Assignment:

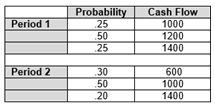

1. Mr. Thompson is considering investing in two period projects with the following probabilities and cash flows:

The discount rate is 7%, and the initial investment is $2,000. How much is the expected NPV of this project? Should Mr. Thompson invest or not? Briefly explain your reasoning.

2. The Paper Cup Company has estimated the following revenue possibilities for the year.

|

Sales

|

Profitability

|

|

1000

|

0.15

|

|

1500

|

0.20

|

|

2200

|

0.30

|

|

2900

|

0.20

|

|

3100

|

0.15

|

a. Find the expected revenue.

b. Find the standard deviation.

c. Find the coefficient of variation.

d. Which of the two measures above (a. or b.) is a better measure of risk when comparing projects with different NPV?

*Questions 1 & 2 are worth 50 points each please provide complete detailed answers

3. Zina Corporation's total cost function is given by TC = 400 + 6Q + 3Q2.

a. If the firm is perfectly competitive and the price of its product is $36, what is the optimal output?

b. At this output rate, what is the profit?

4. Dashen Company is a monopoly that produces at two plants. The demand for its product is given by P = 20 - Q. The marginal cost of plant 1 is MC1 = 2, and the marginal cost of plant 2 is MC2 = 2Q2.

a. How much output does the firm produce at each plant?

B. What price should it charge for its product?

5. Briefly explain how long-run equilibrium is different for each of the following types of markets: perfect competition, monopolistic competition, and monopoly.

Your response must be a minimum of 200 words and will be checked for originality--No Plagiarism.