BINARY CHOICE:

Problem 1. The government’s demand for funds in the country of Fantasyland in 2003 is $ 1.5M. This is compatible with:

a. Net taxes = $ 1.6M; Government purchases = $ 3.1M

b. Net taxes = $ 1.6M; Government purchases = $ 0.1M

Problem 2. Consider the demand for loanable funds by the government in the country of Myland. If the real interest rate is 3%, the quantity of funds demanded by the government is $2 million. If the real interest rate increases to 5%, the quantity of funds demanded by the government will be

a. less than $2 million.

b. $2 million.

Problem 3. In the classical model crowding out would fail to occur if

a. leakages equal injections.

b. for some reason interest rates are fixed in the economy.

Problem 4. According to the classical model, a budget deficit implies that

a. Household saving is less than planned investment due to a decrease in the interest rate.

b. Household saving is greater than planned investment in order to provide funds both for the government and for private investors.

Problem 5. A negative spending shock causes

a. productivity to decrease.

b. firms to operate below normal rates of utilization.

Problem 6. Government subsidies for on-the-job training programs will

a. increase human capital, thus shifting the production function up.

b. increase human capital, thus shifting the labor supply to the right.

Problem 7. If the MPC is 0.75, what is the value of the tax multiplier?

a. -3.0

b. -4.0

Problem 8. Economic interventions by the government in the classical model

a. may have a nominal impact on the economy.

b. may have a real impact on the economy.

Problem 9. An increase in the income tax will

a. decrease the labor supply.

b. decrease the quantity of labor supplied.

MULTIPLE CHOICE

Problem 10. In the Classical model, a fiscal policy that increases government spending and leaves taxes unchanged is going to cause:

a. an increase in private investment (I), due to the increase in the real interest rate.

b. a shift of the market demand for loanable funds to the left.

c. a decrease in private investment (I), due to the increase in the real interest rate.

d. an increase in private investment (I), due to the decrease in the real interest rate.

Please consider the following information about the economy in year 2003 to address the next question.

Savings = $ 350

Planned Investment = $ 1300

Government purchases = $ 1050

Taxes = $ 2000

Problem 11. Which of the following statements is correct?

a. There is a budget deficit of $900.

b. The government is running a budget deficit and the loanable funds market is in equilibrium.

c. The government is running a budget surplus and the loanable funds market is in equilibrium.

d. The government is running a budget surplus and the loanable funds market is not in equilibrium.

Problem 12. The average standard of living is defined as the

a. output of both goods and services per worker.

b. improvement in output.

c. output of both goods and services per capita.

d. total output of both goods and services.

Problem 13. What is the opportunity cost of the last worker to enter the labor force when the labor market is in equilibrium in the economy described below?

Labor demand = 10,000-50w

Labor supply = 50w

(w is the real wages in dollars)

a. $10

b. $50

c. $100

d. $120

Problem 14. Consider the equilibrium in the money market in the Classical model: . Suppose that the Central bank of this country decides to increase the supply of money by 10%. At the same time there is a change in people’s habits such that the fraction of income they want to keep as money decreases by 2%. Then, according to the Classical model, after these changes:

a. the real GDP increases by more than 2%.

b. the nominal GDP (PY) is not affected by these changes.

c. the nominal GDP (PY) increases by more than 10%.

d. the nominal GDP (PY) increases by 10%.

Problem 15. We know the opportunity cost of working for the first person to enter the labor force is less than the opportunity cost of working for the last person to enter the labor force, because of

a. the law of demand.

b. the law of supply.

c. Say’s law.

d. law of comparative advantage.

Problem 16. Which of the following incentives is least likely to increase human capital accumulation?

a. A permanent reduction in the income tax

b. An increase in funding for on-the-job training

c. Government subsidizing student loan programs

d. A reduction in the corporate income tax

The economy of Economica has the following labor supply and demand equations. Use this information to answer next three questions.

LS = (1/3)w - 1

LD = 27 - w

(w is the real wage rate.)

