BINARY CHOICE:

Question 1. One of the reasons the aggregate production function shows diminishing returns to labor is that as the number of workers increases

a. the quantity of land and capital per worker decreases.

b. the quantity of land and capital in the economy decreases.

Question 2. Consider the demand for loanable funds by the businesses in the country of Myland. If the real interest rate is 4%, the quantity of funds demanded is $5 million. If the real interest rate increases to 5%, the quantity of funds demanded will be

a. less than $5 million.

b. $5 million.

Question 3. According to the classical model, if the central bank of a country increases the supply of money:

a. the price level in this country will increase.

b. the Real GDP of this country will increase.

Question 4. Which of the following statements is true about actual real GDP?

a. Actual real GDP can exceed potential real GDP.

b. When actual real GDP equals potential real GDP, it also equals actual nominal GDP.

Question 5. Households increase the quantity of labor they supply when the

a. Real wage rate rises because the opportunity cost of not working falls.

b. Real wage rate rises because the opportunity cost of not working rises.

Question 6. Holding everything else constant and assuming taxes are zero, an increase in the marginal propensity to consume

a. may or may not increase consumption in the short-run equilibrium due to its effect on the equilibrium output.

b. always increases consumption in the short-run equilibrium.

Question 7. In the Keynesian model, cyclical unemployment is caused by

a. a negative spending shock.

b. a positive spending shock.

Question 8. When aggregate expenditure is less than aggregate income, inventories

a. decrease.

b. increase.

Question 9. A decrease in the income tax will

a. increase the labor supply.

b. increase the quantity of labor supplied.

MULTIPLE CHOICE:

Question 10. Economic growth is defined as a long-run increase in an economy’s

a. employment rate.

b. total output of physical goods only.

c. total output of both goods and services.

d. money supply.

Question 11. Consider the following demand and supply of labor information for the country of Simpleland:

LS = w - 5

LD = 120 - 3w

(w = real hourly wage)

At a real hourly wage of $25

a. the labor market in Simpleland is in equilibrium.

b. there is an excess demand of 25 workers.

c. there is an excess demand of 45 workers.

d. there is an excess supply of 25 workers.

Question 12. The assumption that markets clear in the classical model means that:

a. the price in every market is fixed, and the demand and supply curves will shift so that quantities supplied and demanded are equal at that particular price.

b. the prices in all markets instantaneously adjust so that the quantities supplied and demanded are equal.

c. subsidies are paid by the government to producers and consumers so that the quantity demanded and supplied are equal.

d. international trade is not allowed.

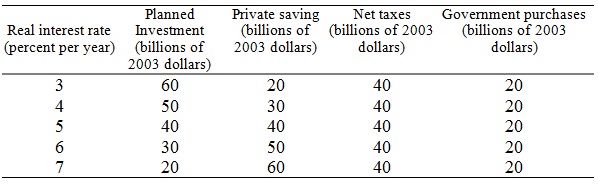

Please consider the following table for the next two questions:

Question 13. When the real interest rate is 6 percent, then the

a. total supply of funds is equal to $50 billion and budget surplus is $20 billion .

b. total supply of funds is equal to $70 billion and budget deficit is $20 billion.

c. total supply of funds is equal to $70 billion and budget surplus is $20 billion.

d. total supply of funds is equal to $50 billion and budget deficit is $20 billion.

Question 14. The equilibrium interest rate is

a. 4 % .

b. 5 % .

c. 6 % .

d. 3 % .

Question 15. To determine GDP from the production function, we need to know

a. the quantity of labor employed.

b. the quantity of labor available for work.

c. the unemployment rate.

d. the quantity of labor supplied by firms.

Question 16. The demand and the supply of labor in the country of Yourland are:

LS = 4w - 10

LD = 80 - 2w

The aggregate production function is:

Real GDP (in billions) = 60 - [2500/(200 + Quantity of labor)]

The real GDP corresponding to the full employment (potential output) is

a. $100 billion.

b. $40 billion.

c. $50 billion.

d. $10 billion.

Question 17. In the Classical model, a fiscal policy that increases government spending and leaves taxes unchanged is going to cause (assume income is unchanged)

a. an increase in both private consumption and private savings.

b. an increase in private saving, but a decrease in private consumption.

c. only a decrease in private savings.

d. a shift to the right of the supply of loanable funds.

