Assignment: Market Equilibrium and Taxes

In this Assignment, you will examine different factors that affect supply and demand, and also supply and demand equations to calculate the equilibrium price and quantity. In addition, you will evaluate the effects of imposing per unit tax on market price, quantity and economic welfare.

Instructions: Answer all of the following questions. You are required to follow proper APA format. Read the Criteria section below for more information before you begin this Assignment.

In this Assignment, you will be assessed on the following outcome:

Analyze the effects of changes in demand and supply on market equilibrium.

1. Analyze what would happen to equilibrium price and quantity in the market for Pepsi if the following occurred. Briefly explain your answers.

a. The price of Coke decreases.

b. Average household income falls from $50,000 to $43,000

c. There are improvements in soft-drink bottling technology.

d. The price of sugar increases and the Pepsi launches an extremely successful advertising campaign.

2. Analyze the following demand and supply equations to answer the questions.

Demand Equation: Qd = 100 - 4P

Supply Equation: Qs = 10 + 6P

a. What is the equilibrium price? What is the equilibrium quantity?

Hint: Equate Qd = Qs. Solve for the equilibrium price and then the quantity.

b. Assume the government places a price ceiling at $7 in the market. What is quantity demanded? What is quantity supplied? Is there a shortage or a surplus?

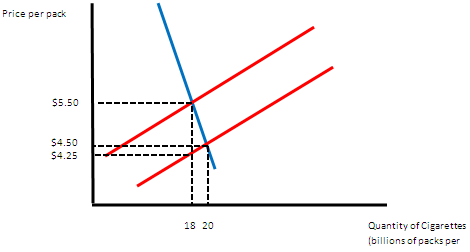

3. Using the diagram below, answer the following questions:

a. How much is the per-unit (pack) tax on cigarettes?

b. What price do consumers pay after the tax?

c. How much tax revenue is collected?

d. What is the amount of deadweight loss after the tax is imposed on cigarettes?