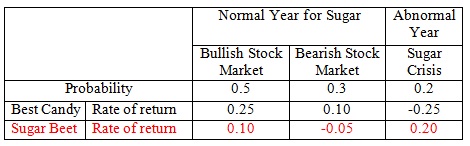

Reconsider the Best Candy and Sugar Beet stock market hedging. Assume that the probability distribution of the rate of return on Best Candy stock is unchanged but for Sugar Beet stock, it becomes the following:

See attached document for data

1) If Humanex's portfolio is half Best Candy stock and half Sugar Beet, what are its expected return and standard deviation? Calculate the standard deviation from the portfolio returns in each scenario?

2) What is the covariance between Best Candy and Sugar Beet?

3) Calculate the portfolio standard deviation using Rule 5