Question 1. Lazlo’s Company provides the following standard cost data for one of its products:

Fixed overhead (2 hrs @ $1 per hour) $20

The fixed overhead rate is based on total budgeted fixed overhead costs of $50,000. During the period, the company produced and sold 24,000 units incurring fixed overhead of $50,000.

The fixed overhead spending variance is

A. $2,500 unfavorable.

B. $500 unfavorable.

C. $2,500 favorable.

D. $2,000 unfavorable.

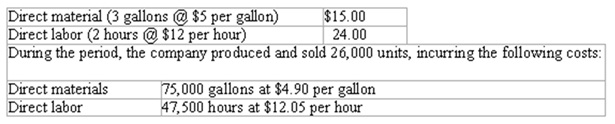

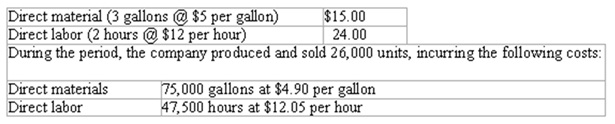

Question 2. The Rising Company provides the following standard cost information for one of its products:

Fixed overhead (2 hrs @ $1 per hour) $20

The fixed overhead rate is based on total budgeted fixed overhead costs of $50,000. During the period, the company produced and sold 24,000 units incurring fixed overhead costs of $49,200.

The fixed overhead volume variance is

A. $2,000 favorable.

B. $2,000 unfavorable.

C. $4,500 favorable.

D. $800 unfavorable.

Question 3. Shelly’s Company makes a product that is expected to require 2 hours of labor per unit of product. The standard cost of labor is $5.20. Shimano actually used 1.9 hours of labor per unit of product. The actual cost of labor was $5.10 per hour. Shimano made 1,000 units of product during the period. Based on this information alone, the labor price variance is

A. $190 favorable.

B. $190 unfavorable.

C. $510 favorable.

D. $510 unfavorable.

Question 4. Kole’s Company makes a product that is expected to require 2 hours of labor per unit of product. The standard cost of labor is $6.00. Kole’s actually used 1.9 hours of labor per unit of product. The actual cost of labor was $6.25 per hour. Kole’s made 1,100 units of product during the period. Based on this information alone, the labor usage variance is

A. $190 favorable.

B. $600 favorable.

C. $660 favorable.

D. $660 unfavorable

Question 5. The standard amount of materials required to make one unit of Product Q is 4 pounds. Lisa's static budget showed a planned production of 4,000 units. During the period the company actually produced 4,100 units of product. The actual amount of materials used averaged 4.1 pounds per unit. The standard price of material is $1 per pound. Based on this information, the materials usage variance was

A. $400 unfavorable.

B. $410 unfavorable.

C. $400 favorable.

D. $410 favorable

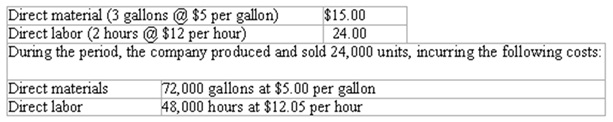

Question 6. The Clancy Company provides the following standard cost data:

The materials price variance was

A. $7,200 favorable.

B. $7,200 unfavorable.

C. $7,500 favorable.

D. $7,500 unfavorable.

Question 7. Clancy Company provides the following standard cost data:

The materials usage variance was

A. $15,000 favorable.

B. $15,000 unfavorable.

C. $14,700 favorable.

D. $14,700 unfavorable.

Question 8. The Clancy Company provides the following standard cost data:

The direct labor price variance was

A. $2,400 favorable.

B. $2,400 unfavorable.

C. $2,375 favorable.

D. $2,375 unfavorable.

Question 9. The following standard cost card is provided for Newbeam Company's Product A:

Direct material (2lbs. @ $5.00 per lb.) $10.00

Direct labor (1 hr @ 8.00 per hr.) 8.00

variable overhead (1 hr @ 3.00 per hr.) 3.00

Fixed overhead (1 hr @ 2.00 per hr.) 2.00

Total standard cost per unit $23.00

The fixed overhead rate is based on total budgeted fixed overhead of $12,000. During the period, the company produced and sold 5,800 units at the following costs.

Direct material 12,000 pounds @ $4.50 per pound

Direct labor 5,750 hours @ $8.00 per hour

Overhead $29,920

The standard manufacturing cost per unit is $23.00 while the actual manufacturing cost per unit was

A. $23.71

B. $23.16

C. $22.40

D. Cannot be determined from the information provided

Question 10. Gainsville Company reported a $4,000 unfavorable direct labor price variance and a $1,500 favorable direct labor usage variance. Select the incorrect statement from the following.

A. The standard direct labor rate must have exceeded the actual direct labor rate.

B. It took the employees less time to produce the outputs than expected.

C. The total direct labor variance is $2,500 unfavorable.

D. It is possible that the supervisor attempted to use more highly skilled (and paid) employees than allowed for by the direct labor standards.

Question 11. Which of the following statements is true?

A. An unfavorable materials usage variance could have resulted from actions taken by the purchasing agent.

B. An unfavorable materials price variance could have resulted from actions taken by the production supervisor.

C. An unfavorable labor usage variance could have resulted from actions taken by the personnel department.

D. All of these statements are true.

Question 12. The Music Company produces and sells a desktop speaker for $100. The company has the capacity to produce 50,000 speakers each period. At capacity, the costs assigned to each unit are as follows:

Unit level costs $45

Product level costs $15

Facility level costs $5

The company has received a special order for 1,000 speakers. If this order is accepted, the company will have to spend $10,000 on additional costs. Assuming that no sales to regular customers will be lost if the order is accepted, at what selling price will the company be indifferent between accepting and rejecting the special order?

A. $100

B. $55

C. $45

D. $65

Question 13. The accounting concept or principle that is perhaps the greatest single culprit in distorting the results of financial statement analysis is the:

A. matching principle.

B. historical cost concept.

C. conservatism principle.

D. time value of money concept.

Question 14. James Company has cash of $20,000, accounts receivable of $30,000, inventory of $16,000, and, equipment of $50,000. Assuming current liabilities of $24,000, this company's working capital is

A. $ 6,000.

B. $26,000.

C. $42,000.

D. $72,000.

Question 15. Morgan Company has total current assets of $45,000, including inventory of $10,000, and current liabilities of $21,000. The company's current ratio is

A. 0.4

B. 1.7

C. 2.1

D. 2.6