (14, 6)

d. (X, Y2) = (14, 2)

Problem 24. Given the information in the graph. Which of the following equations best represents this individual’s demand curve for good X? Assume that P refers to the price of good X and Q refers to the quantity of good X.

a. P = 20 – 2Q

b. P = (13/6) – (1/12)Q

c. P = 20 – Q

d. P = (16/6) – (8/7)Q

Use the following information for the next five questions: Suppose the world price of widgets is $30 and that Econland is small country relative to the world market, so that its trade policy has no effect on the world price. Domestic demand for widgets in Econ land is given by the equation P = 100 – 2Qd . Domestic supply is given by the equation P = 3Qs .

Answer the following questions:

Problem 25. What’s the domestic equilibrium price and quantity of widgets if the economy is a closed economy?

a. P=$20, Q=60

b. P=$60, Q=20

c. P=$ 40, Q=30

d. P=$30, Q=40

Problem 26. Suppose there is a total ban on widget imports. Given this ban, the total surplus in the market for widgets in Econland equals

a. $400

b. $600

c. $1,125

d. $1,000

Problem 27. Suppose that Econland opens its widget market to trade. Compare the consumer surplus when the widget market in Econland is open to trade with the consumer surplus when the widget market in Econland is closed to trade: what is the change in consumer surplus when the market open s to trade?

a. $1,225

b. $400

c. $600

d. $825

Problem 28. Suppose that the government of Econland decides to open its widget market to trade and to implement a tariff in this market so that widgets will sell for $42 in the Econland market. What is the government’s tariff revenu e from the imposition of this tariff?

a. $180

b. $841

c. $60

d. $90

Problem 29. Suppose that the government of Econland decides to open its widget market to trade, but instead of implementing a tariff the government decides to implement a quota. If the quota is set at 15 widgets, what will be the deadweight loss due to this quota?

a. $50

b. $60

c. $70

d. $80

Problem 30. Suppose that Kelly Corp. manufactures gadgets and uses both a variable input (labor) as well as a fixed input (capital) to produce these gadgets. If Kelly Corp. rationally decides to shut down and produce nothing in the short run, which one of the following statements best descr ibes the firm's situation?

a. In the short run total variable costs for the firm are zer o while total fixed costs for the firm are positive.

b. Total fixed costs, total variable costs, and total costs are all equal to zero in the short run since nothing is bein g produced by the firm .

c. In the short run total fixed and total variable costs may be positive and that implies that total costs may be positive for the firm .

d. In the short run, the firm’s marginal costs may be either positive or equal to zero .

Problem 31. Which of the following statements is true?

a. The short run is always a year or shorter in length of time , while the long run is always longer than a year .

b. In the short run a t least one input is fixed; in the long run, all inputs that a firm uses can be varied ,

c. In the short run a firm’s costs only include its fixed costs while in the long run a firm’s costs include its fixed and variable costs .

d. In the short run a firm’s average total cost of production decreases if it experiences increasing returns to scale; in the long run average total cost is increasing .

Problem 32. In the production of corn, all of the following are variable inputs that are used by the farmer except :

a. the amount of fertilizer used after the seeds have been planted .

b. the field that has been cleared of trees for the crop to be planted .

c. the tractor used by the farmer in planting corn, wheat, and barley .

d. the number of hours that the farmer spends cultivating his field of corn

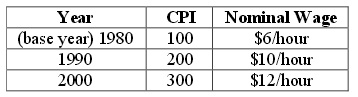

Problem 33. Using the information in the table below, which of the following statements is true?

a. The real wage is increasing from 1980 to 2000 .

b. The real wage is decreasing from 1980 to 2000 .

c. The real wage in 1990 is $8/hour .

d. The real wage in 2000 is greater than the nominal wage in 2000 .

Problem 34. For a firm, the law of diminishing marginal returns to labor is encountered as increasing amounts of labor are hired for a given amount of capital because :

a. as the level of total production increases, the additional labor hired by the firm is less and less skilled .

b. the firm hires more experienced workers before the firm hires less skilled workers .

c. each extra worker hired by the firm decreases the amount of capital available per worker and eventually this causes additional wor kers to be less productive as the workplace becomes more congested and managerial control becomes more difficult .

d. as more and more output is produced by the firm, the firm is forced to cut its product’s price in order to sell its output .

Problem 35. One cost curve for a firm that can never be “U” - shaped is the :

a. average variable cost curve .

b. marginal cost curve .

c. average fixed cost curve .

d. long run average cost curve .

Problem 36. The market for rice has a very inelastic demand (but is not perfectly inelastic) while the price elasticity of supply is 1. Suppose the government imposes an excise tax on the producers in this market. Which of the following statements is true?

a. The economic burden of this excise tax is shared equally by producers and consumers of this product .

b. The consumers of this product bear most of the economic burden of this excise tax .

c. No matter how inelastic the demand curve is, the seller must bear most of the economic burden of this excise tax since the tax is imposed on the seller .

d. The excise tax on this good results in relatively large tax revenues for the government while simultaneously discouraging consumption of the good .