Monopoly:

Q1. Suppose Charter is a monopoly firm in the market for high speed internet in Madison. The total cost and the marginal cost functions for this firm are given by:

TC = 0.125q^2 + 15q + 1000

MC = 0.25q + 15

Where q is the number of user accounts.

The demand for high speed internet in Madison is given by:

p = 150 - q

Where p is the price in dollars per account.

A) Find the equation for marginal revenue for Charter. Draw a graph representing this monopolist's demand curve and its marginal revenue curve.

B) Suppose that Charter acts like a perfectly competitive firm. What quantity and price would Charter charge under these assumptions? What are the values of consumer and producer surplus? If Charter acted like a perfectly competitive firm, what would its economic profits equal? Draw a graph illustrating this situation. In your graph identify the price, quantity, area of consumer surplus, and area of producer surplus.

C) Suppose that Charter uses its monopoly power and acts as a monopolist. What quantity and price will it charge under this assumption? What will be its profit? Compute the values of consumer and producer surplus. What is the value of deadweight loss if Charter acts as a monopolist? Draw a graph illustrating this situation. In your graph identify the price, quantity, area of consumer surplus, area of producer surplus, and area of deadweight loss.

Price Discrimination:

Q2. Metro Transit is the only bus transportation provider in the city of Madison. Its total cost and marginal cost equations are given by:

TC = 0.2q + 10000

MC = 0.2

Where q is the number of rides.

We can divide the population of Madison into two groups. The first group (Group 1) will include students, elderly people and people with special needs. The second group (Group 2) will include all the rest of the population. The demand functions of the two groups are given by:

Group 1: p = 3-0.001q1

Group 2: p = 6-0.001q2

a) Suppose that Metro Transit is a competitive firm and takes the market determined price as the price it will charge.

1) Find the number of rides that each group would choose given this assumption. What will be the price of a ride?

2) Find the values of producer and consumer surplus.

3) Find the profit of Metro Transit.

4) Find the deadweight loss given this pricing decision.

5) Provide a graph illustrating your answer.

b) Suppose that Metro Transit is allowed to behave as a perfect price discriminating (1st degree) monopoly and it can charge different prices for different units and different people..

1) Find the number of rides that each group will choose if the firm acts as a perfect price discriminator.

2) Find the values of producer and consumer surplus.

3) Find the profit of Metro Transit.

4) Find the deadweight loss when the firm acts as a perfect price discriminator.

c) Suppose now that Metro Transit is allowed to behave as a monopoly but it has to charge all its customers the same price (a single price monopolist).

1) Find the number of rides that each group will choose to consume given the firm acts as a single price monopolist. Find the price the firm will charge.

2) Find the values of producer and consumer surplus if the firm acts as a single price monopolist.

3) Find the profit of Metro Transit when the firm acts as a single price monopolist.

4) Find the deadweight loss when the firm acts as a single price monopolist.

d) Suppose now that Metro Transit is allowed to behave as a monopoly and it can discriminate between the groups and charge each group a different price (3rd degree price discrimination).

1) Find the number of rides that each group would choose if the firm acts as a third degree price discriminator. Find the price each group will pay if the firm acts as a third degree price discriminator.

2) Find the values of producer and consumer surplus if the firm acts as a third degree price discriminator.

3) Find the profit of Metro Transit if the firm acts as a third degree price discriminator.

4) Find the deadweight loss when the firm acts as a third degree price discriminator.

Natural Monopoly:

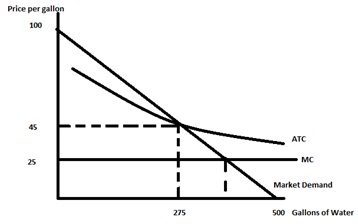

Q3. Madison water utility is the only provider of tap water in Madison. The market demand curve, the average total cost curve and the marginal cost curve for water per day are given in the graph below:

a. Write an equation for the market demand curve given the above information and assuming that the market demand curve is linear.

b. Suppose that this monopoly acts as a single price monopolist. What price will it charge and what quantity will it produce? Explain how you found this answer. Calculate the value of consumer surplus, producer surplus, and deadweight loss if this firm acts as a single price monopolist. Provide a graph to illustrate your answers: this graph should indicate the area of consumer surplus, producer surplus, and deadweight loss. From your graph determine whether this monopoly earns positive, negative, or zero economic profit.

