Review the following academic sources and on the basis of the reading, answer the following questions:

A) Understanding Crude Oil Prices, References: 1. Hamilton (2009) and 2. Maugeri (2009)

B) Economic Regulation of Energy: Crude Oil and Natural Gas, Reference: VHV Ch. 18

C) Open Access and the Evolution of the US Spot Market for Natural Gas, Reference: Doane, J.M. and D.F. Spulber. 1994. Journal of Law and Economics 37(2): 477-517.

D) The Shale Boom and its Impacts, Reference: Hausman, C. and R. Kellogg. 2015. Welfare and Distributional Implications of Shale Gas. NBER Working Paper 21115

Multiple Choice:

1. Based on the Theory of Storage, if Et(Pt+1) > Pt + Ct, where Et (Pt+1) is the current expected oil price in the next period, Pt is the current price and Ct is the so-called “cost of carry”, it would be rational for the oil producers to _______; if Et(Pt+1) < Pt + Ct, the producer should _______.

a. sell oil out of inventory in both cases

b. sell oil out of inventory; put oil into inventory

c. put oil into inventory in both cases

d. put oil into inventory; sell oil out of inventory

2. Marginal user cost is __________.

a. an indicator of physical scarcity

b. opportunity cost of foregone future consumption

c. the same as marginal extraction cost

d. constant over time

3. The U-shaped price path of nonrenewable resources could be consistent with Hotelling model if we assume that _______.

a. both cost-increasing degradation effects and cost-reducing technological change take effect

b. initially price falls as technology effect dominates degradation effect

c. eventually technology effect is overcome by degradation effect and scarcity rent

d. all of the above

4. The statement “speculation could succeed in driving the futures price up” is incorrect because ___.

a. gasoline demand is not completely price inelastic

b. oil producers repond to higher crude oil prices by producing more

c. more production and lower demand should result in continuous inventory accumulation, which was not oberved

d. all of the above

5. Statistical analyses of historical prices indicate that

a. the real prices of oil tend to follow a random walk

b. current price could be a reasonable prediction of future oil prices

c. oil price forecasts tend to have big “normal” ranges, i.e., large confidence intervals

d. all of above

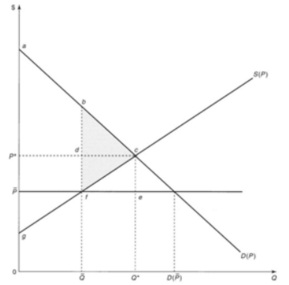

6. In the case of price ceiling as below, what is the welfare impact on consumers?

a. consumer’s welfare is changed by P*dfP‾ - bcd

b. consumer’s welfare is increased by P*dfP‾

c. consumer’s welfare is reduced by bcd

d. need more information

7. (Continued from Q6) what is the welfare impact on producers?

a. producers’ welfare is increased by dcf

b. producers lose P*dfP‾

c. producers lose P * dfP‾ + dcf

d. need more information

8. In the case of price ceiling, if we assume that the limited amount of supply Q‾ is randomly allocated to consumers, D(P), what are the corresponding welfare effects?

a. there is an additional welfare loss of abf for consumers

b. the total welfare loss is acf

c. there is no impact on producers when compared with the case in Q4

d. all of the above

9. The common pool problem has significant implications on the extraction path of nonrenewable resources. Which of the following statement(s) is TRUE?

a. The resulting private user cost is higher than social user cost

b. It reults in the rate of extraction exceeding the social optimal rate, i.e., inefficient use of the resource

c. It encourages the landowners to leave more resource for future extraction

d. all of the above

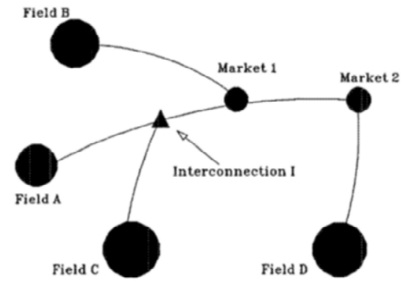

10. Consider a pipeline network shown in the figure below. There are four producing fields, A to D, two end user markets, 1 and 2, and one interconnection node, I. Initially the markets are in equilibrium. Suppose that there is an exogenous increase in the demand for gas at Market 2. Based on the LOOP (Law of One Price), the dynamic changes of the markets/prices are:

a. initially the price in Market 2 will rise

b. buyers in both Markets 1 and 2 will submit higher bids to Fields A to D

c. Prices in all fields will rise and producers will respond with new production level

d. all of above

Short Answer:

11. Assume the market supply curve is S(P) = 30P and the market demand curve is D(P) = 500 - 20P.

(1) Derive the competitive equilibrium price.

(2) Suppose that the government institutes a price ceiling of 5. Derive the welfare loss from price controls.

(3) How much are producers willing to pay in order to get their legislators to remove the price ceiling?

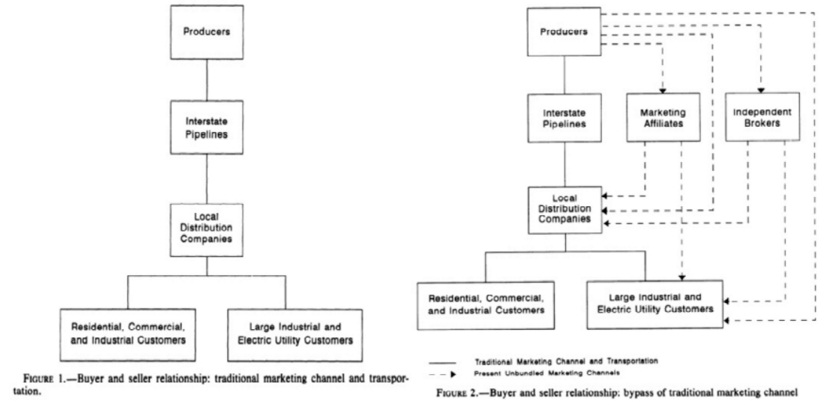

12. Using the information in the following figures to describe the structure changes in the U.S. natural gas market after the “open-access” promoted by the federal regulations.