Problem 17. The full employment number of workers and real wage rate is:

a. 6 and $21

b. 6 and $27

c. 7 and $21

d. 7 and $27

Problem 18. Suppose that in a recession the level of employment is 4 workers. In this situation, the difference between the wage that firms are willing to pay and the wage workers will accept is:

a. $0

b. $2

c. $6

d. $8

Problem 19. When Economica adjusts back to the full employment equilibrium from this recession, we will observe:

a. A rise in employment and fall in the wage rate.

b. A rise in employment and rise in the wage rate.

c. A rise in employment and no change in the wage rate.

d. We cannot determine the direction of the movement in the wage rate or employment from the above information.

Problem 20. The demand and the supply of labor in the country of Yourland are:

The aggregate production function is:

Real GDP (in billions) = 60 - [2400/(200 + Quantity of labor)]

The real GDP corresponding to the full employment level (potential output) is:

a. $100 billion.

b. $40 billion.

c. $50 billion.

d. $10 billion.

Problem 21. A boom will not last forever since

a. firms will find it hard to increase employment over time.

b. for firms the benefit from hiring additional workers is less than the opportunity cost of working.

c. the tax policy of the government will slow down the economy.

d. the government is unwilling to indefinitely continue spending at low levels.

Consider the following information for the next question:

G – T = 225

S = 275 +1000 iR

I = 100 – 250 iR

Where G-T denotes the budget deficit, S denotes household savings, I denotes planned investment and iR denotes the real interest rate.(Hint: in this problem, the real interest rate is written as a decimal: e.g. if the real interest rate is 10%, it is written as iR=0.10)

Problem 22. The equilibrium interest rate and quantity of savings in this economy is:

a. iR = 5%; S=325

b. iR = 6.7%; S=341.7

c. iR = 4%; S=315

d. iR = 14%; S=415

Problem 23. Suppose the labor market is in disequilibrium at 150 million workers. At a wage of $25 labor supply is 150 million workers. At a wage of $15 labor demand is 150 million workers. Which of the following is an accurate statement about the state of the economy?

a. The real wage level is unsatisfactory for the worker.

b. The economy is at full employment output.

c. The labor market disequilibrium is cause purely by shifts of the labor supply.

d. The economy is experiencing a boom.

Problem 24. If autonomous consumption is $200, the MPC is 0.5, taxes are $100, investment spending is $100, government spending is $50, and net exports are $0, what is the short-run equilibrium level of output?

a. $400

b. $500

c. $600

d. $800

Problem 25. In the Keynesian model what is true about the relationship between equilibrium GDP and full employment GDP?

a. If aggregate expenditure is too high at the full employment GDP, equilibrium GDP will be lower than full employment GDP.

b. If aggregate expenditure is too high at the full employment GDP, equilibrium GDP will be higher than full employment GDP.

c. Full employment GDP is always higher than equilibrium GDP.

d. Full employment GDP is always equal to equilibrium GDP.

Problem 26. Which of the following is true?

a. Prices in the classical model do not vary since the economy is always at full employment.

b. Prices in the simple Keynesian model act as a signal to producers to insure that production tends toward the full employment level of output.

c. An increase in labor productivity implies a higher standard of living.

d. In the short run, there is no guarantee that actual and potential GDP will be equal.

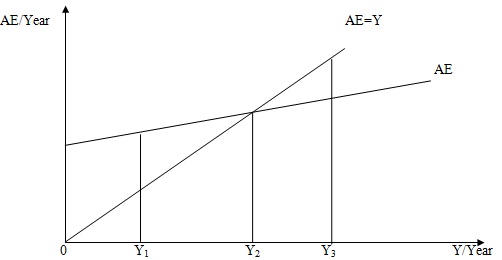

Use the following graph to answer the next question

Problem 27. At Y1

a. inventories are decreasing and producers respond by raising prices for the product.

b. inventories are staying constant as producers increase their production to meet the demand for their product.

c. inventories are decreasing and producers respond by increasing their production.

d. total spending exceeds total production implying that this economy is in an economic boom.

Use the information below to answer the next two questions:

Year Population Employment Output

1990 250 million 120 million $ 10 billion

1994 300 million 150 million $ 12 billion

1998 350 million 200 million $ 17.5 billion

2002 350 million 250 million $ 20 billion

Problem 28. What is labor productivity in 1994?

a. $ 12/worker

b. $ 40/worker

c. $ 80/worker

d. $ 27/worker

Problem 29. By how much has the average standard of living increased between 1994 and 1998 ?

a. 19.3 %

b. 25 %

c. 9.4 %

d. 50 %