c. Suppose that the government in Madison dislikes this monopoly restricting output and charging such high prices. The government also does not like the fact that the monopoly is earning a positive economic profit. If the government decides to regulate this firm so that it produces the socially optimal amount of the good, how many units will the firm produce and what price will consumers be willing to pay for this amount? Will the firm be willing to provide the socially optimal amount of the good? Explain your answer.

d. Suppose that the government in Madison dislikes this monopoly restricting output and charging such high prices but knows that the public would never agree to paying a subsidy to the monopoly. The government also does not like the fact that the monopoly is earning a positive economic profit. If the government decides to regulate this firm so that it earns zero economic profit, how many units will the firm produce and what price will consumers be willing to pay for this amount? Calculate the deadweight loss from the implementation of this type of regulation. Calculate the value of consumer surplus and producer surplus with this type of regulation. Is the consumer better off with regulation or better off with an unregulated market? Explain your answer. Provide a graph to illustrate your answer.

Game Theory:

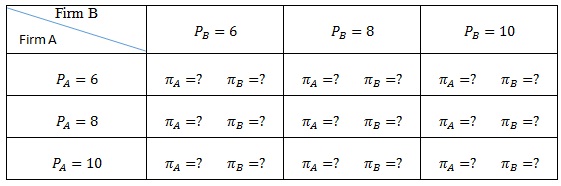

Q4. Suppose that in the market for Falafel (Arabic food) only two firms (firm A and firm B) operate in the Madison area. Each firm can choose a price per meal: the meal can be priced at $6, $8, or $10. The market demand is given by: p=16-2q. Consumers in Madison will always buy from the firm that offers the lowest price. Assume that if the firms choose the same price, then each firm will get 50% of the market.

The cost functions for each firm is given by the following equations:

TCA = qA + 15

TCB = 3qB

What are the strategies for each firm?

Complete the following table:

c) For each firm determine if it has a dominant strategy and, if so, determine what that strategy is. Is there a strategy that firm A or firm B definitely will not engage in?

d) Given your analysis of the payoff matrix, make a prediction about the pricing strategy you expect to see firm A and firm B pursue in this market. Explain your reasoning.

e) What price should each firm charge if they want to maximize the total profit?

f) How much firm A is willing to pay firm B in order to convince firm B to use the strategy that will lead to the optimal allocation? Will firm B accept the offer?

Externalities:

Q5. The market demand for tobacco in Madison is given by:

p = 40 - 2q

And the market supply is given by:

p = 2q

Where q is the number of pouches of tobacco and p is the price in dollars per pouch of tobacco.

Suppose that smoking imposes negative externalities on the population of Madison. Assume that each pouch of tobacco costs the population of Madison $4.

a) What is the price and quantity in this market for tobacco assuming that this is a competitive market and that the externality cost is not incorporated in the market by either the producers or the consumers of the product?

b) Given the above information, find the marginal social benefit and marginal social cost functions for this market.

c) What is the socially optimal number of tobacco pouches in this market? That is, if the externality was internalized in the market, what would be the price of tobacco and how many units would be consumed?

d) Suppose the government sees that without intervention, the competitive equilibrium isn’t socially optimal in this market, and wants to use an excise tax or a subsidy per unit to try and lead the market to the socially optimal equilibrium. What excise tax or subsidy per unit should the government choose to implement to help this market reach the social optimum? What price will the consumers pay for the product if this government program is implemented? What price will producers receive for the product if this government program is implemented? Calculate the tax revenue for the government or the cost to the government of the imposed program.

e) What is the deadweight loss if the government decides not to intervene in this market? That is, what is the deadweight loss that Madison incurs when this externality is not accounted for in the market?

Public good:

Q6. Suppose that 3 student associations are interested in placing more free little libraries around campus. The three associations have different values for these little libraries and they are willing to pay money to make that happen. The willingness to pay for each association is given by the following demand functions:

Association 1: p1=200-2Q

Association 2: p2=100-0.5Q

Association 3: p3=142-Q

The cost of placing a new free library is: $50. That is, the MC of an additional free library is simply MC = $50.

a) Suppose this market is treated as a competitive market. How many libraries will each association want to have on campus? How much will each association contribute or pay for each little library? Are there any free riders in this market? Explain your answer.

b) Find the aggregate demand! (Or the marginal social benefit. Note that we are talking about a public good!!!)

c) What is the socially optimal number of new free libraries? How much should each association contribute per little library in order to get the socially optimal number of free libraries?