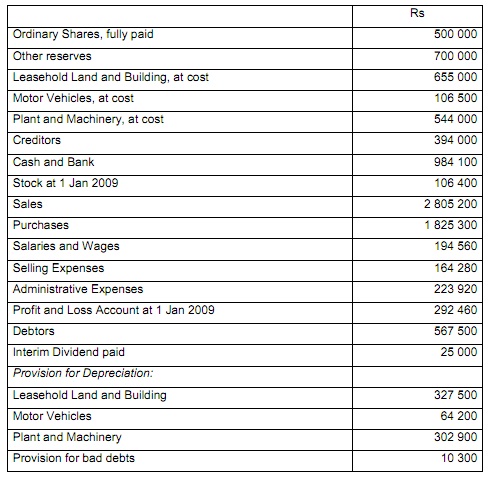

Question 1: Bandana Ltd has an authorized share capital of 750 000 Rs 1 ordinary shares. On 31 December 2009, the given balances were extracted from its books:

The given information is relevant:

1) Stock on hand at 31 December 2009 amounted to Rs 114 500

2) Provision for bad debts is to be adjusted to 2 percent of the outstanding debtors as on 31 December 2009

3) Provision is to be made for:

a) Audit fee Rs 10 000

b) Depreciation on leasehold land and buildings at 5% on cost, plant and machinery 10% on cost and motor vehicles at 20% on cost.

4) The directors wish to transfer Rs 100 000 to general reserve and propose a final dividend of 10%

5) Administrative expenses comprise insurance payments of Rs 20 000 that cover a 15 months period to 31 March 2010.

6) The company is being sued for Rs 190 000 in respect of costs occurring from the expiration of a lease on a property formerly occupied by the company. The company’s legal advisers are of the opinion that the company will not be held liable for this amount.

Required:

Make the following financial statements for the year ended 31st December 2009 for Bandana Ltd in accordance with IAS 1 Presentation of the Financial Statements:

A) An Income Statement.

B) A Statement of Financial Position (Balance Sheet) showing the statement of changes in equity.

Question 2: As per IAS1, preparation of financial statements is based, inter-alia, on the given concepts:

a) The Matching concept

b) The Consistency concept

c) The Prudence concept

d) The Concept of Materiality

Required:

In brief describe any two of the above-mentioned concepts.