Problem 1) Consider an aggregate production function of the form Y=AKαL1-α, where A represents the level of technology, L is the level of Labor, and K is the level of capital. Firms operate in a competitive market and therefore take factor prices as given, with W as the wage rate, R the rental rate of capital, and P the output price.

a. Write down the firm’s profit function based on the information above, and find the necessary conditions for profit maximization (Hint: These conditions were discussed in class and are the same conditions you would get if you set the derivatives of profit with respect to capital and labor to zero using calculus.) Briefly explain why these conditions must hold if the firm is profit maximizing.

b. If the labor income share in production is equal 0.75, find the value of α in the production function using one of the Cobb-Douglas properties discussed in class.

c. What is the level of production if 10 units of capital are used in production, the rental rate of capital is 5, and the output price is 2?

d. What is the level of labor used in this production function based on the information and answers you have found above if the level of technology is 1?

e. What is the wage rate for labor?

Problem 2) Assume that the economy’s aggregate production function is:

Y = F(A,K,L) = AK0.4L0.6

where A is the level of technology, K is the level of capital and L is the level of labor. The consumption function is equal to C = 250 + 0.7 (Y-T). Investment spending is given by the following schedule I = 1650 - 16000r, where r is the real interest rate in decimal form. The government’s fiscal policy is such that the budget has a 100 deficit, with 500 collected in taxes. The supply of capital and the supply of labor are fixed at 100 units each, and the level of technology is 45.

a. What is the level of national savings in this economy?

b. What is the equilibrium interest rate and level of investment spending in this economy?

c. Suppose that there is a production process change, leaving the level of technology the same, but such that the investment function is now I=2050-20000r. What is the new equilibrium level of output, consumption, savings, investment and interest rate in the economy?

d. Do technological changes affect the level of output in the economy? Contrast this with what you found in the previous problem.

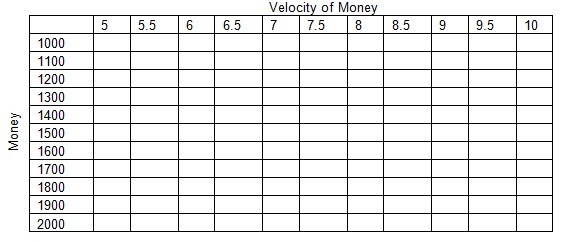

Problem 3) Quantity Theory of Money

a. Let the level of money range from 1000 to 2000 in 100 unit increments (noted in the left most columns) and let the velocity of money range from 5 to 10 in 0.5 increments (noted in the top rows). The price level in each cell is one defined by the quantity theory of money, and is consistent with a fixed output of $100 and the Money supply in that row and velocity of money in that column.

b. Based on your calculations in the table above and what you know about the quantity theory of money, examine the validity of the following statement. “If production is constant and the ratio of money individuals wish to hold is always the same, the amount of money in the economy and inflation are unrelated.”

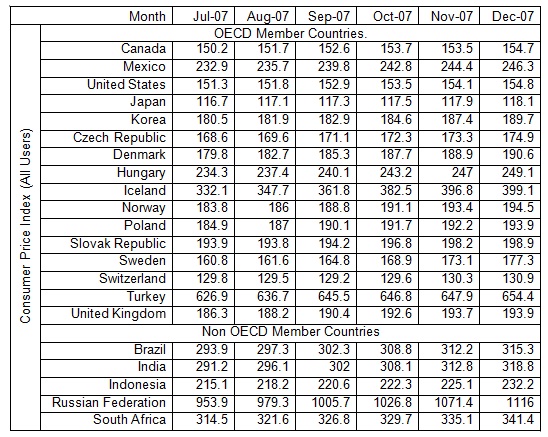

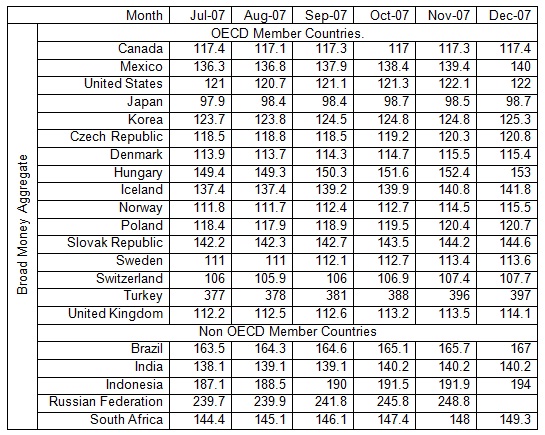

4) Below are two tables of statistics selected from the Organization for Economic Cooperation and Development (OECD) website.

CPI for OECD Member and Nonmember Countries

Money Supply for OECD Member and Nonmember Countries

a. Use the quantity theory of money and the approximation techniques for percentage change discussed in class to find an approximate relationship between the percentage change in CPI and the percentage change in Money Supply.

b. Use these tables to create a table containing two different correlation coefficients for each of the listed countries and the average of all countries. The first correlation coefficient is between CPI and Money Supply, and the second correlation coefficient is between the percentage change in CPI and the percentage change in Money Supply. (Hint: Excel has a function call “correl” in which you select the series and excel creates the correlation coefficient for you. For interpretive purposes, a Correlation Coefficient indicates the strength and direction of a linear relationship between two variables.)

a. Explain whether you believe the Quantity theory of Money holds in the listed countries above: support your position with the statistics you created in the part (b) of this problem.