Assignment:

The response to each question should be at least one page (single space, front size: 12). Please submit all you answers in one file and put your name on your exam copy

1. You own and operate a chain of bagel restaurants throughout the Mid-Atlantic States, and you have been in this business for over 30 years. From your experience, you believe your current store size provides the lowest average total cost for business in your industry, and you also believe that any other firms in the business should have very similar cost structure.

In the past two years, a new entrant into your market has built very large restaurants that are roughly three- times the size of your stores. They charge prices that are comparable to your prices, but they are getting a lot of attention and taking some of your market share. If you are correct about the industry cost structure and the new entrant has built stores that are far too large, what do you think will happen in this market? Should you respond by increasing the size of your restaurants? Are there other thinks you should do?

2. a. For the following simultaneous advertising game, please determine if either firm has a dominant strategy. The payoffs for NIKE are in the lower left comer of each cell, and the payoffs for ADIDAS are in the upper right corner of each cell. Then, please determine if the game has one or more Nash equilibria and state these possible outcomes.

|

|

ADIDAS

|

|

Ads No Ads

|

|

NIKE

|

Ads

|

$15 Million

$65 million

|

$30 Million

$50 million

|

|

No Ads

|

$ -5 Million

$20 Million

|

$5 Million

$10 Million

|

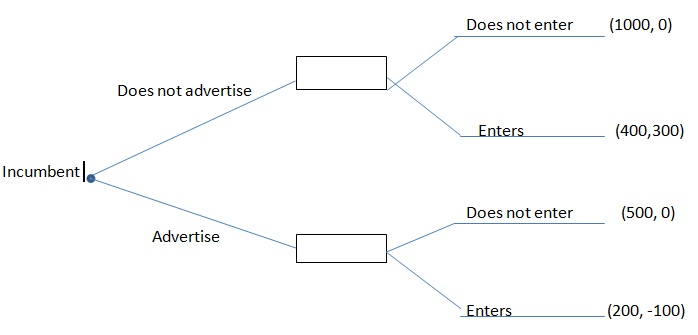

b. For this sequential entry game, the incumbent firm can make an advertising expenditure (i.e., sunk cost) to potentially deter entry. First, please determine the entrant's optimal decision if the incumbent advertises and if the incumbent does not advertise. Recall that the number in the (x, y) is the incumbent's profit, and the second number is the entrant's profit. Second, please determine the incumbent's optimal decision (Advertise or do not advertise). Third, please determine the optimal outcome from the game if the sequence of decisions is reversed (i.e., the entrant moves first). Finally, what is the incumbent's first-mover advantage?

C. Convert this sequential game into a simultaneous game

First, please determine the entrant's optimal decision if the incumbent advertises and if the incumbent does not advertise. Recall that the number in the (x, y) is the incumbent's profit, and the second number is the entrant's profit. Second, please determine the incumbent's optimal decision (Advertise or do not advertise). Third,

Determine the dominant strategies for both players and the Nash equilibrium if any.

3. Complete the table below then answer the different questions.

|

Output

|

Price/unit

|

Fixed costs

|

Variable cost

|

Total cost

|

Total revenue

|

Marginal cost

|

Average

Cost

|

Marginal revenue

|

Total profit

|

|

0

|

|

48

|

0

|

|

|

|

|

|

|

|

1

|

55

|

48

|

25

|

|

|

|

|

|

|

|

2

|

50

|

48

|

46

|

|

|

|

|

|

|

|

3

|

47

|

48

|

66

|

|

|

|

|

|

|

|

4

|

44.5

|

48

|

82

|

|

|

|

|

|

|

|

5

|

42.6

|

48

|

100

|

|

|

|

|

|

|

|

6

|

41

|

48

|

120

|

|

|

|

|

|

|

|

7

|

39.6

|

48

|

141

|

|

|

|

|

|

|

|

8

|

38.025

|

48

|

168

|

|

|

|

|

|

|

|

9

|

36

|

48

|

198

|

|

|

|

|

|

|

|

10

|

33.9

|

48

|

230

|

|

|

|

|

|

|

|

11

|

32

|

48

|

272

|

|

|

|

|

|

|

|

12

|

30

|

48

|

321

|

|

|

|

|

|

|

a. What is the level of output that maximizes this firm profit?

b. What is the total profit corresponding to that output level?

c. At which output level the firm will consider exiting the market or the industry?

d. Will the firm exit or stay in the market? In other words, will the firm stop or keep producing? (Support you decision with facts, numbers )

e. Show your answers fromquestions a) and b) graphically. In other words, show how this firm maximizes it profit graphically. (Your will need a Demand. MR, MC and AC curves to determine the output andthe price and the level of profit).