Problem 1: Models, Assumptions and Production Possibilities

The production possibilities frontier (PPF) is a simple model used to demonstrate several key economic principles and concepts concerning a country's total productive output from year to year and production, in this context, the process of transforming economic resources into products to satisfy the daily needs and wants of everyone living in modern society.

A. Detail three assumptions the PPF model makes about the output from the transformation process (production), the efficient use of economic resources and the level of technology which lead to the fixed position and shape of the production possibilities frontier line in any given year.

B. Draw and label a graph of the PPF model representing Australia in 2018. Assume the Australian economy has a 6% unemployment rate and around a 2.5% inflation rate. Note on the graph with the letter 'A' your estimation of where Australia's 2018 output combination (GDP) would lie. With the letter 'B' identify an unattainable output level, with 'C' an efficient level of output and with 'D' an inefficient output level of GDP. In addition, draw and label a second PPF line representing Australia in 2019 that reflects the completion and full uptake of the National Broadband Network (NBN), ceteris paribus.

C. The statement "economists think at the margin" reflects the idea that effective problem solving and decision making rely on marginal analysis. Briefly comment on what other phenomena or events would cause the same shift in the PPF line from 2018 to 2019 as in B above and explain the shape of the PPF line if the marginal rate of transformation (MRT) of resources to products was always at a constant rate?

Problem 2: Demand, Supply and Market Prices

Consider the global commodity market for Lithium in 2018:

A. At the start of the year, Tesla began to significantly increase production of its car batteries and Power-walls (domestic power batteries) by commissioning a large production facility in Nevada, USA. Given that lithium is the key input in their batteries, explain what the effect on the market price and quantity of Lithium traded would be ceteris paribus.

B. During the year several new Lithium mines in Australia and Chile commenced production of the commodity. Explain what the effect would be on the market price for Lithium of the entry into the market of these new mines ceteris paribus.

C. Surprisingly for many analysts, the market price of Lithium remained relatively unchanged in 2018 even though the quantity exchanged rose significantly. Given the changes in demand and supply detailed in 1A and 1B above draw a graph to demonstrate and explain why the market price of Lithium remained stable.

Problem 3: Elasticity and Total Revenue

A. The price elasticity of demand co-efficient for Gold Coast Theme Park tickets over the winter months is 2.5. What type of demand are theme park owners facing over winter and what could they do to increase daily total revenue for their parks during this season? Use a graph to explain your answer.

B. Researchers at Tourism Queensland have found that Backpacker accommodation has an income elasticity of demand co-efficient of 0.75. What type of good is Backpacker accommodation and what does this value of 0.75 mean for an increase in the number of Backpacker hostels opening in Queensland if real incomes in the main source countries of our foreign tourists are expected to increase in the coming years?

C. Blackmores Vitamins released an over-50's multi-vitamin supplement in 2018 and examination of the 2018 sales data has revealed that at a price of $20 per bottle they sold 45,000 units per month and at $30 per bottle only 30,000 units per month were sold. What type of price elasticity of demand does this product have and would any changes in its price have an impact on the total revenue Blackmores Pharmaceuticals could earn from this product? Explain.

Problem 4: Market Structures

A. What are the key characteristics of a market in perfect competition and explain how economists argue that firms in perfectly competitive markets that remain for the long-run, produce the most efficient economic outcome for society in terms of prices and business efficiency?

B. Monopoly markets can be viewed as a type of market failure in that this market structure fails to allocate resources efficiently in terms of the prices paid and the quantities exchanged. Explain how a firm operating in a monopoly market in the long-run makes super-normal profit at consumers' expense? What can be done to moderate this inefficient outcome and what benefits do monopoly firms bring to an economy that justifies their continued existence?

Problem 5: Costs of Production & profit-maximization

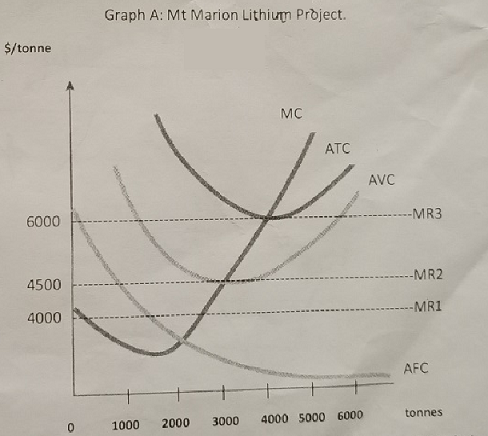

Graph A below represents the cost curves for Mt Marion Lithium Mine in the Pilbara in Western Australia.

