Question 1. Which of the following is not a possible consequence of an effective price floor?

a. A surplus develops, creating a need for storage or disposal of the good in excess supply.

b. An alternative market develops in which people illegally exchange the good at a price lower than the price floor.

c. The price of the good in the regulated area is higher than the world price of the good.

d. Taxpayers experience a higher tax burden due to added government expenses associated with the price floor.

e. Consumers are unable to buy as much of the good as they would like to at the regulated price.

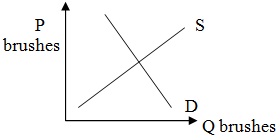

Question 2. Suppose the market for hairbrushes can be described by the following graph:

Two events affect the market this year. First, shaved heads become a popular fashion statement. Second, labor costs for hairbrush manufacturers increase. How can we characterize the new market equilibrium as compared to the old one?

a. The price will be lower, but the quantity may be higher or lower.

b. The price and quantity will both be lower.

c. The price may be higher or lower, but the quantity is lower.

d. The price may be higher or lower, but the quantity is higher.

e. The price is higher and the quantity is lower.

Question 3. The supply curve for farm good X is QS = 20P – 16. A bad storm hits that affects farmers’ ability to grow good X. Which of the following could describe the new supply curve? (Hint: you may want to solve the supply equation for P to get started)

a. QS = 20P – 60

b. QS = 20P – 8

c. QS = 30P – 16

d. QS = 20P – 4

e. QS = 20P – 16 (no change; the storm causes a movement along the curve)

Question 4. Wisconsin dairy farmers are having a hard time making a living selling milk. The current demand and supply conditions are:

Demand: QD = -10P + 50

Supply: QS = 20P – 10

Price is in dollars and quantity is in millions of gallons per day.

a) What are the market equilibrium price and quantity?

b) Suppose the government steps in to help the farmers. The government does not want to buy any excess supply of milk (it does not have extra storage space), so it decides to use a subsidy program rather than a price floor. The government will guarantee farmers that they will receive $2.50 per gallon of milk, and just asks that they sell all of the milk they produce at whatever price they can get for it. How much milk will the dairy farmers supply now?

c) What price do farmers need to charge in order to sell all of the milk they are supplying?

d) Let’s examine the outcomes for the farmer.

How much money will farmers receive each day in total from consumers for the milk they sell?

How much will farmers get from the government each day?

Compare the farmers’ total revenue with and without the subsidy – which is bigger? By how much?

Question 5. The market for cigarettes in the U.S. has been the topic of a lot of debate. Let’s think about how this market works and how it is affected by government intervention. Suppose the demand and supply curves for cigarettes are the following:

Demand: P = - (1/100) QD + 7

Supply: P = (1/50) QS + 1

The price is in dollars and quantity is in millions of packs per week.

a) What is the market equilibrium in cigarettes?

b) Suppose the government places a $1.50 per pack excise tax on cigarettes in an effort to reduce smoking. Cigarette producers are required to pay this tax out of their revenues. Draw the supply and demand graph based on the original supply and demand curves, and then show the change caused by this tax. What is the new equilibrium price and quantity?

c) There are several implications of this tax program for the various groups in the economy. Let’s consider each:

Consumers: How much have prices increased for consumers?

Producers: How much do producers receive per pack AFTER they pay the excise tax?

Government: How much money is collected in excise taxes?

Is this tax strategy successful in reducing smoking?

d) Some people have argued that increased cigarette prices will not reduce smoking. What are they assuming about the demand curve for cigarettes?