Complete the given tasks regarding the Topic: Overheads in approximately 8 pages (2,000 words).

Question 1:

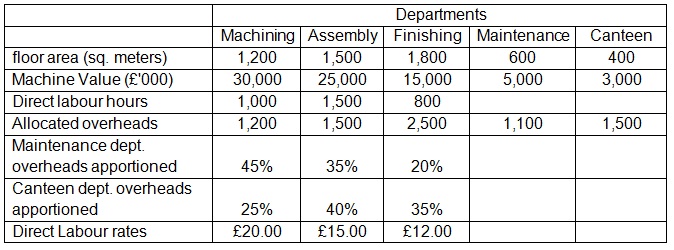

Kayak Ltd. manufactures machine tools to customers’ orders. It has five departments: three production departments (machining, assembly and finishing) and two service departments (maintenance and canteen). Budgeted overhead costs for the coming year are provided below:

Overheads £

Rent and Rates 32,000

Machine Insurance 15,000

Machine Depreciation 45,000

Production supervisors' salaries 60,000

Heating and Lighting 16,000

The following additional information is provided on the five departments at Kayak Ltd.

You are required to:

Write a report (800 words) to the management of Kayak Ltd. advising them on the pricing of a unit of machine tool. Your report should be based entirely on the analysis of your model for the overhead analysis sheet and should cover the following:

• A discussion of the allocation and apportionment of overheads to each of the five departments, comparing the total overheads in each department with the aid of a chart generated from your model.

• A discussion of the total overheads in the three production departments following the re-apportionment of the service cost centres’ overheads using the direct method.

• A discussion of the total product price and how it was built up - using the overhead absorption rate. You will need to prepare a standard cost card showing the budgeted total cost of one unit of machine tool using the information on each unit of machine tool provided below:

i. Direct materials - £108.65 per unit

ii. Direct Labour - Machining dept. - 0.5 hours of direct labour

- Assembly dept. - 1.5 hours of direct labour

- Finishing dept. - 2 hours of direct labour

iii. The company applies a 30% mark-up on total unit cost in order to set the selling price.

• Explain how the overheads in the maintenance department will change if heating and lighting were to increase by £4,000.

• Suppose rent and rates increased by £8,000, propose a strategy of passing on the increase to the customers by specifying a new selling price for the product which maintains Kayak Ltd.’s 30% mark-up.

Question 2:

Epsilon Ltd. prepared its budget for the four quarters of 2014 based on the following information:

• An estimated sales figure of 2,000 units of its sole product – the blik was forecast to be sold in the first quarter.

• The investment in advertising is expected to yield a 500 unit increment in demand for the blik in each succeeding quarter.

• In order to meet the production levels of each succeeding quarter, Epsilon Ltd. will carry finished stock of 20% of the following quarter’s sales volume.

• The opening stock of finished goods for the year is 400 bliks.

• One unit of blik is sold for £180.

• The budgeted variable costs for one unit of blik are as follows:

Quantity per blik Cost per kg/hr (£) Cost per blik

Direct material 2.5 kg £14

Direct Labour 3 hours £17

Variable production overheads 27

Additional information:

• Budgeted fixed overheads for the year: £432,000

• Actual fixed overheads for the year: £432,000

• Actual Sales for 2014 was found to be 90% of the budgeted sales units for the year.

• Actual production units for 2014 amounted to 95% of the budgeted production units for the year.

You are required to:

Write a report (800 words) to the management of Epsilon Ltd. based on the analysis of your model on absorption and marginal costing, covering the following:

• A discussion on the sales and production budgets over the four quarters of the year (use charts to enhance your report)

• Differentiate between absorption and marginal costing, illustrating the differences using the figures from your model.

• A brief explanation on why the marginal costing profit differs from the absorption costing profit, stating the circumstances under which both profits will be the same.

• A brief discussion on how many units of bliks must be sold at the current price in order to break-even

• Propose a new selling price for the blik which should enable Epsilon Ltd. break-even at 3,000 units.

• Briefly discuss the best, worst and most-likely scenarios for the sales revenue, absorption costing profit for the year and the break-even point by varying the sales growth, selling price and the cost (per kg) of direct materials as shown below (use the scenario summary to discuss your figures):

Sales growth Selling price Material price (£/kg)

Best 700 200 10

Most-likely 400 170 15

Worst 100 150 18

Question 3:

Write a reflective summary of 400 words on your learning experience on this module.

What is expected within students’ answers?

The report for each question must begin on a new page with the following headings

• Kayak Ltd.

• Epsilon Ltd.

• Reflective Summary

Use charts and tables (the scenario summary) as required in the body of the reports

You must Include your excel models in the appendix. Complete the identification area, the input area and the output area for each model.

Your overhead analysis sheet must show the overheads and the basis of apportionment to each of the five departments. Your analysis sheet should show the re-apportionment of the service department overheads to the three production departments (using the direct-method), ending in the calculation of the overhead absorption rates for each of the three production departments.