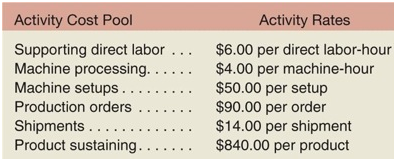

Klumper Corporation is a diversified manufacturer of industrial goods. The company's activity-based costing system contains the following six activity cost pools and activity rates:

Activity data have been supplied for the following two products:

Required:

Determine the total overhead cost that would be assigned to each of the products listed above in the activity-based costing system.

EXERCISE Comprehensive Activity-Based Costing Exercise

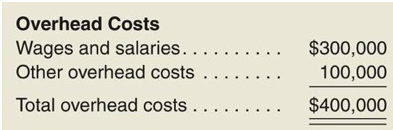

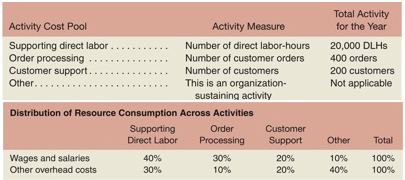

Advanced Products Corporation has supplied the following data from its activity-based costing system:

During the year, Advanced Products completed one order for a new customer, Shenzhen Enterprises. This customer did not order any other products during the year. Data concerning that order follow:

• Using Exhibit 8-5 as a guide, prepare a report showing the first-stage allocations of overhead costs to the activity cost pools.

• 2. Using Exhibit 8-6 as a guide, compute the activity rates for the activity cost pools.

• 3. Prepare a report showing the overhead costs for the order from Shenzhen Enterprises including customer support costs.

• 4. Using Exhibit 8-11 as a guide, prepare a report showing the customer margin for Shenzhen Enterprises.

EXERCISE Contrasting Traditional and ABC Product Costs

Model X100 sells for $120 per unit whereas Model X200 offers advanced features and sells for $500 per unit. Management expects to sell 50,000 units of Model X100 and 5,000 units of Model X200 next year. The direct material cost per unit is $50 for Model X100 and $220 for Model X200. The company's total manufacturing overhead for the year is expected to be $1,995,000. A unit of Model X100 requires 2 direct labor-hours and a unit of Model X200 requires 5 direct labor-hours. The direct labor wage rate is $20 per hour.

Required:

1. The company currently applies manufacturing overhead to products using direct labor-hours as the allocation base. Using this traditional approach, compute the product margins for X100 and X200.

2. Management is considering an activity-based costing system and would like to know what impact this would have on product costs. Preliminary analysis suggests that under activity-based costing, a total of $1,000,000 in manufacturing overhead cost would be assigned to Model X100 and a total of $600,000 would be assigned to Model X200. In addition, a total of $150,000 in nonmanufacturing overhead would be applied to Model X100 and a total of $350,000 would be applied to Model X200. Using the activity-based costing approach, compute the product margins for X100 and X200.

3. Explain why the product margins computed in requirement (1) differ from those computed in requirement (2).