Assignment: Long-run Macroeconomic Equilibrium and Stock Market Boom

Let us assume the economy reaches its long-run macroeconomic equilibrium in 2020. When the economy is in the long run macroeconomic equilibrium, the stock market will also reach its boom. This will in turn lead to increases in stock prices more than expected, and the stock prices will stay high for some period.

Answer the following questions based on the scenarios of long macroeconomic equilibrium and consequent stock market boom.

a) Which curve will shift? Is it AS curve or AD curve? In which direction does the shift occur?

b) In the short-run, what will happen to the price level and output (real GDP)?

c) What will happen to the expected price level? What impact does this have on wage bargaining power of workers?

d) In the long-run, which curve will shift due to the change in price expectations created by the stock market boom? In which direct will it shift?

e) How does the new long-run macroeconomic equilibrium differ from the original equilibrium?

2) Studies indicate that net exports and net capital outflows tend to be equal.

a) Why do net exports and net capital outflows tend to be equal? How does an increase in the price level change interest rates?

b) How does this change in interest rates lead to changes in investment and net exports?

3) Assume there is a decrease in the demand for goods and services, which leads to a decrease in the real GDP and eventually the economy into recession.

a) When the economy enters recession due to a decline in demand, what will happen to the price level?

b) Assume there is no government intervention. What will ensure that the economy still eventually gets back to the natural rate of output (real GDP)?

4) A number macroeconomic variables decline during recessions. One of these variables is the GDP.

a) What other variables, besides real GDP, tend to decline during recessions? Given the definition of real GDP and its components, explain the declines in these economic variables which are to be expected.

b) Empirical studies indicate that the long-run trend in real GDP of the USA has an upward trend. How is this possible given business cycles and macroeconomic fluctuations? What factors explain the upward trend in spite of the cycles?

5) Assume there are short-run and long-run Macroeconomic Equilibriums in the economy.

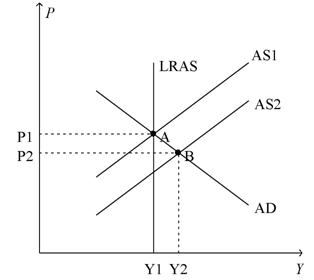

Refer to the AS and AD curves above to answer the following questions.

a) What is the initial point of the long-run macroeconomic equilibrium? What are the equilibrium values? What does the appearance of the long-run aggregate-supply (LRAS) curve indicate? How does it differ from AS?

b) What are the factors that can shift short-run aggregate supply curve from AS1 to AS2? What does Point A represent in the graph? What does point B represent? Is it the short-run or long-run macroeconomic equilibrium? Explain.

c) Assume aggregate demand (AD) is held constant, in the long-run, starting from point B, what will the economy likely experience? Will it reach the long equilibrium?