Question 18. Consider the following information about the country of Myland:

(G – T) = $600

T = $400

I = $800 - 4000 iR

The equilibrium interest rate, iR, is 10%

(Hint: in this problem, the real interest rate is written as a decimal: e.g., if the real interest rate is 10%, it is written as iR=0.10).

According to the Classical model, leakages in this problem equal

a. $1,400 .

b. $1,000 .

c. $600 .

d. $1,800 .

Question 19. An economic boom due to an increase in labor demand

a. will cause labor productivity to decrease.

b. will cause labor productivity to remain the same.

c. will cause labor productivity to increase.

d. will have an uncertain effect on labor productivity.

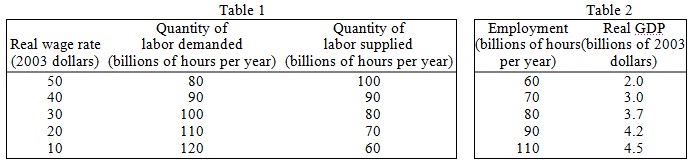

The tables below show a nation’s labor demand and labor supply schedules and its production function

Question 20. In the country described above, the equilibrium real wage rate is ____ , the equilibrium quantity of labor is ____ billion hours per year and the potential GDP is ____ billions of 2003 dollars.

a. $50; 100; $4.5

b. $40; 90; $4.2

c. $30; 80; $4.2

d. $40; 90; $4.5

Question 21. Many European countries have laws that require firms to pay large fines when firing workers. This policy is most likely to have the unintended consequence of

a. reducing the probability of a recession.

b. reducing the probability of a boom.

c. increasing the real wage.

d. speeding up the adjustment after a recession.

Question 22. The MPC is 0.8. Holding everything else constant, if government purchases increase by $1 and taxes decrease by $2, the short-run equilibrium level of output will increase by

a. $1.

b. $3.

c. $13.

d. $15.

Question 23. If autonomous consumption is $1,000, the MPC is 0.75, taxes are $500, investment spending is $800, and government purchases equal $500, what is equilibrium GDP? (Assume net exports equal 0.)

a. $1,925

b. $9,200

c. $2,567

d. $7,700

Question 24. In the simple short-run Keynesian model presented in Chapter 10, if GDP=$5 trillion and aggregate expenditure=$4.6 trillion, we would expect

a. prices to fall until the additional $0.4 trillion of output was sold.

b. prices to rise.

c. output to rise as businesses anticipate that buyers will spend more in the future to compensate for weak spending in this period.

d. inventories to rise by $0.4 trillion.

Question 25. Suppose the labor market is initially in equilibrium and that you are using a classical model. Holding everything else constant, government decreases the income tax. This will result in

a. lower labor productivity since workers can reduce their work effort and still maintain the same level of income due to the lower income tax rate.

b. a downward shift in the aggregate production function since less labor will be available.

c. an upward shift in the aggregate production function since more labor will be available.

d. lower labor productivity since workers will choose to supply more labor when the income tax decreases.

Use the information below to answer the next two questions:

Y T C

0 10 16

100 10 56

200 10 96

300 10 136

Question 26. What is the consumption function as a function of aggregate income?

a. C = 20 + .4(Y-T)

b. C = 16 + .4(Y-T)

c. C = 16 + .4Y

d. C = 24 + .4Y

Question 27. What is the saving function as a function of disposable income?

a. S =-20+.6(Y-T)

b. S = -16+.6(Y-T)

c. S = -16+.6Y

d. S = -24+.6Y

Use the information below to answer the next two questions:

Year Population Employment Output

1990 250 million 120 million $ 10 billion

1994 300 million 150 million $ 12 billion

1998 350 million 200 million $ 15 billion

2002 350 million 250 million $ 20 billion

Question 28. What is labor productivity in 1994?

a. $ 27.27/worker

b. $ 42.86/worker

c. $ 80/worker

d. $ 75/worker

Question 29. By how much has the average standard of living increased between 1990 and 1998?

a. 6.25%

b. 7.15%

c. 7.75%

d. 5.5%