Question 1

a. Explain the relationship between NPV and a firm's value. Why might the relationship not behave as expected?

b. Explain why NPV is generally preferred over IRR when choosing among competing (mutually exclusive) projects.

Question 2

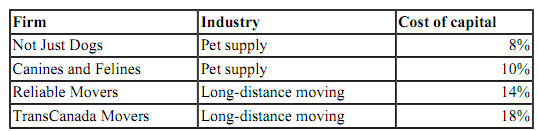

BMP Consulting (BMPC) conducted an analysis of Delta Corp. and found that the firm consists of two different divisions: Pet Lovers, a pet supply retail outlet, and Able Move, a long-distance moving company. Delta is currently considering a project related to pet supplies and has asked for BMPC's assistance with the analysis. As a part of its response, BMPC examined firms that operate within the industries of each of Delta's two divisions, finding the following:

a. When is it appropriate to use the firm's weighted average cost of capital (WACC) to evaluate a proposed investment?

b. Based on this information, what is a reasonable discount rate for BMPC to use in its assessment of the proposed pet supply project? Describe any assumptions that you make in arriving at this discount rate.

c. What would be the potential implications for Delta if WACC is used to evaluate the pet supply project?

Source: Adapted from Introduction to Corporate Finance, Second Edition, Booth and Cleary, 2010, John Wiley & Sons Canada, Ltd., Chapter 13, Practice Problem 22, page 547. Reproduced with permission from John Wiley & Sons Canada, Ltd.