A. The global commodity market for Lithium is perfectly competitive. Consequently what is the relationship between demand, average revenue, market price and marginal revenue for this mine and using marginal analysis how does the mine choose its profit maximizing level of output?

B. In 2019, the mine will produce 4000 tonnes of lithium ore and without any upgrades in facilities is forecast to produce 4000 tonnes annually over its life. At a market price of $6000/tonne, what level of profit would the mine make in 2019? At this price will the mine be sustainable? Explain.

C. If the market price of Lithium is expected to fall in 2020, below what price should the mine temporarily shut-down and why? If the price of Lithium remains lower than the current $6000/tonne well into the foreseeable future (the long-run) what are the implications for the mine? Explain.

Problem 6: Externalities, Market Failure and Climate Change

A. Explain briefly the economic view of market failure and apart from monopolies, what else can lead markets to fail?

B. Explain using a graph how a carbon tax would correct for the negative externality created by carbon emissions from coal fired power stations in the electricity market?

C. Flu vaccinations create positive externalities for society. How does the Government intervene in the Flu vaccine market to ensure maximum benefits are received? Demonstrate using a graph.

Problem 7: Business Cycles, Inflation and Unemployment

A. Explain the different types of unemployment in the economy. How does the economist's view of full employment differ from the notion of zero unemployment?

B. How do levels of cyclical unemployment and inflation in the economy reflect the phases of the business cycle? Explain in which phase cyclical unemployment is at its peak and the corresponding impact on the price level.

C. What are the limitations of the Consumer Price Index (CPI) in measuring the level of inflation?

Problem 8: Aggregate Demand and Supply

A. What are explanations for the 3 different slopes across the range of the AS curve?

B. What is the GDP Gap? According to Keynes, what role can the Government play in reducing the 'Gap' referring to the role of the spending multiplier?

C. Draw an AD-AS diagram to show the effects of cost-push inflation on the equilibrium price level and output for an economy and explain the effect on employment levels.

Problem 9: Monetary Policy and Financial Systems

A. The RBA Board is responsible for determining monetary policy in Australia. What mechanism does the RBA use to implement expansionary and contractionary monetary policy and under what conditions is it applied?

B. Describe the role the Reserve Bank of Australia (RBA) plays in credit creation within the Australian banking system specifically in terms of the credit creation multiplier?

C. Explain how the level of savings is related to the level of investment in a closed economy compared to an open economy and explain how the level of investment in the present influences economic growth in the future.

Problem 10: Fiscal Policy

A. Where in the phases of the business cycle and under what market conditions should the government implement expansionary fiscal policy and conversely, when is contractionary fiscal policy warranted?

B. What are the three lags that can affect the appropriate timing for effective fiscal policy changes? What does this imply for the policy goal of reducing the severity of the peaks and troughs of the business cycle?

C. Treasury officials have identified a potential $80 billion GDP gap in the economy for 2019/20. With a spending multiplier of 4, how much extra spending does the government need to undertake to close this gap in the coming year? If the government runs a budget deficit to do this how does the 'crowding out' effect impact on not achieving this $80 billion increase and why?

Our Fiscal Policy Assignment Help service is one of the best online platforms for students to enhance their academic grades, without any effort. Our online service leaves no stone unturned in order to satisfy the academic requirements of the students.

Tags: Fiscal Policy Assignment Help, Fiscal Policy Homework Help, Fiscal Policy Coursework, Fiscal Policy Solved Assignments, Monetary Policy and Financial Systems Assignment Help, Monetary Policy and Financial Systems Homework Help, Aggregate Demand and Supply Assignment Help, Aggregate Demand and Supply Homework Help, Inflation and Unemployment Assignment Help, Inflation and Unemployment Homework Help, Costs of Production & profit-maximization Assignment Help, Costs of Production & profit-maximization Homework Help, Elasticity and Total Revenue Assignment Help, Elasticity and Total Revenue Homework Help